Free Fl Dr 312 Template

The Florida Department of Revenue provides the DR-312 form, known as the Affidavit of No Florida Estate Tax Due, to facilitate the process for estates that are not liable for Florida estate tax. This form is essential for personal representatives of estates where a federal estate tax return is not required, specifically when the estate does not owe any taxes under Chapter 198 of the Florida Statutes. The personal representative must affirm their status and provide details about the decedent, including their date of death and domicile at that time. The form serves as a declaration that the estate is free from Florida estate tax obligations, thereby releasing any associated liens. It is important to note that this affidavit cannot be used if a federal estate tax return, such as Form 706 or 706-NA, is required. Once completed, the form must be filed with the appropriate clerk of the circuit court in the county where the decedent owned property, rather than sent to the Florida Department of Revenue. By filing the DR-312, personal representatives can ensure the estate is recognized as nontaxable, streamlining the distribution of assets to beneficiaries.

Document Specifics

| Fact Name | Fact Description |

|---|---|

| Form Title | The form is officially titled "Affidavit of No Florida Estate Tax Due" (DR-312). |

| Effective Date | This form became effective on January 1, 2021. |

| Governing Rules | The form is governed by Rule 12C-3.008 of the Florida Administrative Code. |

| Purpose | It is used to declare that no Florida estate tax is due for the estate of a decedent. |

| Filing Requirement | Form DR-312 must be filed with the clerk of the circuit court where the decedent owned property. |

| Personal Representative | The form must be signed by the personal representative of the estate, as defined in Florida Statutes. |

| Federal Tax Return | A federal estate tax return (Form 706 or 706-NA) is not required for estates using this form. |

| Liability Acknowledgment | The personal representative acknowledges personal liability for any distributions made from the estate. |

Similar forms

Form DR-313: Affidavit of No Federal Estate Tax Due - Similar to the DR-312, this form is used to affirm that no federal estate tax is owed. It serves as proof that the estate does not require a federal tax return, similar to how the DR-312 addresses Florida estate tax.

Form DR-314: Application for a Florida Estate Tax Waiver - This form is used to request a waiver of the Florida estate tax. Like the DR-312, it involves the personal representative and addresses estate tax issues, though it focuses on obtaining a waiver rather than affirming non-liability.

Form 706: United States Estate (and Generation-Skipping Transfer) Tax Return - This federal form is required when an estate exceeds certain thresholds. While the DR-312 states that no federal return is needed, the 706 is the opposite, detailing the estate’s tax obligations.

Form 706-NA: United States Estate Tax Return for Nonresident Aliens - Similar to Form 706, this form applies to nonresident aliens. The DR-312 indicates that a federal return is not required, while this form is specifically for those who must file.

Form DR-315: Affidavit of Exemptions from Florida Estate Tax - This document is used to declare exemptions under Florida law. Like the DR-312, it is a declaration made by the personal representative regarding tax obligations.

- Texas Real Estate Purchase Agreement: This document outlines the terms and obligations of the buyer and seller in a property transaction in Texas, making it essential for both parties to understand the contents for a smooth process. Additional resources are available at fillable-forms.com/.

Form DR-316: Notice of Election to Take a Florida Estate Tax Exemption - This form allows personal representatives to elect for certain exemptions. It relates to estate tax but differs in that it is more about choosing exemptions rather than affirming non-liability.

Form DR-317: Florida Estate Tax Return - This is the actual return filed when estate taxes are due. The DR-312 is used when no tax is owed, whereas this form is for reporting taxable estates.

Form DR-318: Certificate of No Florida Estate Tax Due - This certificate confirms that no estate tax is due, similar to the DR-312. However, it is often used in conjunction with other filings to provide official confirmation.

