Blank Durable Power of Attorney Document

Planning for the future is a vital aspect of ensuring that your wishes are respected, especially when it comes to financial and healthcare decisions. One important tool in this planning process is the Durable Power of Attorney (DPOA) form. This legal document allows you to designate a trusted individual, known as your agent or attorney-in-fact, to make decisions on your behalf should you become unable to do so yourself. Unlike a regular power of attorney, the durable version remains effective even if you become incapacitated, providing peace of mind that your affairs will be managed according to your preferences. The form typically outlines the specific powers granted to your agent, which can range from handling financial transactions to making healthcare choices. It is essential to consider who you trust to act in your best interests, as this person will have significant authority over your matters. Additionally, understanding the nuances of the DPOA, including how it can be revoked or modified, ensures that you maintain control over your decisions throughout your life. As you navigate the complexities of this important document, knowing its implications can help safeguard your future and provide clarity for your loved ones.

Durable Power of Attorney - Designed for Individual States

Document Attributes

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney allows an individual (the principal) to designate someone else (the agent) to make decisions on their behalf, even if they become incapacitated. |

| Durability | This type of power of attorney remains effective even after the principal loses the ability to make decisions due to illness or disability. |

| State-Specific Forms | Each state has its own requirements and forms for a Durable Power of Attorney. For example, in California, it is governed by the California Probate Code, Section 4400. |

| Agent's Authority | The agent can have broad or limited authority, depending on how the document is drafted. This can include financial matters, healthcare decisions, or both. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent to do so. |

| Importance | Having a Durable Power of Attorney is crucial for ensuring that your wishes are followed and that someone you trust can manage your affairs when you cannot. |

Similar forms

A Durable Power of Attorney (DPOA) is an important legal document that allows one person to act on behalf of another in financial or legal matters. There are several other documents that serve similar purposes or provide related powers. Below is a list of these documents, each explained for clarity.

- General Power of Attorney: This document grants broad authority to someone to act on your behalf in various matters, but it typically becomes invalid if you become incapacitated.

- Healthcare Power of Attorney: Similar to a DPOA, this document allows someone to make medical decisions for you if you are unable to do so yourself. It focuses specifically on health-related matters.

- California LLC 12 Form: To maintain your LLC’s active status, ensure timely filing of the California PDF Forms within the required timeframes.

- Living Will: While not a power of attorney, a living will outlines your wishes regarding medical treatment in situations where you cannot communicate. It complements a Healthcare Power of Attorney.

- Revocable Trust: This legal arrangement allows you to manage your assets during your lifetime and specifies how they should be distributed after your death. It can provide similar benefits in terms of asset management.

- Advance Healthcare Directive: This combines a living will and a healthcare power of attorney, detailing your healthcare preferences and appointing someone to make decisions on your behalf.

- Financial Power of Attorney: This document specifically grants someone the authority to handle financial matters, such as banking, investments, and property management, similar to a DPOA.

- Special Power of Attorney: This grants authority for specific tasks or transactions, rather than a broad range of powers. It can be tailored to particular needs, much like a DPOA.

- Guardianship Document: This legal arrangement appoints someone to make decisions for a minor or an incapacitated adult, similar to the decision-making powers granted by a DPOA.

- Executor Appointment: This document names someone to manage your estate after your death. While it comes into effect after your passing, it shares the responsibility of overseeing your affairs with a DPOA.

Understanding these documents can help ensure that your wishes are honored and that the right people are in place to make decisions on your behalf when needed. Each document serves a specific purpose, and choosing the right one depends on your individual circumstances.

