Free Childcare Receipt Template

The Childcare Receipt form serves as an important document for parents and childcare providers alike. This form not only provides proof of payment for childcare services but also outlines essential details such as the date of service, the amount paid, and the names of the children receiving care. Each receipt includes a space for the provider's signature, which adds a layer of authenticity and accountability. Parents can use this form for their records, and it may also be necessary for tax purposes or to qualify for certain financial assistance programs. The structure of the form allows for multiple entries, accommodating various dates and amounts, making it a versatile tool for tracking childcare expenses. By maintaining accurate records through the Childcare Receipt form, families can better manage their childcare budgets and ensure transparency in their financial dealings with providers.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of the Form | The Childcare Receipt form serves as a record of payment for childcare services. It is essential for parents to keep this document for their records and potential tax purposes. |

| Information Required | Each receipt must include the date of service, the amount paid, the name of the person making the payment, the names of the children receiving care, and the provider's signature. |

| State-Specific Laws | In many states, childcare receipts are governed by local tax laws. For example, in California, parents may use these receipts to claim childcare expenses on their state tax returns under California Revenue and Taxation Code Section 17052. |

| Record Keeping | It is advisable for parents to keep copies of all childcare receipts for at least three years. This can help in case of audits or when applying for financial aid or tax credits. |

Similar forms

-

Invoice: Like the Childcare Receipt form, an invoice provides a detailed record of services rendered, including the date, amount due, and the recipient's information. It serves as a formal request for payment and can be used for tax purposes.

-

Payment Receipt: This document confirms that a payment has been made. Similar to the Childcare Receipt, it includes the date, amount, and service details, providing proof of transaction for both parties.

-

Service Agreement: A service agreement outlines the terms of service between the provider and the client. While it may not serve as a receipt, it shares similarities in detailing the services provided and the duration of care.

-

Tax Document (Form 1099): This form is used to report income received by independent contractors. It is similar to the Childcare Receipt in that both documents track payments made for services, which can be relevant for tax filings.

-

Billing Statement: A billing statement summarizes charges over a specific period. It includes dates and amounts owed, paralleling the Childcare Receipt in providing a clear financial record for services rendered.

Civil Case Cover Sheet: The Civil Case Cover Sheet is a crucial document for initiating a civil action in California. Ensure you provide accurate information by utilizing resources such as California PDF Forms.

-

Contract for Child Care Services: This document outlines the expectations and responsibilities of both the provider and the parents. It shares similarities with the Childcare Receipt by specifying the service period and the names of the children involved.

