Free CBP 6059B Template

The CBP 6059B form plays a significant role in the customs process for travelers entering the United States. This form is used primarily to declare goods and items that individuals are bringing into the country, ensuring compliance with U.S. customs regulations. Travelers must complete this document to provide essential information about the items they possess, which helps customs officials assess duties and taxes accurately. The form also serves to identify any prohibited or restricted items that may not be allowed into the country, thereby safeguarding national security and public health. Additionally, it aids in the collection of data that can inform future customs policies. Understanding the requirements and implications of the CBP 6059B form is crucial for anyone planning to travel internationally, as it not only facilitates a smoother entry process but also helps avoid potential legal complications that could arise from non-compliance.

Document Specifics

| Fact Name | Description |

|---|---|

| Form Title | The CBP 6059B form is officially titled the "Customs Declaration Form." It is used for declaring goods when entering the United States. |

| Purpose | This form is designed to help U.S. Customs and Border Protection (CBP) assess the value and nature of items being brought into the country. |

| Who Needs It | All travelers entering the U.S. must complete this form if they are bringing goods that exceed a certain value or if they have specific items to declare. |

| Where to Obtain | The form is available at ports of entry, on CBP's website, and can often be filled out on international flights or cruises before arrival. |

| Submission Method | Travelers must submit the completed form to a CBP officer upon arrival in the United States. |

| Legal Basis | The requirements for the CBP 6059B form are governed by U.S. Customs laws, particularly under Title 19 of the U.S. Code. |

| Penalties for Non-Compliance | Failure to declare items can result in fines, confiscation of goods, or even legal action, emphasizing the importance of accurate reporting. |

| Information Required | The form asks for details such as the traveler's name, address, flight information, and a list of items being declared. |

| Exemptions | Some items may be exempt from declaration, such as gifts under a certain value or personal items not intended for resale. |

| Form Updates | The CBP 6059B form may be updated periodically, so it’s important to check for the most current version before travel. |

Similar forms

-

CBP Form 7501: This form is used for the entry of merchandise into the United States. Like the CBP 6059B, it collects information about the goods being imported and the parties involved in the transaction.

- Arizona Notice to Quit: This form is essential for landlords to formally request tenants to vacate, similar to how the aforementioned forms collect critical information regarding one's status; for more details, visit Arizona PDF Forms.

-

CBP Form 2865: This document is for the declaration of personal effects and household goods. Similar to the CBP 6059B, it helps customs officials understand what items are being brought into the country.

-

CBP Form 3520: Used for the declaration of certain gifts from foreign persons. This form serves a similar purpose by detailing the nature of the items and their value, just like the CBP 6059B.

-

CBP Form I-94: This arrival/departure record is issued to foreign visitors. It tracks entry into the U.S. and is similar in that it captures essential information about individuals entering the country.

-

Customs Declaration Form (Form 6059B): This is a general declaration form for travelers. It is very similar to the CBP 6059B in that it requires travelers to declare items they are bringing into the U.S.

-

Form 8840: This form is used for the closer connection exception to the substantial presence test. It requires personal information and is similar in its need for detailed reporting, like the CBP 6059B.

-

Form 8843: This is a statement for exempt individuals and individuals with a medical condition. Like the CBP 6059B, it gathers specific information about the individual’s status and presence in the U.S.

-

Form 1040NR: This is the U.S. Nonresident Alien Income Tax Return. It requires detailed information about income and residency, paralleling the CBP 6059B in its thoroughness.

-

Form I-20: Issued to international students, this form outlines their eligibility for study in the U.S. It is similar in that it provides critical information about the individual’s status in the country.

-

Form DS-160: This is the Online Nonimmigrant Visa Application. It collects extensive personal information, akin to the CBP 6059B, to facilitate entry into the U.S.

