Blank Employee Loan Agreement Document

When employers consider providing financial assistance to employees, an Employee Loan Agreement form becomes an essential tool. This document outlines the terms and conditions under which the loan is granted, ensuring both parties understand their rights and responsibilities. Key aspects of the form include the loan amount, repayment schedule, interest rates, and consequences of default. It also specifies whether the loan is secured or unsecured, which impacts the lender's rights in case of non-repayment. Additionally, the agreement often includes clauses regarding the employee's termination and how it affects the loan. By clearly detailing these elements, the Employee Loan Agreement helps to foster transparency and trust between employers and employees, while also protecting the interests of both parties. Understanding this form is crucial for both sides to navigate the complexities of workplace loans effectively.

Document Attributes

| Fact Name | Details |

|---|---|

| Definition | An Employee Loan Agreement is a contract between an employer and an employee outlining the terms of a loan provided to the employee. |

| Purpose | This agreement helps protect both parties by clearly stating the loan amount, repayment schedule, and interest rates, if applicable. |

| Governing Law | The agreement is typically governed by state laws. For example, in California, it falls under the California Civil Code. |

| Loan Amount | The form specifies the exact amount of money being loaned to the employee. |

| Repayment Terms | It outlines the repayment schedule, including due dates and the method of payment. |

| Interest Rate | If applicable, the agreement states the interest rate, which must comply with state usury laws. |

| Default Conditions | The agreement includes conditions under which the employee may default on the loan and the consequences of such default. |

| Signatures | Both the employer and employee must sign the agreement to make it legally binding. |

Similar forms

- Promissory Note: This document outlines the borrower's promise to repay a loan. Like the Employee Loan Agreement, it specifies terms such as the loan amount, interest rate, and repayment schedule.

- Loan Agreement: To clearly define the terms of your loan, utilize the essential Loan Agreement resources for accurate documentation and compliance.

- Loan Agreement: A broader document that can apply to various types of loans, not just those between employers and employees. It includes similar details regarding the loan's terms and conditions.

- Employment Contract: This agreement defines the relationship between an employer and an employee. It may include clauses related to loans or advances, similar to how an Employee Loan Agreement operates within the employment context.

- Repayment Plan: A document that outlines the schedule and method for repaying a debt. It is similar to the repayment terms in an Employee Loan Agreement, detailing how and when payments should be made.

- Personal Loan Agreement: This is a contract between a borrower and a lender for personal loans. It shares similarities in structure and terms with the Employee Loan Agreement, focusing on repayment and interest.

- Credit Agreement: This document governs the terms of credit extended to a borrower. Like the Employee Loan Agreement, it defines the obligations of both parties regarding the loan.

- Advance Payment Agreement: This document allows for payments made in advance of services rendered. Similar to an Employee Loan Agreement, it specifies terms for repayment if the advance is treated as a loan.