Durable Power of Attorney Example

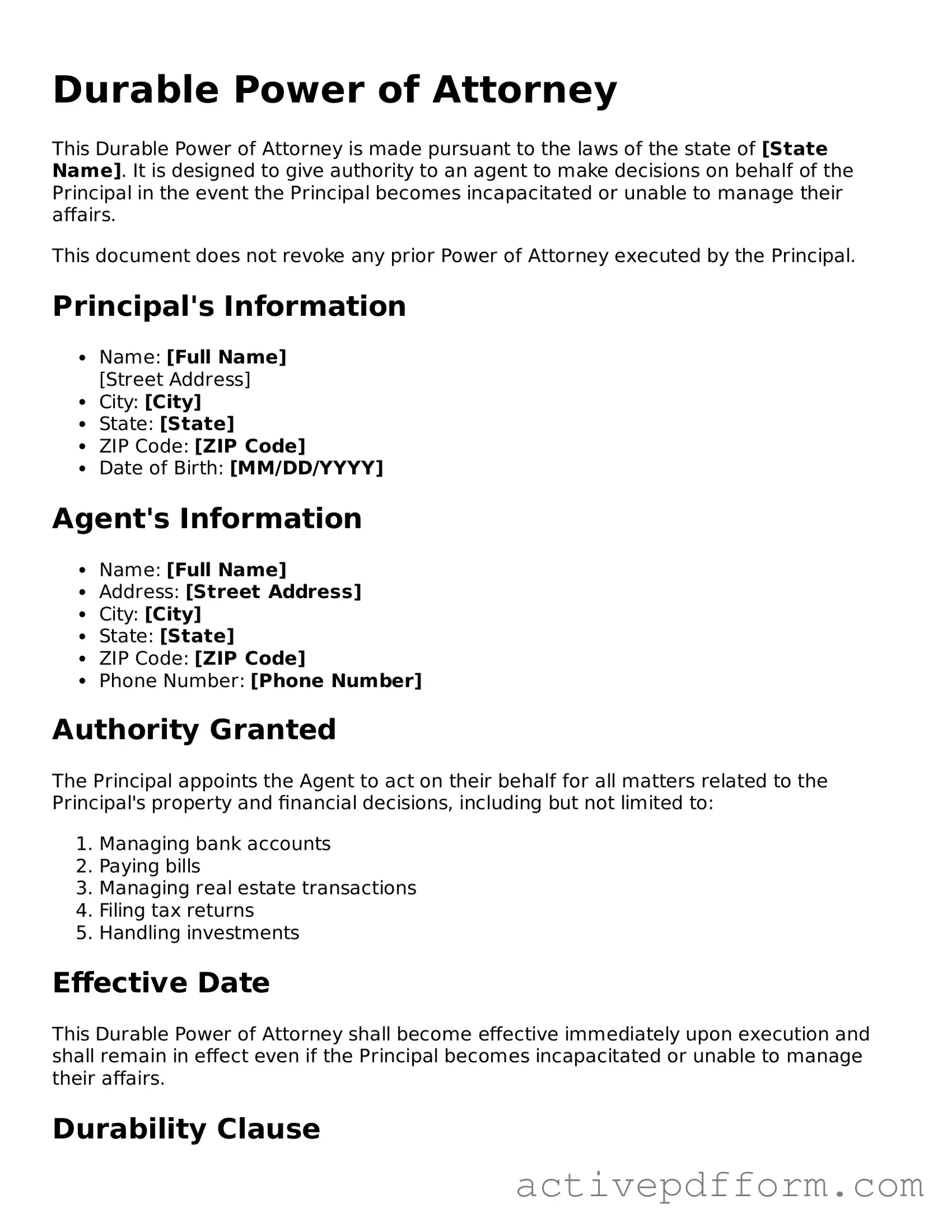

Durable Power of Attorney

This Durable Power of Attorney is made pursuant to the laws of the state of [State Name]. It is designed to give authority to an agent to make decisions on behalf of the Principal in the event the Principal becomes incapacitated or unable to manage their affairs.

This document does not revoke any prior Power of Attorney executed by the Principal.

Principal's Information

- Name: [Full Name]

- City: [City]

- State: [State]

- ZIP Code: [ZIP Code]

- Date of Birth: [MM/DD/YYYY]

Agent's Information

- Name: [Full Name]

- Address: [Street Address]

- City: [City]

- State: [State]

- ZIP Code: [ZIP Code]

- Phone Number: [Phone Number]

Authority Granted

The Principal appoints the Agent to act on their behalf for all matters related to the Principal's property and financial decisions, including but not limited to:

- Managing bank accounts

- Paying bills

- Managing real estate transactions

- Filing tax returns

- Handling investments

Effective Date

This Durable Power of Attorney shall become effective immediately upon execution and shall remain in effect even if the Principal becomes incapacitated or unable to manage their affairs.

