Free Cash Drawer Count Sheet Template

The Cash Drawer Count Sheet is a vital tool used in various retail and service environments to track and manage cash transactions effectively. This form serves multiple purposes, including documenting the cash on hand, recording sales, and ensuring that all transactions are accounted for at the end of a shift or business day. Typically, it includes sections for the starting cash balance, cash received from sales, cash paid out, and the ending cash balance. By providing a structured format for these entries, the form helps to minimize errors and discrepancies, facilitating accurate financial reporting. Additionally, the Cash Drawer Count Sheet can assist in identifying trends in cash flow, which may be useful for inventory management and operational planning. Overall, this form plays a crucial role in maintaining financial integrity and accountability within a business. It is essential for employees to complete the form accurately and consistently to ensure effective cash management practices are upheld.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Cash Drawer Count Sheet is used to track cash transactions and balances in a cash drawer. |

| Importance | This form helps ensure accurate accounting and prevents discrepancies in cash handling. |

| Frequency of Use | Businesses typically use this sheet daily or at the end of each shift. |

| Information Included | The form usually includes fields for starting cash, cash sales, cash drops, and ending cash. |

| Record Keeping | Maintaining this form is important for audits and financial reporting. |

| State Regulations | Some states may have specific requirements for cash handling and record-keeping practices. |

| Accessibility | The Cash Drawer Count Sheet should be easily accessible to employees handling cash. |

Similar forms

Daily Sales Report: This document summarizes the total sales for a given day, breaking down revenue by categories. Like the Cash Drawer Count Sheet, it helps in reconciling cash flow and ensuring accuracy in financial reporting.

Cash Register Z Report: Generated at the end of a shift, this report provides a detailed account of all transactions processed. It serves a similar purpose to the Cash Drawer Count Sheet by confirming cash on hand matches recorded sales.

Petty Cash Log: This document tracks small cash expenses. Similar to the Cash Drawer Count Sheet, it records cash inflows and outflows, ensuring accountability and proper tracking of funds.

Bank Deposit Slip: Used to document cash and checks being deposited into a bank account, this slip parallels the Cash Drawer Count Sheet by detailing cash amounts and providing a record for financial reconciliation.

Inventory Count Sheet: This form records the quantity of products on hand. Like the Cash Drawer Count Sheet, it is essential for maintaining accurate financial records and ensuring that reported figures match physical counts.

Expense Report: This document tracks business-related expenses. It shares similarities with the Cash Drawer Count Sheet by documenting cash usage and ensuring that all expenditures are accounted for.

Living Will Form: When planning for future healthcare decisions, consider our essential guide to Living Will documentation to express your medical treatment preferences clearly.

Sales Receipt: Issued to customers upon purchase, this document provides proof of transaction. It is akin to the Cash Drawer Count Sheet in that both serve to validate financial activities and maintain accurate records of sales.