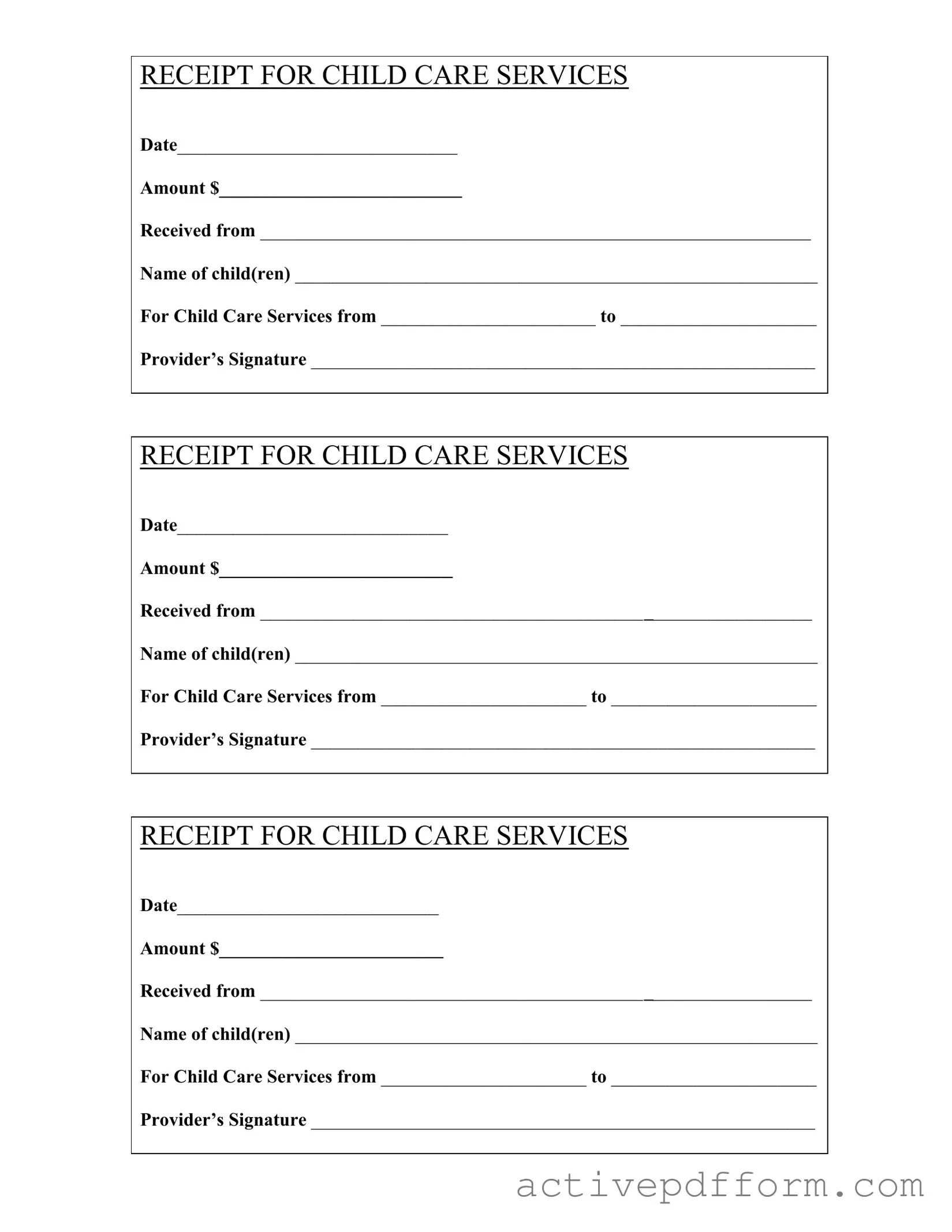

Childcare Receipt Example

RECEIPT FOR CHILD CARE SERVICES

Date______________________________

Amount $__________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from _______________________ to _____________________

Provider’s Signature ______________________________________________________

RECEIPT FOR CHILD CARE SERVICES

Date_____________________________

Amount $_________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from ______________________ to ______________________

Provider’s Signature ______________________________________________________

RECEIPT FOR CHILD CARE SERVICES

Date____________________________

Amount $________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from ______________________ to ______________________

Provider’s Signature ______________________________________________________

Understanding Childcare Receipt

What is the purpose of the Childcare Receipt form?

The Childcare Receipt form serves as an official record of payment for childcare services. It provides important details, such as the date of service, the amount paid, and the names of the children receiving care. This documentation can be essential for parents seeking reimbursement from employers or for tax purposes. Keeping accurate records helps ensure that families can easily track their childcare expenses.

What information do I need to fill out on the form?

To complete the Childcare Receipt form, you will need to provide specific information. This includes the date of the childcare service, the total amount paid, and the name of the individual or entity making the payment. Additionally, you should list the names of the children who received care and the dates for which the services were provided. Finally, the childcare provider must sign the form to validate the receipt.

How can I use the completed form?

What should I do if I lose the Childcare Receipt form?

If the Childcare Receipt form is lost, it is important to contact the childcare provider to request a duplicate. Most providers maintain records of their transactions and can issue a new receipt upon request. Ensure that you provide them with the necessary details, such as the date of service and the amount paid, to facilitate the process. Keeping digital copies of important documents can help prevent future losses.

Dos and Don'ts

When filling out the Childcare Receipt form, attention to detail is crucial. Here are seven important dos and don'ts to keep in mind:

- Do ensure that all fields are filled out completely.

- Don't leave any sections blank, as this may cause confusion.

- Do write clearly and legibly to avoid misinterpretation.

- Don't use abbreviations that may not be understood by others.

- Do double-check the dates to confirm accuracy.

- Don't forget to include the provider's signature for validation.

- Do keep a copy of the completed receipt for your records.

Check out Common Templates

Free Printable Cash Drawer Count Sheet Pdf - An essential tool for maintaining financial accuracy in retail.

Yugioh Deck List Form - Every detail shared on this form reflects your adherence to the game’s standards.

In order to navigate the complex landscape of housing in New York City, applicants often rely on comprehensive resources to guide them through the process, including the essential nytemplates.com/blank-nyc-housing-application-template, which provides a template for the NYC Housing Application Form that simplifies the initial steps toward securing a place to live.

Salary Advance Agreement - This document enables employees to communicate their financial needs clearly.