Blank Deed in Lieu of Foreclosure Document

When homeowners face the daunting prospect of foreclosure, they often seek alternatives that can help them avoid the severe repercussions of losing their property. One such option is the Deed in Lieu of Foreclosure, a legal document that allows a borrower to voluntarily transfer ownership of their property back to the lender in exchange for the cancellation of their mortgage debt. This process can be a win-win situation, as it enables homeowners to sidestep the lengthy and often stressful foreclosure process while providing lenders with a straightforward way to reclaim their asset. The Deed in Lieu of Foreclosure form typically includes essential details such as the property description, the parties involved, and any conditions that must be met for the transfer to be valid. Additionally, it may outline any potential liabilities the borrower might still face post-transfer, making it crucial for homeowners to fully understand the implications before proceeding. By exploring this option, individuals can find a path toward financial relief and a fresh start, but it’s important to navigate the process with care and awareness.

Deed in Lieu of Foreclosure - Designed for Individual States

Document Attributes

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal agreement where a homeowner voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Voluntary Process | The process is voluntary, meaning the homeowner agrees to give up their property rather than face foreclosure proceedings. |

| Benefits for Homeowners | This option can help homeowners avoid the lengthy and stressful foreclosure process, potentially protecting their credit score. |

| Benefits for Lenders | Lenders may find this process beneficial as it allows them to avoid the costs and delays associated with foreclosure. |

| State-Specific Forms | Many states have specific forms that must be used for a Deed in Lieu of Foreclosure. For example, California follows Civil Code Section 2929.5. |

| Legal Advice Recommended | Homeowners are advised to seek legal counsel before entering into a Deed in Lieu of Foreclosure to understand their rights and obligations. |

| Impact on Credit Score | While a Deed in Lieu of Foreclosure may have a less severe impact on a credit score compared to foreclosure, it can still negatively affect creditworthiness. |

| Tax Implications | Homeowners should be aware of potential tax implications, as forgiven debt may be considered taxable income under certain circumstances. |

| Deficiency Judgments | In some states, lenders may pursue deficiency judgments if the property sells for less than the outstanding mortgage balance, even after a Deed in Lieu. |

| Alternative Options | Homeowners should consider alternatives such as loan modifications or short sales, which may be more beneficial in certain situations. |

Similar forms

- Loan Modification Agreement: This document allows a borrower and lender to change the terms of an existing loan. Similar to a deed in lieu of foreclosure, it aims to avoid foreclosure by making payments more manageable for the borrower.

- Short Sale Agreement: In a short sale, the lender agrees to accept less than the total amount owed on the mortgage. Like a deed in lieu of foreclosure, it provides a way for the homeowner to avoid foreclosure and minimize financial damage.

- Transfer-on-Death Deed: The Arizona Transfer-on-Death Deed form allows property owners to designate beneficiaries who will receive their property upon their passing, without the need for probate. This legal document can simplify the transfer of property and provide clarity for heirs, ensuring that assets are distributed according to the owner's wishes. To start the process of securing your property for future beneficiaries, consider filling out the form by clicking the button below. For more information, visit Arizona PDF Forms.

- Forbearance Agreement: This document temporarily suspends or reduces mortgage payments for a specified period. It is similar to a deed in lieu because both aim to help homeowners keep their homes while addressing financial hardships.

- Mortgage Release or Satisfaction: This document signifies that a borrower has paid off their mortgage, or the lender has agreed to release the borrower from the obligation. It relates to a deed in lieu of foreclosure in that both documents can conclude a mortgage agreement without foreclosure.

- Repayment Plan: A repayment plan outlines how a borrower will repay missed mortgage payments over time. This document shares similarities with a deed in lieu of foreclosure by offering a solution to avoid losing the home.

- Quitclaim Deed: A quitclaim deed transfers ownership of property from one party to another without guaranteeing that the title is clear. It is similar to a deed in lieu of foreclosure in that both involve the transfer of property ownership, often to resolve financial issues.

- Bankruptcy Filing: Filing for bankruptcy can halt foreclosure proceedings and allow for debt restructuring. This document is similar to a deed in lieu of foreclosure because both provide a way to manage financial distress without losing a home.

- Property Settlement Agreement: This agreement outlines the division of property and debts during a divorce or separation. Like a deed in lieu, it can involve the transfer of property ownership to resolve financial obligations.