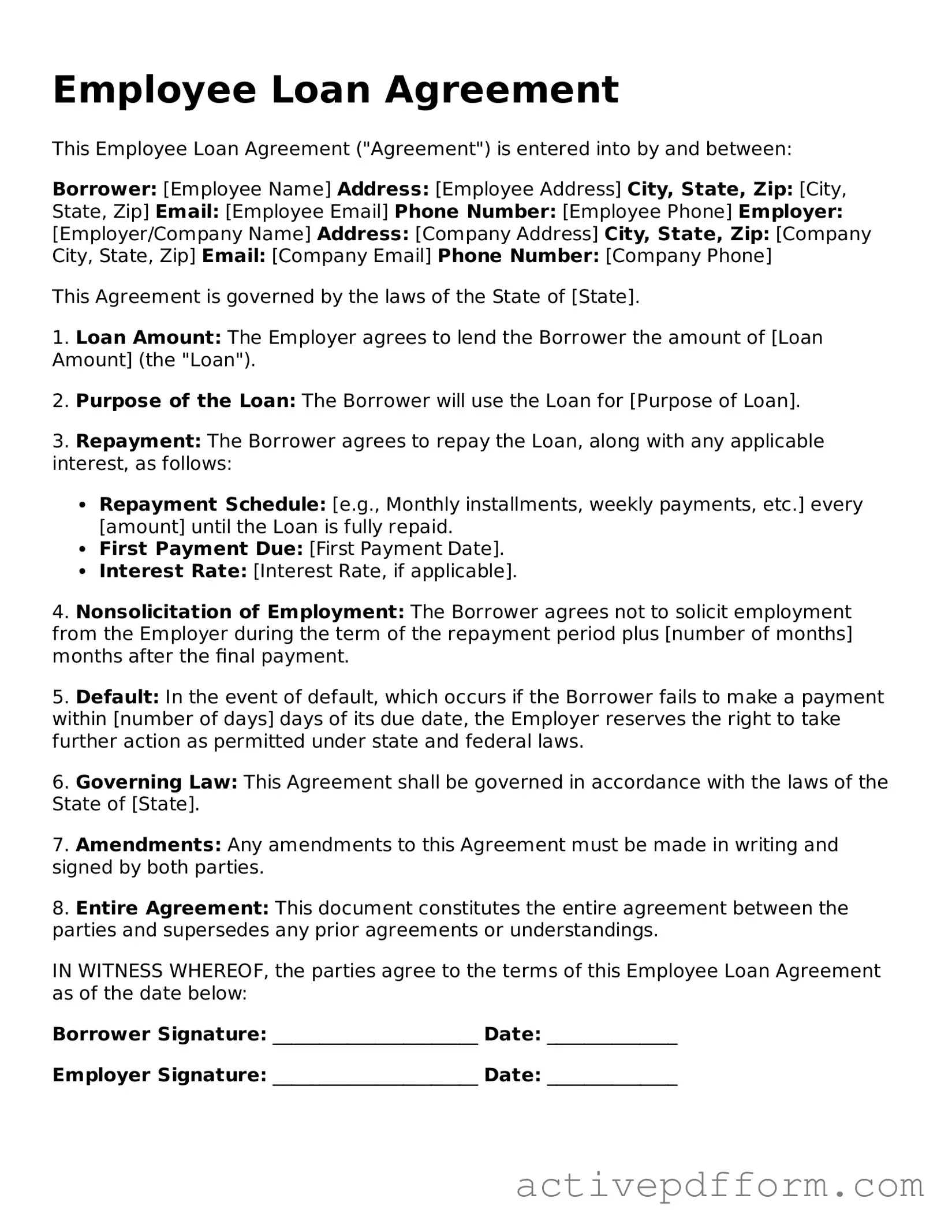

Employee Loan Agreement Example

Employee Loan Agreement

This Employee Loan Agreement ("Agreement") is entered into by and between:

Borrower: [Employee Name] Address: [Employee Address] City, State, Zip: [City, State, Zip] Email: [Employee Email] Phone Number: [Employee Phone] Employer: [Employer/Company Name] Address: [Company Address] City, State, Zip: [Company City, State, Zip] Email: [Company Email] Phone Number: [Company Phone]

This Agreement is governed by the laws of the State of [State].

1. Loan Amount: The Employer agrees to lend the Borrower the amount of [Loan Amount] (the "Loan").

2. Purpose of the Loan: The Borrower will use the Loan for [Purpose of Loan].

3. Repayment: The Borrower agrees to repay the Loan, along with any applicable interest, as follows:

- Repayment Schedule: [e.g., Monthly installments, weekly payments, etc.] every [amount] until the Loan is fully repaid.

- First Payment Due: [First Payment Date].

- Interest Rate: [Interest Rate, if applicable].

4. Nonsolicitation of Employment: The Borrower agrees not to solicit employment from the Employer during the term of the repayment period plus [number of months] months after the final payment.

5. Default: In the event of default, which occurs if the Borrower fails to make a payment within [number of days] days of its due date, the Employer reserves the right to take further action as permitted under state and federal laws.

6. Governing Law: This Agreement shall be governed in accordance with the laws of the State of [State].

7. Amendments: Any amendments to this Agreement must be made in writing and signed by both parties.

8. Entire Agreement: This document constitutes the entire agreement between the parties and supersedes any prior agreements or understandings.

IN WITNESS WHEREOF, the parties agree to the terms of this Employee Loan Agreement as of the date below:

Borrower Signature: ______________________ Date: ______________

Employer Signature: ______________________ Date: ______________

Understanding Employee Loan Agreement

What is an Employee Loan Agreement?

An Employee Loan Agreement is a formal document outlining the terms and conditions under which an employer provides a loan to an employee. This agreement typically includes details such as the loan amount, interest rate, repayment schedule, and any other obligations or rights of both parties. It serves to protect both the employer and employee by clearly defining the expectations and responsibilities associated with the loan.

Who is eligible to apply for an Employee Loan?

Eligibility for an Employee Loan often depends on the specific policies of the employer. Generally, full-time employees who have completed a certain period of service with the company may qualify. Some employers may also consider factors such as the employee's credit history, current financial obligations, and overall job performance. It is important for employees to review their company's specific guidelines to understand their eligibility.

What should I consider before taking an Employee Loan?

Before proceeding with an Employee Loan, it’s crucial to assess your financial situation. Consider the total amount you need and how it aligns with your ability to repay it. Review the interest rate and repayment terms, as these can significantly impact your budget. Additionally, think about how the loan might affect your job security and relationship with your employer. Open communication with your HR department can provide clarity and help you make an informed decision.

How is the repayment process structured?

The repayment process for an Employee Loan is typically outlined in the agreement. Common structures include fixed monthly payments or deductions from the employee's paycheck. The agreement will specify the duration of the loan and any interest that may accrue. Employees should be aware of the repayment schedule and any penalties for late payments to avoid complications. It is advisable to keep track of payments and maintain communication with the employer if any financial difficulties arise.

What happens if I cannot repay the loan?

If an employee finds themselves unable to repay the loan, it is essential to communicate this situation to the employer as soon as possible. The Employee Loan Agreement may include provisions for renegotiating terms or extending the repayment period. Failing to address repayment issues could lead to negative consequences, such as deductions from future wages or damage to the employee-employer relationship. Seeking assistance early on can lead to more favorable outcomes.

Dos and Don'ts

When filling out an Employee Loan Agreement form, it's essential to approach the process with care. Here are some key dos and don'ts to keep in mind:

- Do read the entire agreement carefully before signing.

- Do provide accurate personal and employment information.

- Do understand the terms of repayment, including interest rates and deadlines.

- Do ask questions if any part of the agreement is unclear.

- Don't rush through the form; take your time to ensure accuracy.

- Don't leave any sections blank; fill in all required fields.

- Don't ignore the consequences of defaulting on the loan.

Following these guidelines can help ensure a smooth process when dealing with an Employee Loan Agreement. Clarity and attention to detail are your best allies in this endeavor.