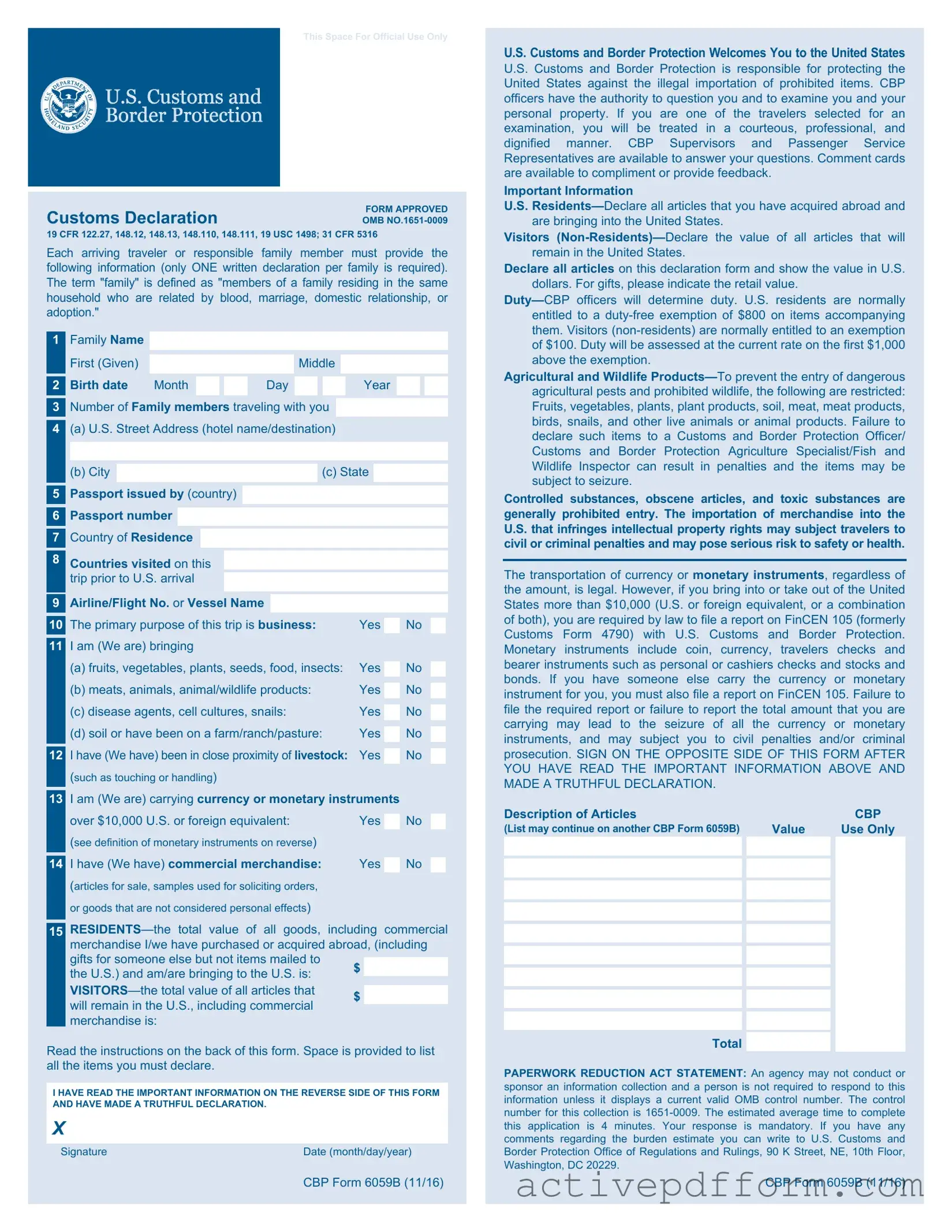

CBP 6059B Example

This Space For Official Use Only

Customs Declaration |

FORM APPROVED |

OMB |

19 CFR 122.27, 148.12, 148.13, 148.110, 148.111, 19 USC 1498; 31 CFR 5316

Each arriving traveler or responsible family member must provide the following information (only ONE written declaration per family is required). The term "family" is defined as "members of a family residing in the same household who are related by blood, marriage, domestic relationship, or adoption."