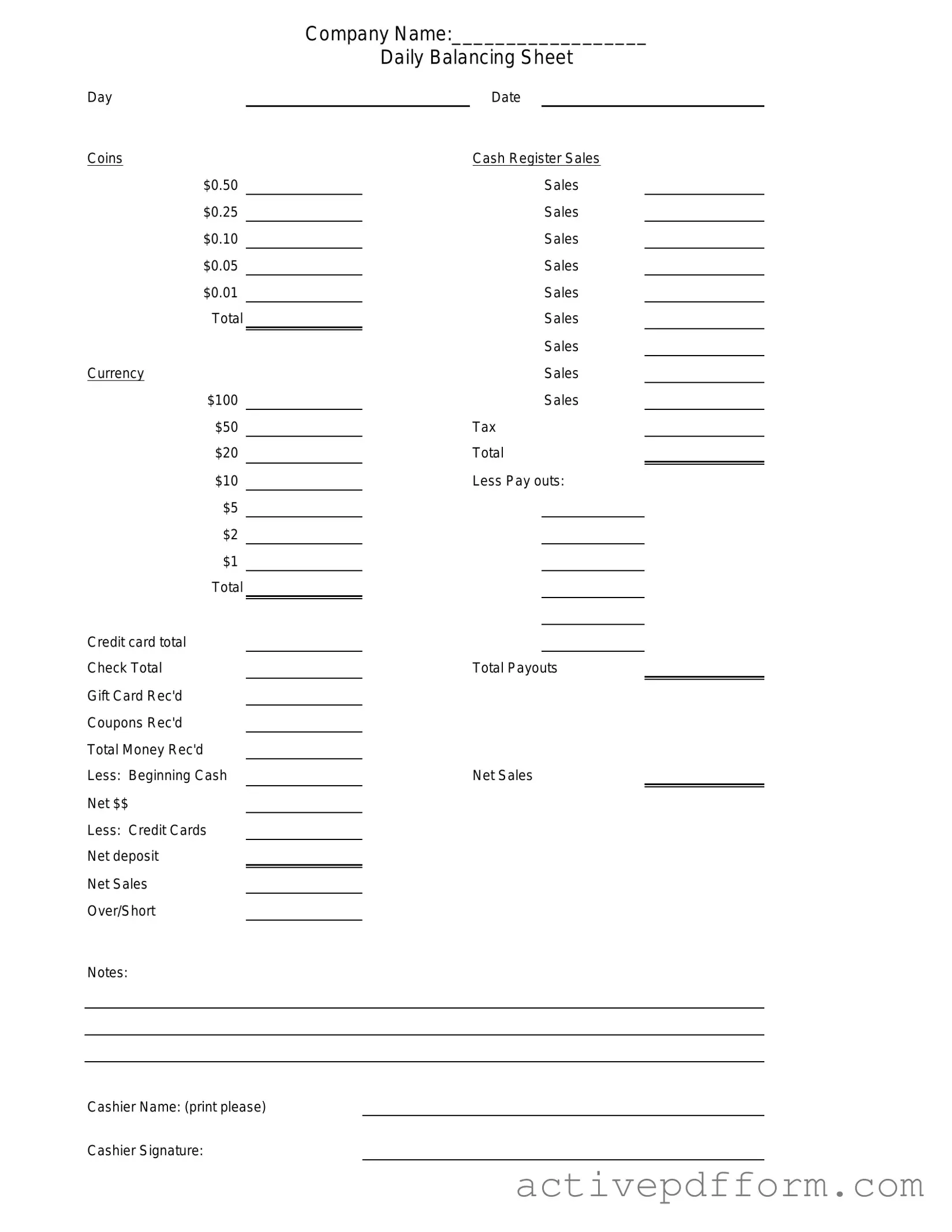

Cash Drawer Count Sheet Example

|

Company Name:__________________ |

|||||

|

|

Daily Balancing Sheet |

||||

Day |

|

|

Date |

|

||

Coins |

|

|

Cash Register Sales |

|||

$0.50 |

|

|

|

Sales |

|

|

$0.25 |

|

|

|

Sales |

|

|

$0.10 |

|

|

|

Sales |

|

|

$0.05 |

|

|

|

Sales |

|

|

$0.01 |

|

|

|

Sales |

|

|

Total |

|

|

|

Sales |

|

|

|

|

|

|

Sales |

|

|

Currency |

|

|

|

Sales |

|

|

$100 |

|

|

|

Sales |

|

|

$50 |

|

|

Tax |

|

||

$20 |

|

|

Total |

|

||

$10 |

|

|

Less Pay outs: |

|||

$5 |

|

|

|

|

|

|

$2 |

|

|

|

|

|

|

$1 |

|

|

|

|

|

|

Total |

|

|

|

|

|

|

Credit card total |

|

|

|

|

|

|

|

|

|

|

|

|

|

Check Total |

|

|

Total Payouts |

|||

Gift Card Rec'd |

|

|

|

|

|

|

Coupons Rec'd |

|

|

|

|

|

|

Total Money Rec'd |

|

|

|

|

|

|

Less: Beginning Cash |

|

|

Net Sales |

|||

Net $$ |

|

|

|

|

|

|

Less: Credit Cards |

|

|

|

|

|

|

Net deposit |

|

|

|

|

|

|

Net Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

Over/Short |

|

|

|

|

|

|

Notes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cashier Name: (print please)

Cashier Signature:

Understanding Cash Drawer Count Sheet

What is a Cash Drawer Count Sheet?