Deed in Lieu of Foreclosure Example

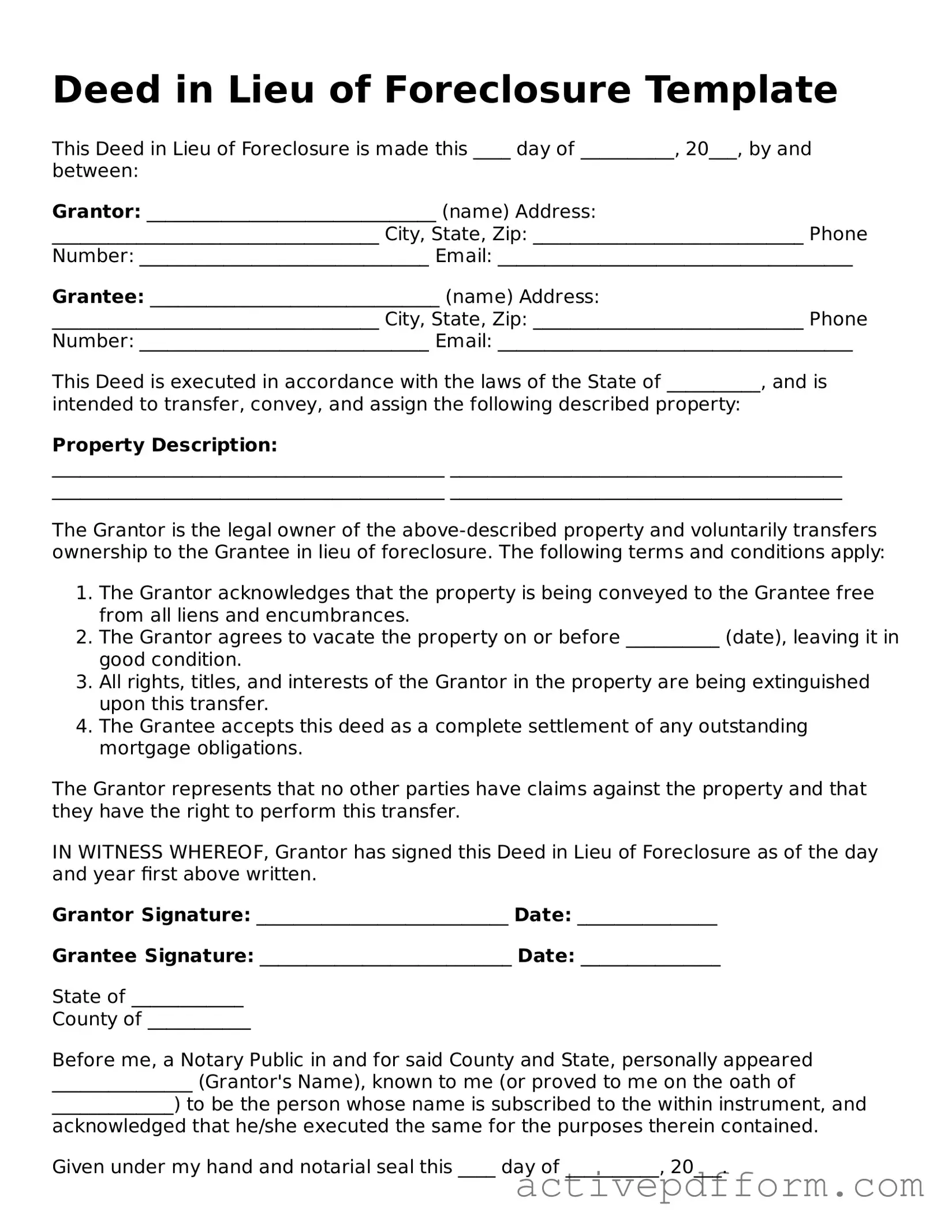

Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made this ____ day of __________, 20___, by and between:

Grantor: _______________________________ (name) Address: ___________________________________ City, State, Zip: _____________________________ Phone Number: _______________________________ Email: ______________________________________

Grantee: _______________________________ (name) Address: ___________________________________ City, State, Zip: _____________________________ Phone Number: _______________________________ Email: ______________________________________

This Deed is executed in accordance with the laws of the State of __________, and is intended to transfer, convey, and assign the following described property:

Property Description:

__________________________________________

__________________________________________

__________________________________________

__________________________________________

The Grantor is the legal owner of the above-described property and voluntarily transfers ownership to the Grantee in lieu of foreclosure. The following terms and conditions apply:

- The Grantor acknowledges that the property is being conveyed to the Grantee free from all liens and encumbrances.

- The Grantor agrees to vacate the property on or before __________ (date), leaving it in good condition.

- All rights, titles, and interests of the Grantor in the property are being extinguished upon this transfer.

- The Grantee accepts this deed as a complete settlement of any outstanding mortgage obligations.