1Family Name

|

First (Given) |

|

|

|

|

|

Middle |

|

|

|

|

|||

|

Birth date |

Month |

|

|

|

Day |

|

|

|

|

Year |

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

||||

3Number of Family members traveling with you

4(a) U.S. Street Address (hotel name/destination)

(b) City  (c) State

(c) State

5Passport issued by (country)

6Passport number

7Country of Residence

8 Countries visited on this

trip prior to U.S. arrival

9 |

Airline/Flight No. or Vessel Name |

|

|

|

|

|

|

|

The primary purpose of this trip is business: |

|

|

|

|

|

|

10 |

Yes |

|

No |

|

|

||

11I am (We are) bringing

(a)fruits, vegetables, plants, seeds, food, insects: Yes  No

No

(b) meats, animals, animal/wildlife products: |

Yes |

|

No |

|

(c) disease agents, cell cultures, snails: |

Yes |

|

No |

|

|

|

|||

(d) soil or have been on a farm/ranch/pasture: |

Yes |

|

No |

|

|

|

12I have (We have) been in close proximity of livestock: Yes  No (such as touching or handling)

No (such as touching or handling)

13I am (We are) carrying currency or monetary instruments

|

over $10,000 U.S. or foreign equivalent: |

Yes |

|

No |

|

|

(see definition of monetary instruments on reverse) |

|

|

|

|

|

|

|

|

|

|

14 |

I have (We have) commercial merchandise: |

Yes |

|

No |

|

|

|

||||

|

(articles for sale, samples used for soliciting orders, |

|

|

|

|

|

or goods that are not considered personal effects) |

|

|

|

|

|

|

|

|

|

|

|

|||

15 |

|||

|

merchandise I/we have purchased or acquired abroad, (including |

||

|

gifts for someone else but not items mailed to |

$ |

|

|

|

||

|

the U.S.) and am/are bringing to the U.S. is: |

|

|

|

|

|

|

|

$ |

|

|

|

|

||

|

will remain in the U.S., including commercial |

|

|

|

|

|

|

|

merchandise is: |

|

|

Read the instructions on the back of this form. Space is provided to list all the items you must declare.

I HAVE READ THE IMPORTANT INFORMATION ON THE REVERSE SIDE OF THIS FORM AND HAVE MADE A TRUTHFUL DECLARATION.

X

Signature |

Date (month/day/year) |

U.S. Customs and Border Protection Welcomes You to the United States

U.S. Customs and Border Protection is responsible for protecting the United States against the illegal importation of prohibited items. CBP officers have the authority to question you and to examine you and your personal property. If you are one of the travelers selected for an examination, you will be treated in a courteous, professional, and dignified manner. CBP Supervisors and Passenger Service Representatives are available to answer your questions. Comment cards are available to compliment or provide feedback.

Important Information

U.S.

Visitors

Declare all articles on this declaration form and show the value in U.S. dollars. For gifts, please indicate the retail value.

Agricultural and Wildlife

Controlled substances, obscene articles, and toxic substances are generally prohibited entry. The importation of merchandise into the U.S. that infringes intellectual property rights may subject travelers to civil or criminal penalties and may pose serious risk to safety or health.

The transportation of currency or monetary instruments, regardless of the amount, is legal. However, if you bring into or take out of the United States more than $10,000 (U.S. or foreign equivalent, or a combination of both), you are required by law to file a report on FinCEN 105 (formerly Customs Form 4790) with U.S. Customs and Border Protection. Monetary instruments include coin, currency, travelers checks and bearer instruments such as personal or cashiers checks and stocks and bonds. If you have someone else carry the currency or monetary instrument for you, you must also file a report on FinCEN 105. Failure to file the required report or failure to report the total amount that you are carrying may lead to the seizure of all the currency or monetary instruments, and may subject you to civil penalties and/or criminal prosecution. SIGN ON THE OPPOSITE SIDE OF THIS FORM AFTER YOU HAVE READ THE IMPORTANT INFORMATION ABOVE AND MADE A TRUTHFUL DECLARATION.

