Blank Deed of Trust Document

A Deed of Trust is a crucial legal document that plays a significant role in real estate transactions, particularly when it comes to securing a loan. This form involves three key parties: the borrower, the lender, and a neutral third party known as the trustee. In essence, the borrower conveys the property title to the trustee, who holds it as collateral for the loan until the borrower fulfills their repayment obligations. The Deed of Trust outlines the terms of the loan, including the amount borrowed, interest rates, and repayment schedule, ensuring that all parties are clear on their responsibilities. Additionally, it provides a framework for what happens if the borrower defaults on the loan, including the process for foreclosure. Understanding the intricacies of a Deed of Trust is vital for anyone involved in real estate, as it not only protects the lender’s investment but also clarifies the borrower’s rights and obligations. By grasping the major aspects of this form, individuals can navigate the complexities of property financing with greater confidence.

Document Attributes

| Fact Name | Description |

|---|---|

| Definition | A Deed of Trust is a legal document that secures a loan by transferring the title of the property to a trustee until the loan is repaid. |

| Parties Involved | Typically, there are three parties: the borrower (trustor), the lender (beneficiary), and the trustee. |

| Purpose | The primary purpose is to protect the lender's interest in the property while allowing the borrower to retain possession. |

| State-Specific Forms | Each state may have its own version of the Deed of Trust, reflecting local laws and regulations. |

| Governing Law | In California, for instance, the Deed of Trust is governed by the California Civil Code. |

| Foreclosure Process | In the event of default, the trustee can initiate a non-judicial foreclosure process, which is typically faster than judicial foreclosure. |

| Recording | To be enforceable against third parties, a Deed of Trust must be recorded in the county where the property is located. |

| Rights of the Borrower | The borrower retains the right to occupy the property and make decisions regarding its use, as long as the loan is in good standing. |

| Trustee's Role | The trustee acts as a neutral third party who holds the title and manages the foreclosure process if necessary. |

| Common Usage | Deeds of Trust are commonly used in many states, including California, Texas, and Virginia, as a means to secure real estate loans. |

Similar forms

- Mortgage: Both a deed of trust and a mortgage are used to secure a loan with real property. In a mortgage, the borrower retains ownership of the property while the lender has a lien on it. A deed of trust involves a third party, known as a trustee, who holds the title until the loan is repaid.

- Deed form: A Georgia Deed form is essential for the transfer of property ownership within the state. For more information on how to properly complete this document, visit georgiapdf.com/deed/.

- Promissory Note: This document outlines the borrower's obligation to repay the loan. While a deed of trust secures the loan with the property, the promissory note details the terms, including interest rates and repayment schedules.

- Security Agreement: Similar to a deed of trust, a security agreement is used to secure a loan with collateral. However, security agreements are typically used for personal property rather than real estate, making them more common in business loans.

- Loan Agreement: This document encompasses the terms of the loan, including interest rates, payment schedules, and penalties for late payments. A deed of trust is often referenced within a loan agreement as the security for the loan.

- Quitclaim Deed: While not used for securing loans, a quitclaim deed transfers ownership of property. It is similar in that it involves real estate, but it does not create a security interest like a deed of trust does.

- Title Insurance Policy: This document protects the lender and borrower from losses due to defects in the title. While a deed of trust secures the loan, title insurance ensures that the property's title is clear, providing additional security for the lender.

