Blank Florida Affidavit of Gift Document

The Florida Affidavit of Gift form serves as a crucial document for individuals wishing to transfer ownership of property or assets without the exchange of money. This form is particularly relevant in situations where gifts are made, such as transferring real estate or personal property to family members or friends. By completing this affidavit, the donor officially declares their intent to give the specified property, ensuring that the transfer is recognized legally. The form typically requires details such as the donor's and recipient's names, a description of the property, and the date of the gift. Additionally, the affidavit must be signed in the presence of a notary public, adding a layer of authenticity and legal validity to the transaction. Understanding the importance of this form can help individuals navigate the complexities of property transfers and avoid potential disputes in the future.

Document Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Florida Affidavit of Gift form is used to document the transfer of property or assets as a gift from one person to another. |

| Governing Law | This form is governed by Florida Statutes, specifically under Chapter 731 regarding wills, trusts, and estates. |

| Signature Requirement | The form must be signed by the donor (the person giving the gift) in the presence of a notary public. |

| Tax Implications | Gifts may have tax implications, including potential gift tax, which should be considered when completing the form. |

| Notarization | Notarization serves to verify the identity of the donor and the authenticity of the document. |

| Use Cases | This affidavit is commonly used for real estate, vehicles, and other significant personal property transfers. |

| Record Keeping | It is advisable to keep a copy of the completed affidavit for personal records and potential future reference. |

| Revocation | A gift made through this affidavit can be revoked, but it typically requires a formal process to ensure clarity. |

Similar forms

The Affidavit of Gift form is an important document used to formally declare the transfer of property or assets as a gift. Several other documents share similar purposes or functions. Here’s a look at seven documents that are comparable to the Affidavit of Gift:

- Gift Letter: A gift letter serves as a written statement from the giver to the recipient, confirming that the transfer of funds or property is a gift and not a loan. This document often includes details about the gift and the relationship between the parties.

- Bill of Sale: This document is used to transfer ownership of personal property. It outlines the terms of the sale, but can also be adapted to signify a gift by stating that no payment is required.

- Deed of Gift: A deed of gift is a legal document that formally transfers ownership of real estate or personal property from one party to another without any exchange of money. It typically requires notarization.

- Trust Agreement: A trust agreement establishes a trust, which can include provisions for gifting assets to beneficiaries. It details the terms under which the assets are managed and distributed.

- Transfer on Death Deed: This document allows a property owner to designate a beneficiary who will receive the property upon the owner's death, effectively making it a gift that takes effect after death.

- Power of Attorney: A power of attorney can enable one person to act on behalf of another in financial matters, including making gifts. It grants authority to manage assets and can facilitate the gifting process.

- New York Certificate Form: This legal document is essential for establishing a corporation in New York State and can be found here: https://nytemplates.com/blank-new-york-certificate-template/.

- Charitable Donation Receipt: This document is issued by charitable organizations to acknowledge a donation. It serves as proof of the gift for tax purposes and outlines the value of the contribution.

Understanding these documents can help clarify the process of gifting and ensure that the intentions of the giver are properly documented. It’s essential to choose the right document based on the specific circumstances surrounding the gift.

