Free Cash Receipt Template

The Cash Receipt form plays a crucial role in financial transactions, serving as a formal record of cash received by a business or organization. This document not only provides essential details such as the date of the transaction, the amount received, and the method of payment—whether cash, check, or electronic transfer—but also includes information about the payer and the purpose of the payment. By capturing these details, the form helps ensure transparency and accountability in financial dealings. Additionally, it often contains a unique receipt number, which aids in tracking and referencing the transaction in future financial records. The proper use of a Cash Receipt form can enhance organizational efficiency, reduce the risk of errors, and support effective auditing practices. Understanding its components and significance is vital for anyone involved in managing finances, whether in a small business or a larger institution.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Cash Receipt form is used to document the receipt of cash payments for goods or services provided. |

| Components | This form typically includes fields for the date, amount received, payer's information, and purpose of the payment. |

| Record Keeping | Maintaining a copy of the Cash Receipt form is essential for accurate financial record-keeping and auditing purposes. |

| State-Specific Regulations | In some states, such as California, the use of a Cash Receipt form may be governed by specific accounting regulations outlined in the California Business and Professions Code. |

Similar forms

- Invoice: Like a Cash Receipt form, an invoice details a transaction. It shows what was purchased, the amount owed, and payment terms.

- Motor Vehicle Bill of Sale: For those navigating vehicle ownership transfers, our comprehensive Motor Vehicle Bill of Sale options ensure all details are legally documented.

- Payment Voucher: This document authorizes a payment. Similar to the Cash Receipt, it confirms that funds have been allocated for a specific expense.

- Sales Receipt: A sales receipt serves as proof of purchase. It confirms that a transaction has occurred, much like a Cash Receipt form does.

- Deposit Slip: A deposit slip is used to deposit cash or checks into a bank account. It records the amount deposited, similar to how a Cash Receipt documents received payments.

- Credit Memo: This document is issued to reduce the amount owed by a customer. It functions similarly to a Cash Receipt by adjusting the financial records of a transaction.

- Payment Confirmation: A payment confirmation verifies that a payment has been received. This is akin to a Cash Receipt, which also confirms receipt of funds.

- Transaction Record: A transaction record logs all details of a financial transaction. Like a Cash Receipt, it helps maintain accurate financial documentation.

- Expense Report: An expense report outlines incurred costs and requests reimbursement. It shares similarities with the Cash Receipt by tracking financial exchanges.