Deed of Trust Example

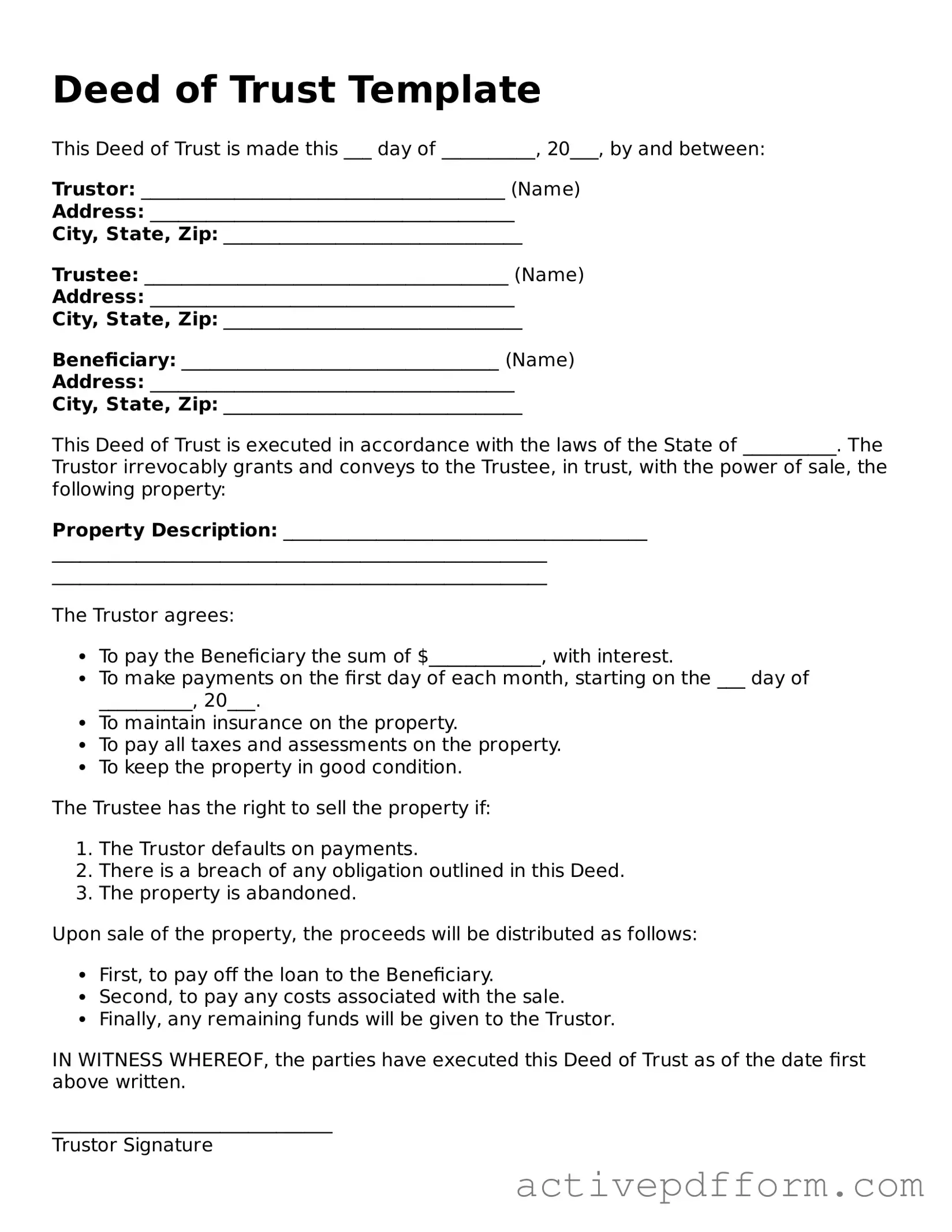

Deed of Trust Template

This Deed of Trust is made this ___ day of __________, 20___, by and between:

Trustor: _______________________________________ (Name)

Address: _______________________________________

City, State, Zip: ________________________________

Trustee: _______________________________________ (Name)

Address: _______________________________________

City, State, Zip: ________________________________

Beneficiary: __________________________________ (Name)

Address: _______________________________________

City, State, Zip: ________________________________

This Deed of Trust is executed in accordance with the laws of the State of __________. The Trustor irrevocably grants and conveys to the Trustee, in trust, with the power of sale, the following property:

Property Description: _______________________________________

_____________________________________________________

_____________________________________________________

The Trustor agrees:

- To pay the Beneficiary the sum of $____________, with interest.

- To make payments on the first day of each month, starting on the ___ day of __________, 20___.

- To maintain insurance on the property.

- To pay all taxes and assessments on the property.

- To keep the property in good condition.

The Trustee has the right to sell the property if:

- The Trustor defaults on payments.