Durability Clause

This Power of Attorney shall not be affected by the subsequent disability or incapacity of the Principal.

Signature

By signing below, the Principal affirms that they are of sound mind and are executing this Durable Power of Attorney voluntarily.

Principal's Signature: ________________________________

Date: ________________________________

Witness Signature: ________________________________

Date: ________________________________

Agent's Signature: ________________________________

Date: ________________________________

Understanding Durable Power of Attorney

What is a Durable Power of Attorney?

A Durable Power of Attorney (DPOA) is a legal document that allows you to appoint someone to make decisions on your behalf if you become unable to do so. Unlike a regular power of attorney, a DPOA remains effective even if you become incapacitated. This ensures that your financial and legal matters can be managed without interruption.

Who should I appoint as my agent?

Choosing the right agent is crucial. Ideally, your agent should be someone you trust implicitly, such as a family member, close friend, or professional advisor. Consider their ability to handle financial matters and their willingness to act in your best interest. Communication about your wishes and values is also important to ensure they understand your preferences.

What powers can I grant my agent?

You have the flexibility to grant a wide range of powers to your agent. These can include managing bank accounts, paying bills, buying or selling property, and making investment decisions. You can also limit the powers to specific tasks or areas. It’s essential to be clear about what you want your agent to handle.

How does a Durable Power of Attorney become effective?

A Durable Power of Attorney can become effective immediately upon signing, or you can specify that it only takes effect upon your incapacity. If you choose the latter, you may need to provide medical documentation to confirm your inability to make decisions. This ensures that your agent can step in when needed.

Can I revoke or change my Durable Power of Attorney?

Yes, you can revoke or change your Durable Power of Attorney at any time, as long as you are mentally competent. To revoke it, you should create a written statement indicating your intent to cancel the document. Notify your agent and any relevant institutions, such as banks or healthcare providers, to prevent confusion.

What happens if I don’t have a Durable Power of Attorney?

If you become incapacitated without a Durable Power of Attorney in place, your loved ones may need to go through a lengthy and potentially costly court process to gain the authority to make decisions on your behalf. This can lead to delays and added stress during an already challenging time.

Are there any risks associated with a Durable Power of Attorney?

While a Durable Power of Attorney can be a powerful tool, there are risks involved. If your agent misuses their authority, it could lead to financial loss or disputes among family members. It’s important to choose someone trustworthy and to regularly review the document to ensure it aligns with your current wishes.

Do I need a lawyer to create a Durable Power of Attorney?

While it’s not legally required to have a lawyer draft your Durable Power of Attorney, consulting one can be beneficial. A lawyer can help ensure that the document meets state laws and accurately reflects your wishes. If you choose to create one on your own, make sure to follow your state’s requirements carefully.

Dos and Don'ts

When filling out a Durable Power of Attorney form, it’s essential to approach the process thoughtfully. Here are some important do's and don'ts to keep in mind:

- Do choose a trusted individual as your agent. This person will have significant authority over your financial and medical decisions.

- Do clearly outline the powers you are granting. Specify what decisions your agent can make on your behalf.

- Do sign the document in front of a notary public. This step adds an extra layer of validity to the form.

- Do discuss your wishes with your agent beforehand. Open communication can prevent misunderstandings later.

- Don't leave any sections blank. Incomplete forms can lead to confusion and may not be honored.

- Don't forget to keep copies of the signed document. Ensure that your agent and any relevant parties have access to it.

By following these guidelines, you can ensure that your Durable Power of Attorney form is filled out correctly and reflects your intentions accurately.

Consider More Types of Durable Power of Attorney Templates

Power of Attorney Letter for Car - This document can also be revoked or amended by the vehicle owner at any time.

How to Revoke a Power of Attorney in California - Revocation is effective immediately upon submission of this form.

The Missouri Tractor Bill of Sale form is a crucial legal document for anyone involved in the buying or selling of a tractor, ensuring a transparent transfer of ownership. To make this process smoother and more efficient, you can utilize the Tractor Bill of Sale form, which outlines all necessary details for both parties.

Sample of Power of Attorney to Sell Property - Delegate administrative property tasks effectively with a Real Estate Power of Attorney.