Description of Articles |

|

|

CBP |

(List may continue on another CBP Form 6059B) |

|

Value |

Use Only |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

PAPERWORK REDUCTION ACT STATEMENT: An agency may not conduct or sponsor an information collection and a person is not required to respond to this information unless it displays a current valid OMB control number. The control number for this collection is

CBP Form 6059B (11/16) |

CBP Form 6059B (11/16) |

Understanding CBP 6059B

What is the CBP 6059B form?

The CBP 6059B form is a customs declaration form used by travelers entering the United States. It collects information about the items you are bringing into the country, including goods, currency, and any items that may be subject to duty or restrictions.

Who needs to fill out the CBP 6059B form?

All travelers, including U.S. citizens and foreign visitors, must complete the CBP 6059B form when entering the United States. This requirement applies whether you are arriving by air, land, or sea.

How can I obtain the CBP 6059B form?

You can obtain the CBP 6059B form at various points of entry into the United States. Customs and Border Protection (CBP) officials typically provide the form on flights and at border crossings. Additionally, you may find it online on the CBP website for reference.

What information do I need to provide on the CBP 6059B form?

The form requires basic information such as your name, address, and passport number. You will also need to declare any items you are bringing into the U.S., including gifts, food, and merchandise. It’s important to be honest and thorough to avoid potential penalties.

What happens if I don’t fill out the CBP 6059B form?

If you fail to fill out the CBP 6059B form, you may face delays at customs or, in some cases, fines. Customs officials may question you about your belongings, and not providing accurate information can lead to complications or seizures of your items.

Can I submit the CBP 6059B form electronically?

Currently, the CBP 6059B form must be completed in paper format. However, some airlines provide a digital version of the form for their passengers to fill out before arrival. Check with your airline for options that may simplify the process.

What should I do if I make a mistake on the CBP 6059B form?

If you realize you made a mistake after submitting the form, inform a CBP officer immediately upon arrival. They can assist you in correcting the information. It is better to address errors proactively to avoid misunderstandings.

Are there any items I cannot bring into the U.S.?

Yes, certain items are prohibited or restricted from entering the U.S. These include illegal drugs, certain food products, and items that may pose a risk to public health or safety. Always check the latest guidelines from the CBP website before traveling.

How long does it take to process the CBP 6059B form at customs?

Processing time for the CBP 6059B form can vary. Typically, it is a quick process, but it may take longer during busy travel times or if there are additional questions about your declaration. Being prepared and having your form ready can help expedite the process.

Dos and Don'ts

When filling out the CBP 6059B form, there are several important things to keep in mind. Here is a list of what you should and shouldn't do:

- Do read the instructions carefully before starting.

- Do provide accurate and complete information.

- Do use black or blue ink if filling out the form by hand.

- Do check for any spelling errors before submitting.

- Don't leave any required fields blank.

- Don't use abbreviations that may confuse the reader.

- Don't submit the form without reviewing it for clarity.

Following these guidelines can help ensure a smooth process when completing the form.

Check out Common Templates

Faa 8050-2 - Buyers should consult the form to understand what information is required before completing a sale.

Fedex Bol Pdf - Shippers can select optional services, such as liftgate or inside pickup/delivery, based on their needs.

For those looking to navigate the process of transactions effectively, understanding the Ohio Bill of Sale form requirements is crucial. This legal document serves to formalize the transfer of ownership and ensure both parties are protected during the sale. For more information, you can explore this comprehensive guide to the Ohio Bill of Sale.

IRS E-file Signature Authorization - The IRS requires Form 8879 for all electronically filed returns to maintain compliance.