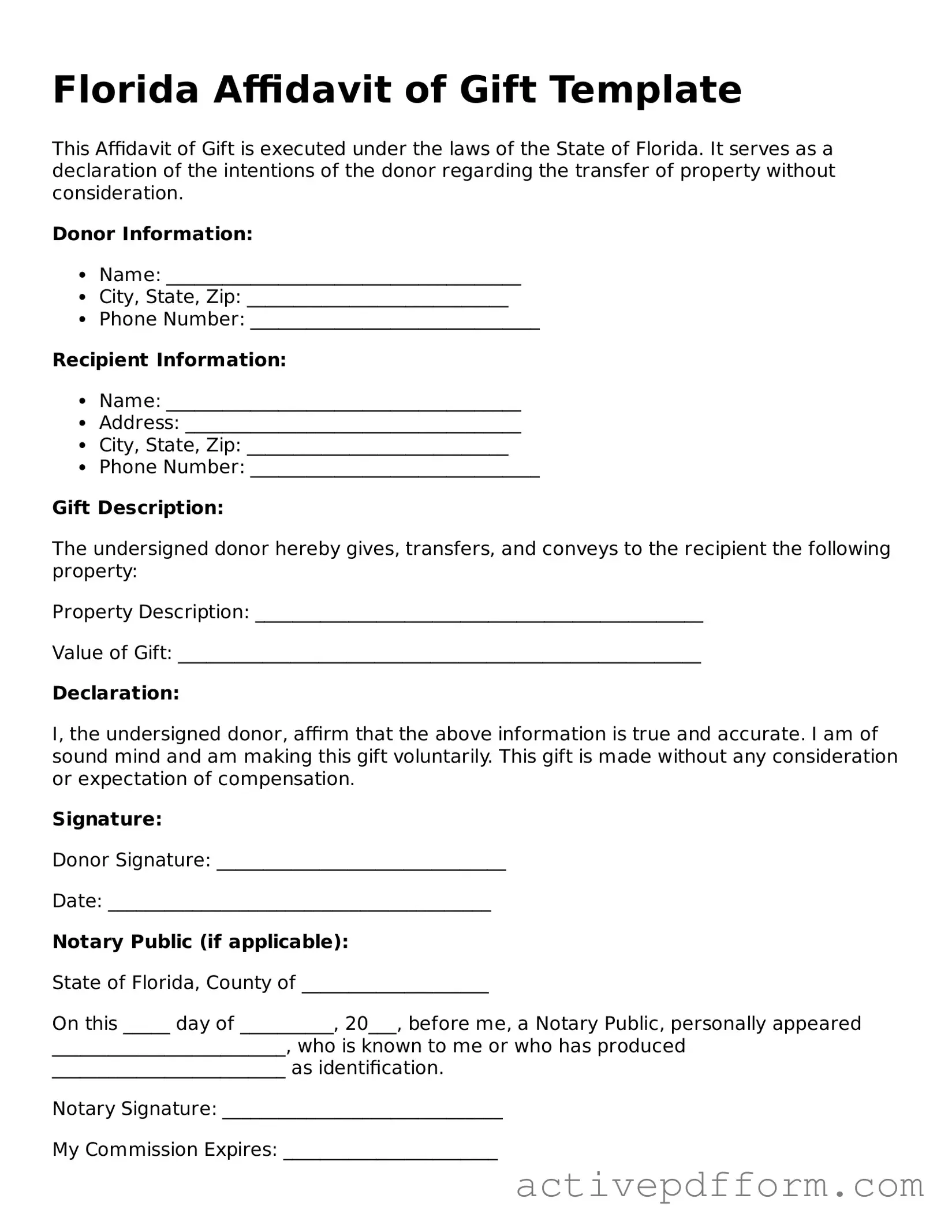

Florida Affidavit of Gift Example

Florida Affidavit of Gift Template

This Affidavit of Gift is executed under the laws of the State of Florida. It serves as a declaration of the intentions of the donor regarding the transfer of property without consideration.

Donor Information:

- Name: ______________________________________

- City, State, Zip: ____________________________

- Phone Number: _______________________________

Recipient Information:

- Name: ______________________________________

- Address: ____________________________________

- City, State, Zip: ____________________________

- Phone Number: _______________________________

Gift Description:

The undersigned donor hereby gives, transfers, and conveys to the recipient the following property:

Property Description: ________________________________________________

Value of Gift: ________________________________________________________

Declaration:

I, the undersigned donor, affirm that the above information is true and accurate. I am of sound mind and am making this gift voluntarily. This gift is made without any consideration or expectation of compensation.

Signature:

Donor Signature: _______________________________

Date: _________________________________________

Notary Public (if applicable):

State of Florida, County of ____________________

On this _____ day of __________, 20___, before me, a Notary Public, personally appeared _________________________, who is known to me or who has produced _________________________ as identification.

Notary Signature: ______________________________

My Commission Expires: _______________________

Understanding Florida Affidavit of Gift

What is the Florida Affidavit of Gift form?

The Florida Affidavit of Gift form is a legal document used to declare the transfer of property or assets as a gift. This form is typically used when someone wishes to transfer ownership without any exchange of money or consideration. It serves to formalize the gift and may be required for tax purposes or to clarify ownership in case of disputes.

Who needs to use the Affidavit of Gift form?

This form is generally used by individuals who are gifting property, such as real estate, vehicles, or other significant assets. Both the giver (donor) and the recipient (donee) may need to sign the document to confirm the transaction. It can be useful in situations where formal documentation is necessary to avoid misunderstandings later on.

Is the Affidavit of Gift form required for all gifts?

How do I complete the Affidavit of Gift form?

To complete the form, you will need to provide specific details about the gift, including a description of the property, the names and addresses of both the donor and the donee, and the date of the gift. Both parties should sign the document in the presence of a notary public to ensure its validity.

Do I need a notary public to sign the Affidavit of Gift?

Yes, it is advisable to have the Affidavit of Gift signed in front of a notary public. This adds an extra layer of authenticity and helps ensure that the signatures are legitimate. Notarization can also be beneficial if the document needs to be presented in court or to other entities.

Are there any tax implications associated with gifting property?

Yes, gifting property may have tax implications. The IRS allows individuals to gift a certain amount each year without incurring gift tax. As of 2023, this limit is $17,000 per recipient. If the gift exceeds this amount, the donor may need to file a gift tax return. Consulting with a tax professional is recommended to understand any obligations.

Can the Affidavit of Gift be revoked after it is signed?

Once the Affidavit of Gift is signed and notarized, it typically cannot be revoked without the consent of both parties. However, if the gift was made under duress or with fraudulent intent, there may be grounds for revocation. Legal advice may be necessary in such cases.

Where can I obtain a Florida Affidavit of Gift form?

The Florida Affidavit of Gift form can often be obtained from various online legal document providers, or it may be available at local county clerk offices. Ensure that you are using the most current version of the form to comply with state requirements.

What should I do after completing the Affidavit of Gift form?

After completing the form, both the donor and donee should retain copies for their records. If the gift involves real estate, you may need to file the affidavit with the county property appraiser or clerk of court. It is also wise to consult with a legal professional to ensure all necessary steps are taken.

Dos and Don'ts

When filling out the Florida Affidavit of Gift form, it is essential to approach the process with care and attention to detail. Below are some important dos and don'ts to keep in mind.

- Do read the instructions carefully before starting the form.

- Do provide accurate and complete information about the gift and the parties involved.

- Do sign and date the affidavit in the appropriate sections.

- Do ensure that the form is notarized, as required.

- Do keep a copy of the completed affidavit for your records.

- Don't leave any sections blank; fill in all required fields.

- Don't use ambiguous language; be clear and specific about the gift.

- Don't forget to check for any additional documentation that may be needed.

- Don't submit the form without reviewing it for errors or omissions.

Browse Other Popular Affidavit of Gift Templates for Specific States

Selling a Car in Texas - This document can be particularly beneficial when gifting high-value items such as vehicles or artwork.

When transferring ownership of a motorcycle, it's crucial to have the proper documentation to avoid any issues later on; therefore, you can use the Arizona Motorcycle Bill of Sale to ensure that all necessary details are recorded accurately. This legal document serves as proof of sale and can be easily obtained by visiting Arizona PDF Forms, allowing for a quick and efficient process for both buyers and sellers.