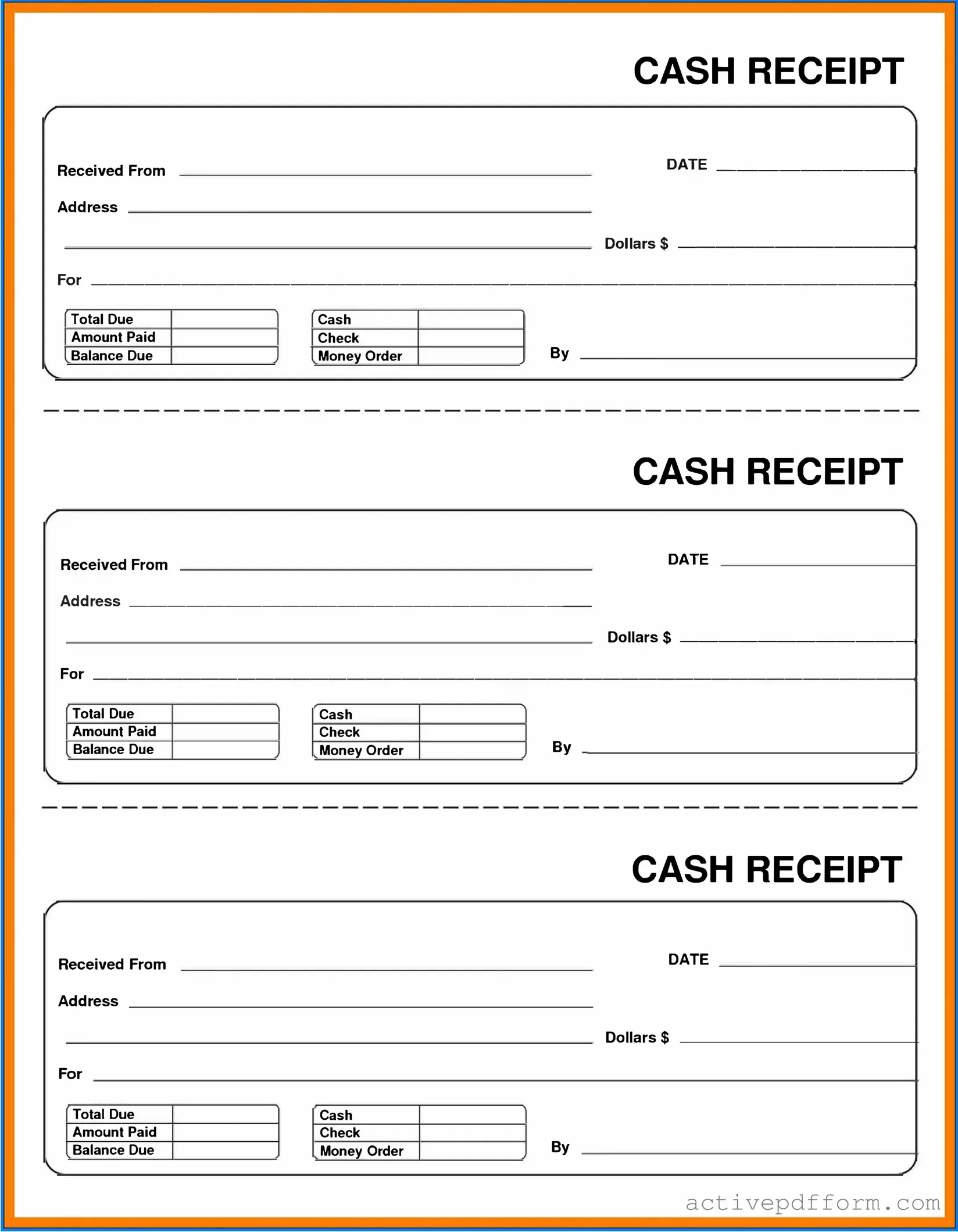

Cash Receipt Example

CASH RECEIPT

Received From |

|

� |

|||

Address |

|

|

Dollars$ |

||

|

|

|

|

||

|

� |

||||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

CASH RECEIPT

Received From |

|

|

|

|

|

|

|

|

|

DATE |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||||||

Address ________________________ |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Dollars$ |

+ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Due |

|

|

|

|

|

Cash |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Amount Paid |

|

|

|

|

|

Check |

|

|

By |

|

|

|

|

|

|

Balance Due |

|

|

|

|

|

Money Order |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH RECEIPT

Received From |

|

DATE |

|||

Address |

|

|

|

||

|

|

|

|

Dollars$ |

|

For |

|

|

|

||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

Understanding Cash Receipt

What is a Cash Receipt form?

A Cash Receipt form is a document used to acknowledge the receipt of cash payments. It serves as proof that a transaction has taken place and that the payment has been received by the seller or service provider. This form is important for both record-keeping and accounting purposes.

When should I use a Cash Receipt form?

You should use a Cash Receipt form whenever you receive cash payments from customers or clients. This includes payments for goods, services, or any other financial transactions. It is particularly useful for businesses that deal with cash transactions regularly.

What information is typically included in a Cash Receipt form?

A Cash Receipt form usually includes details such as the date of the transaction, the name of the payer, the amount received, the purpose of the payment, and the signature of the person receiving the cash. Some forms may also include a unique receipt number for tracking purposes.

Is a Cash Receipt form legally binding?

Yes, a Cash Receipt form can be considered legally binding as it serves as evidence of a transaction. It can be used in case of disputes regarding payments. However, it is important to ensure that the form is filled out accurately and signed by both parties involved in the transaction.

Can I create my own Cash Receipt form?

Absolutely! You can create your own Cash Receipt form as long as it includes all the necessary information. Many businesses opt for customized forms that reflect their branding. Just make sure it captures all essential details for effective record-keeping.

How do I store Cash Receipt forms?

Cash Receipt forms should be stored securely to protect sensitive financial information. You can keep them in physical form in a locked filing cabinet or digitally by scanning and saving them in a secure cloud storage system. Ensure that you have a backup to prevent loss of data.

What should I do if I lose a Cash Receipt form?

If you lose a Cash Receipt form, it is advisable to document the loss and notify the involved parties. If possible, recreate the receipt with the same details and have it signed again. Keeping a record of lost receipts can help maintain accurate financial records.

How long should I keep Cash Receipt forms?

Generally, it is recommended to keep Cash Receipt forms for at least three to seven years, depending on your local laws and accounting practices. This retention period helps in case of audits or any financial inquiries that may arise in the future.

Can Cash Receipt forms be used for electronic payments?

While Cash Receipt forms are primarily designed for cash transactions, they can also be adapted for electronic payments. If you receive payments via credit cards, bank transfers, or online payment platforms, you can use the form to acknowledge those payments as well.

What is the difference between a Cash Receipt and an Invoice?

A Cash Receipt confirms that payment has been received, while an Invoice is a request for payment. An Invoice is issued before payment is made, detailing the amount owed for goods or services. Once payment is received, a Cash Receipt is generated to acknowledge that the transaction has been completed.

Dos and Don'ts

When filling out a Cash Receipt form, attention to detail is essential. Here are some guidelines to help ensure accuracy and compliance.

- Do: Write clearly to avoid any misinterpretation of the information.

- Do: Double-check the amount received to ensure it matches the payment.

- Do: Include the date of the transaction for accurate record-keeping.

- Do: Provide a description of the payment to clarify its purpose.

- Do: Ensure all required signatures are obtained before finalizing the form.

- Don't: Leave any fields blank; this can lead to confusion later.

- Don't: Use correction fluid or tape on the form; it can raise questions about the integrity of the document.

- Don't: Forget to keep a copy for your records; this helps with future reference.

- Don't: Alter the form after submission; changes can complicate the audit trail.

- Don't: Ignore the instructions provided with the form; they are there for a reason.

Following these do's and don'ts can help ensure that the Cash Receipt form is filled out correctly and efficiently.

Check out Common Templates

Sworn Statement Army - This form affirms that every statement made is entered into the official record.

The California Form REG 262 is essential for anyone looking to transfer ownership of a vehicle or vessel, and it must be completed alongside the title or a duplicate title application. For convenience and to ensure you meet all requirements, you can access resources to help you fill out this necessary form, such as the California PDF Forms.

Megger Test Form - Aids in identifying potential hazards within electrical systems.

How to Fill Out W9 - It's a straightforward form that requires minimal information.