The Grantor represents that no other parties have claims against the property and that they have the right to perform this transfer.

IN WITNESS WHEREOF, Grantor has signed this Deed in Lieu of Foreclosure as of the day and year first above written.

Grantor Signature: ___________________________ Date: _______________

Grantee Signature: ___________________________ Date: _______________

State of ____________

County of ___________

Before me, a Notary Public in and for said County and State, personally appeared _______________ (Grantor's Name), known to me (or proved to me on the oath of _____________) to be the person whose name is subscribed to the within instrument, and acknowledged that he/she executed the same for the purposes therein contained.

Given under my hand and notarial seal this ____ day of __________, 20___.

Notary Public Signature: ___________________________

My Commission Expires: _________________________

Understanding Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal agreement where a homeowner voluntarily transfers ownership of their property to the lender to avoid foreclosure. This process can help the homeowner escape the lengthy and stressful foreclosure process while allowing the lender to take possession of the property more quickly.

How does a Deed in Lieu of Foreclosure work?

In this arrangement, the homeowner signs a deed that transfers the property to the lender. In return, the lender typically agrees to cancel the mortgage debt, relieving the homeowner of their financial obligation. Both parties must agree to the terms, and it’s important to ensure that the property is free of other liens to proceed smoothly.

What are the benefits of a Deed in Lieu of Foreclosure?

One major benefit is the potential for a quicker resolution compared to foreclosure. Homeowners can avoid the negative impact on their credit score that comes with foreclosure. Additionally, it may provide an opportunity for the homeowner to negotiate relocation assistance from the lender.

Are there any drawbacks to a Deed in Lieu of Foreclosure?

Yes, there are potential drawbacks. While it may help avoid foreclosure, it can still affect your credit score, though typically less severely. Furthermore, not all lenders accept a Deed in Lieu, and homeowners may need to demonstrate financial hardship to qualify.

Who is eligible for a Deed in Lieu of Foreclosure?

Eligibility varies by lender, but generally, homeowners facing financial difficulties and unable to keep up with mortgage payments may qualify. It's essential to communicate openly with the lender about your situation and explore this option if you are struggling.

What should I do before considering a Deed in Lieu of Foreclosure?

Homeowners should gather all relevant financial documents and consult with a housing counselor or attorney. Understanding your rights and options is crucial. Additionally, it’s wise to contact your lender to discuss your situation and express interest in a Deed in Lieu.

Can I still live in my home during the Deed in Lieu process?

Typically, once the Deed in Lieu is executed, the homeowner must vacate the property. However, some lenders may allow a short period for the homeowner to remain in the home, often referred to as a "cash for keys" agreement. This varies by lender, so it’s essential to discuss this aspect upfront.

How does a Deed in Lieu of Foreclosure affect my credit score?

A Deed in Lieu of Foreclosure can impact your credit score, but generally less severely than a foreclosure. It may be reported as a settled account, which is more favorable than a foreclosure. However, the exact impact depends on your credit history and the reporting practices of your lender.

What is the process for completing a Deed in Lieu of Foreclosure?

The process usually involves several steps: first, the homeowner contacts the lender to express interest. Next, the lender will evaluate the homeowner's financial situation. If approved, both parties will sign the necessary documents, and the homeowner will transfer the property title to the lender. Finally, the lender will cancel the mortgage debt.

Dos and Don'ts

When filling out the Deed in Lieu of Foreclosure form, it's important to approach the process carefully. Here are nine things you should and shouldn't do:

- Do ensure you understand the implications of signing the deed.

- Do gather all necessary documents, including your mortgage agreement and proof of ownership.

- Do consult with a legal professional to clarify any uncertainties.

- Do communicate openly with your lender about your situation.

- Do keep copies of all correspondence related to the deed.

- Don't rush through the form without reviewing it thoroughly.

- Don't ignore any potential tax consequences that may arise from the deed.

- Don't forget to check if there are any liens on the property.

- Don't assume that the deed will automatically resolve all your financial issues.

Consider More Types of Deed in Lieu of Foreclosure Templates

California Corrective Deed - A Corrective Deed strengthens the legal framework of property ownership.

To gain a clearer understanding of the eviction process, landlords and tenants alike can refer to comprehensive resources, including the https://nytemplates.com/blank-notice-to-quit-template/, which provides valuable templates and guidance on the Notice to Quit form and its significance in formalizing the eviction process.

How to Get a Quit Claim Deed - Allows the right to share ownership without guarantees.

Does California Have a Transfer on Death Deed - The Transfer-on-Death Deed is effective immediately upon signing, but the transfer occurs only after the owner's death.