- There is a breach of any obligation outlined in this Deed.

- The property is abandoned.

Upon sale of the property, the proceeds will be distributed as follows:

- First, to pay off the loan to the Beneficiary.

- Second, to pay any costs associated with the sale.

- Finally, any remaining funds will be given to the Trustor.

IN WITNESS WHEREOF, the parties have executed this Deed of Trust as of the date first above written.

______________________________

Trustor Signature

______________________________

Trustee Signature

______________________________

Beneficiary Signature

Notarization:

State of __________

County of __________

Subscribed and sworn to before me this ___ day of __________, 20___.

______________________________

Notary Public

My commission expires: ________________

Understanding Deed of Trust

What is a Deed of Trust?

A Deed of Trust is a legal document that secures a loan by transferring the title of a property to a trustee. This arrangement involves three parties: the borrower (trustor), the lender (beneficiary), and the trustee. The trustee holds the title until the borrower repays the loan in full.

How does a Deed of Trust differ from a mortgage?

While both a Deed of Trust and a mortgage serve to secure a loan, they differ in structure and enforcement. A mortgage involves two parties: the borrower and the lender. In contrast, a Deed of Trust adds a third party, the trustee, who holds the title and can initiate foreclosure if the borrower defaults.

What are the key components of a Deed of Trust?

A Deed of Trust typically includes the names of the parties involved, a description of the property, the loan amount, the terms of repayment, and the rights and responsibilities of each party. It may also outline what happens in case of default.

What happens if the borrower defaults on the loan?

If the borrower defaults, the trustee has the authority to initiate foreclosure proceedings. This process allows the property to be sold to recover the outstanding loan amount. The specific steps and timeline for foreclosure can vary by state.

Is a Deed of Trust recorded with the county?

Yes, a Deed of Trust is typically recorded with the county where the property is located. This recording provides public notice of the lender's interest in the property and protects the lender's rights in the event of a default.

Can a Deed of Trust be refinanced?

Yes, a borrower can refinance a loan secured by a Deed of Trust. This process usually involves paying off the existing loan and creating a new loan, which may require a new Deed of Trust. The borrower should consult with their lender to understand the specific steps involved.

What are the benefits of using a Deed of Trust?

A Deed of Trust can offer several advantages. It typically allows for a quicker foreclosure process compared to a mortgage. Additionally, it provides a clear structure for the responsibilities of each party involved, which can help prevent disputes.

Who can serve as a trustee in a Deed of Trust?

A trustee can be an individual or an institution, such as a bank or title company. The trustee must be impartial and cannot have a vested interest in the loan. It’s essential to choose a reliable trustee, as their role is crucial in managing the property title and handling foreclosure if necessary.

Can a Deed of Trust be modified?

Yes, a Deed of Trust can be modified, but this typically requires the consent of all parties involved. Modifications may include changes to the loan terms, such as interest rates or repayment schedules. It is advisable to document any changes formally to ensure clarity and legal enforceability.

Dos and Don'ts

When filling out the Deed of Trust form, it’s important to pay attention to details. Here are some things you should and shouldn’t do:

- Do read the instructions carefully before starting.

- Do ensure all names and addresses are accurate.

- Do sign the document in the presence of a notary.

- Do keep a copy for your records after submission.

- Do double-check the dates and amounts listed.

- Don’t leave any sections blank unless instructed.

- Don’t use white-out to correct mistakes.

- Don’t rush through the process; take your time.

- Don’t forget to include any required attachments.

- Don’t submit the form without reviewing it first.

Consider More Types of Deed of Trust Templates

Does California Have a Transfer on Death Deed - Tax implications may exist for beneficiaries receiving property via a Transfer-on-Death Deed; consulting a tax advisor can be worthwhile.

For those navigating property transfers, understanding the implications of a quitclaim deed is essential. A simple Texas Quitclaim Deed allows individuals to convey their rights in a property without the promise of a clear title, making it a practical choice in certain circumstances.

How to Get a Quit Claim Deed - Used frequently in estate planning situations.