Fl Dr 312 Example

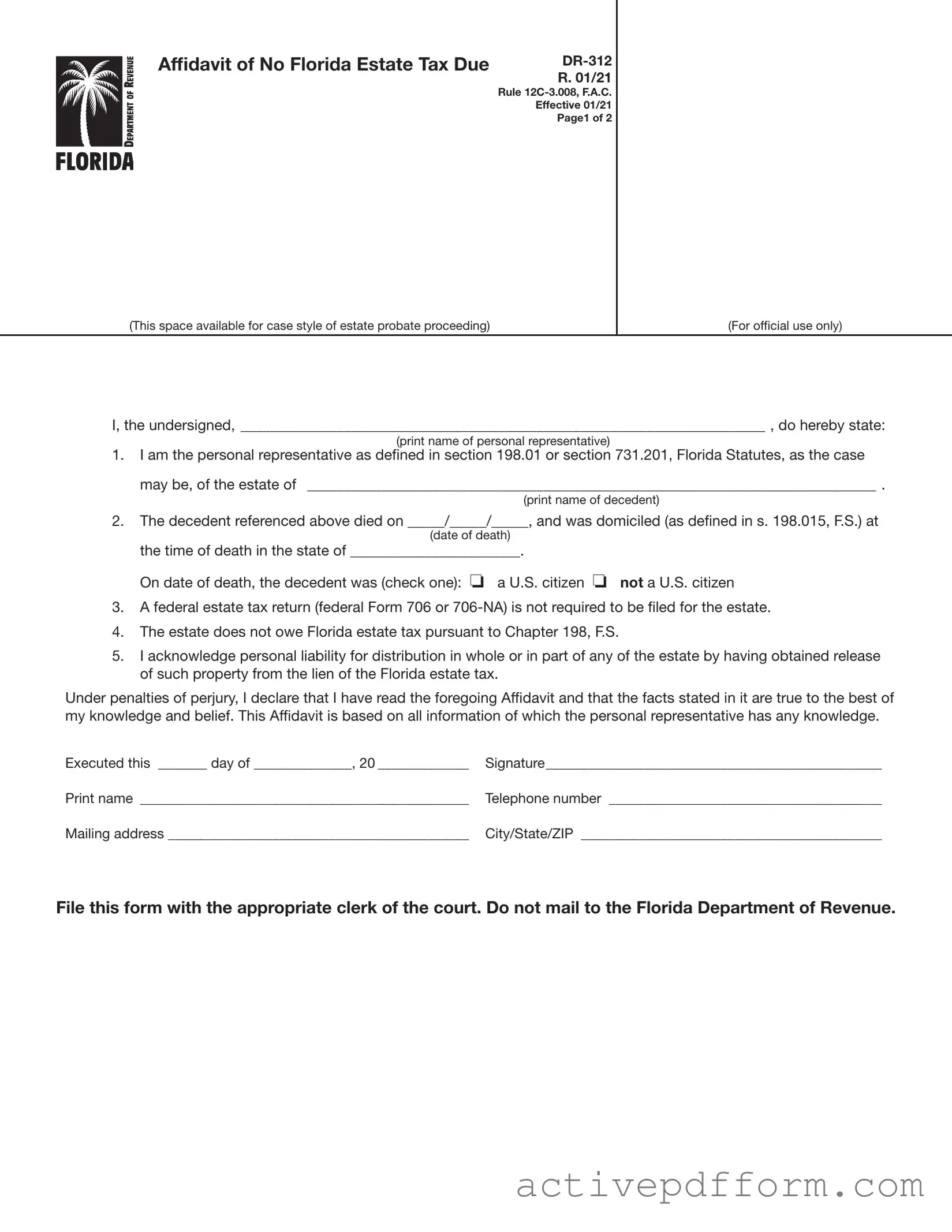

Affidavit of No Florida Estate Tax Due

Rule

Effective 01/21

Page1 of 2

(This space available for case style of estate probate proceeding) |

(For official use only) |

I, the undersigned, _______________________________________________________________________ , do hereby state:

(print name of personal representative)

1.I am the personal representative as defined in section 198.01 or section 731.201, Florida Statutes, as the case may be, of the estate of _____________________________________________________________________________ .

(print name of decedent)

2.The decedent referenced above died on _____/_____/_____, and was domiciled (as defined in s. 198.015, F.S.) at

(date of death)

the time of death in the state of _______________________.

On date of death, the decedent was (check one): o a U.S. citizen o not a U.S. citizen

3.A federal estate tax return (federal Form 706 or

4.The estate does not owe Florida estate tax pursuant to Chapter 198, F.S.

5.I acknowledge personal liability for distribution in whole or in part of any of the estate by having obtained release of such property from the lien of the Florida estate tax.

Under penalties of perjury, I declare that I have read the foregoing Affidavit and that the facts stated in it are true to the best of my knowledge and belief. This Affidavit is based on all information of which the personal representative has any knowledge.

Executed this _______ day of ______________, 20 _____________ |

Signature________________________________________________ |

Print name _______________________________________________ |

Telephone number _______________________________________ |

Mailing address ___________________________________________ |

City/State/ZIP ___________________________________________ |

File this form with the appropriate clerk of the court. Do not mail to the Florida Department of Revenue.

R. 01/21

Page 2 of 2

Instructions for Completing Form

File this form with the appropriate clerk of the court. Do not mail to the Florida Department of Revenue.

General Information

If Florida estate tax is not due and a federal estate tax return (federal Form 706 or

Form

The

Where to File Form

Form

When to Use Form

Form

and a federal estate tax return (federal Form 706 or

Federal thresholds for filing federal Form 706 only: (For informational purposes only. Please confirm with Form 706 instructions.)