A Cash Drawer Count Sheet is a tool used by businesses to track the cash in their registers. It helps ensure that the amount of cash on hand matches the sales recorded. This form is essential for maintaining accurate financial records and preventing discrepancies in cash management.

Why is it important to use a Cash Drawer Count Sheet?

Using a Cash Drawer Count Sheet is crucial for several reasons. First, it provides a clear record of cash transactions, helping to identify any potential errors or theft. Second, it aids in reconciling cash at the end of a shift or day, ensuring that the cash drawer is balanced. Finally, it serves as a valuable tool for financial audits and accountability within the business.

How often should I complete a Cash Drawer Count Sheet?

The frequency of completing a Cash Drawer Count Sheet can vary based on the business's needs. Many businesses choose to complete it at the end of each shift to ensure accuracy and accountability. Others may do so daily or weekly, depending on cash flow and transaction volume. Consistency is key, as it helps establish a routine for cash management.

What information should be included in a Cash Drawer Count Sheet?

A comprehensive Cash Drawer Count Sheet should include several key pieces of information. This typically includes the date, the cashier's name, the starting cash amount, total sales, cash received, cash paid out, and the ending cash amount. Additionally, it may include a breakdown of cash denominations, such as the number of $1, $5, $10, and $20 bills, as well as coins. This detailed record helps ensure accuracy during cash reconciliation.

What should I do if the cash count does not match the recorded sales?

If the cash count does not match the recorded sales, it is important to remain calm and systematic. First, double-check the count to ensure there were no mistakes in the cash handling. Review the sales records for any discrepancies, such as unrecorded transactions or errors in the cash drawer. If the mismatch persists, document the difference and report it to a supervisor or manager for further investigation. Taking these steps can help identify potential issues and prevent future occurrences.

Can the Cash Drawer Count Sheet be used for electronic payments?

Yes, the Cash Drawer Count Sheet can be adapted to include electronic payments. While the primary focus is on cash transactions, it is beneficial to track credit card, debit card, and other forms of payment as well. Including this information provides a more comprehensive view of the total sales and cash flow, ensuring that all financial transactions are accounted for during reconciliation.

Dos and Don'ts

When filling out the Cash Drawer Count Sheet form, accuracy is crucial for maintaining financial integrity. Here are some important guidelines to follow:

- Do: Count all cash and coins carefully to ensure accurate totals.

- Do: Record the date and time of the count to provide a clear reference.

- Do: Double-check your entries for any mistakes before submitting the form.

- Do: Keep the completed form in a secure location for future reference.

- Don't: Rush through the counting process, as this can lead to errors.

- Don't: Forget to include any checks or credit card receipts in your totals.

- Don't: Leave any sections of the form blank; every field should be filled out.

- Don't: Share the completed form with unauthorized personnel to protect sensitive information.

Check out Common Templates

How Long Is the Waiting List for Section 8 - If you need extra time beyond the initial 60 days, this form is necessary for submitting your request.

The Texas RV Bill of Sale form is a crucial legal document that records the transfer of ownership of a recreational vehicle between a seller and a buyer. To ensure clarity and prevent any future disputes, it's important to understand the details of this document, which can be found at https://fillable-forms.com. Properly completing this form not only helps in creating a formal record of the sale but also facilitates a smoother registration process with the state.

Pdf Printable Puppy Shot Record - Use the Proof of Vaccination form to demonstrate responsible pet ownership.