Date of Death |

Dollar Threshold |

(year) |

for Filing Form 706 |

|

(value of gross estate) |

|

|

2000 and 2001 |

$675,000 |

|

|

2002 and 2003 |

$1,000,000 |

|

|

2004 and 2005 |

$1,500,000 |

|

|

For 2006 and forward |

|

go to the IRS website at |

|

www.irs.gov to obtain |

|

thresholds. |

|

|

|

For thresholds for filing federal Form

If an administration proceeding is pending for an estate, Form

To Contact Us

Information, forms, and tutorials are available on the Department’s website floridarevenue.com

If you have any questions, or need assistance, call Taxpayer Services at

To find a taxpayer service center near you, go to: floridarevenue.com/taxes/servicecenters

For written replies to tax questions, write to: Taxpayer Services - Mail Stop

5050 W Tennessee St Tallahassee FL

Subscribe to Receive Email Alerts from the Department.

Subscribe to receive an email when Tax Information Publications and proposed rules are posted to the Department’s website. Subscribe today at floridarevenue.com/dor/subscribe.

Reference Material

Rule Chapter

Understanding Fl Dr 312

What is the purpose of the FL DR 312 form?

The FL DR 312 form, also known as the Affidavit of No Florida Estate Tax Due, is used to declare that an estate does not owe any Florida estate tax. It serves as evidence that the estate is not subject to tax and helps remove any estate tax lien from the Florida Department of Revenue.

Who should complete the FL DR 312 form?

This form should be completed by the personal representative of the estate, which can include anyone in actual or constructive possession of the decedent's property. If you are responsible for managing the estate and can confirm that no Florida estate tax is due, this form is for you.

When should I use the FL DR 312 form?

Use the FL DR 312 form when the estate is not subject to Florida estate tax under Chapter 198, F.S., and when a federal estate tax return (Form 706 or 706-NA) is not required. If the estate meets these criteria, this form is the appropriate documentation to file.

Where do I file the FL DR 312 form?

The FL DR 312 form must be filed directly with the clerk of the circuit court in the county where the decedent owned property. It is important not to send this form to the Florida Department of Revenue.

What happens if I file the FL DR 312 form?

Once filed, the FL DR 312 form acts as proof that the estate is not liable for Florida estate tax. It also helps to remove any liens that the Department of Revenue may have placed on the estate's property.

Can I use the FL DR 312 form if a federal estate tax return is required?

No, the FL DR 312 form cannot be used if a federal estate tax return (Form 706 or 706-NA) is required to be filed. Ensure that you meet the criteria for using this form before proceeding.

What information do I need to provide on the FL DR 312 form?

You will need to provide your name as the personal representative, the decedent's name, the date of death, the decedent's citizenship status, and a statement confirming that no federal estate tax return is necessary. Additionally, you must include your contact information for official purposes.

What are the penalties for providing false information on the FL DR 312 form?

Providing false information on the FL DR 312 form can lead to personal liability for the distribution of the estate's property. It's essential to ensure that all statements made in the affidavit are true and accurate to the best of your knowledge.

How can I get assistance if I have questions about the FL DR 312 form?

If you have questions or need help, you can contact the Florida Department of Revenue's Taxpayer Services at 850-488-6800, Monday through Friday. You can also find additional resources and information on their website at floridarevenue.com.

Dos and Don'ts

When filling out the FL DR 312 form, keep these guidelines in mind:

- Ensure you accurately print the name of the personal representative.

- Clearly state the name of the decedent.

- Provide the correct date of death.

- Indicate the decedent's citizenship status by checking the appropriate box.

- File the form with the appropriate clerk of the court.

- Include your signature and printed name on the form.

- Double-check all information for accuracy before submission.

- Do not send the form to the Florida Department of Revenue.

Additionally, avoid these common mistakes:

- Do not leave any required fields blank.

- Do not use the 3-inch by 3-inch space for any writing or marking.

- Do not submit the form without your signature.

- Do not file the form if a federal estate tax return is required.

- Do not mail the form; it must be filed in person.

- Do not forget to check the filing deadlines.

- Do not assume the form is unnecessary without confirming the estate's tax status.

- Do not neglect to keep a copy for your records.

Check out Common Templates

Can I Claim Exempt on My W4 - Initiative reflects the employee's ability to take charge and act proactively.

The Nyc Apartment Registration Form is an essential document for landlords and property managers in New York City. This form collects important information about the apartment and its owner, helping to ensure compliance with housing regulations. Properly completing and submitting this form is crucial for facilitating the rental process and maintaining transparency, and you can find a useful template at nytemplates.com/blank-nyc-apartment-registration-template/.

Texas Temporary Tag - The application process for temporary tags is usually straightforward.