Blank California Transfer-on-Death Deed Document

In California, estate planning can be a complex process, but the Transfer-on-Death Deed (TOD Deed) offers a straightforward solution for property owners looking to transfer their real estate upon death without the need for probate. This legal document allows individuals to designate one or more beneficiaries who will automatically inherit their property when they pass away. By utilizing a TOD Deed, property owners can maintain full control over their assets during their lifetime, and they can even revoke or change the deed if circumstances change. This form is particularly useful for those who want to simplify the transfer process for their loved ones and avoid the often lengthy and costly probate process. It is important to note that the TOD Deed only applies to real property and does not affect any other assets, such as bank accounts or personal belongings. Additionally, beneficiaries do not have any rights to the property until the owner's death, ensuring that the owner retains full authority over their property while alive. Understanding how to properly fill out and file a Transfer-on-Death Deed can significantly ease the burden on family members during a difficult time.

Document Attributes

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death (TOD) Deed allows property owners in California to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The TOD Deed is governed by California Probate Code Sections 5600-5695. |

| Eligibility | Any individual who owns real property in California can create a TOD Deed, provided they are of sound mind and at least 18 years old. |

| Revocation | A Transfer-on-Death Deed can be revoked at any time before the property owner's death by filing a revocation form with the county recorder. |

| Benefits | This deed simplifies the transfer process, avoiding the time and costs associated with probate, while allowing the property owner to retain full control during their lifetime. |

Similar forms

- Will: A will outlines how a person's assets should be distributed after their death. Like a Transfer-on-Death Deed, it allows individuals to specify beneficiaries for their property.

- Motorcycle Bill of Sale: Essential for proof of ownership in Texas, the https://fillable-forms.com provides a straightforward template for documenting the sale, including all necessary buyer and seller information to ensure a smooth transaction.

- Living Trust: A living trust holds assets during a person's lifetime and specifies how they should be managed and distributed after death. Similar to a Transfer-on-Death Deed, it avoids probate.

- Beneficiary Designation: This document is used for financial accounts, such as life insurance or retirement accounts, to designate who will receive the assets upon the account holder's death. It functions similarly by directly transferring assets to named beneficiaries.

- Joint Tenancy with Right of Survivorship: This form of property ownership allows two or more people to own property together. Upon the death of one owner, the surviving owner automatically receives the deceased's share, akin to the Transfer-on-Death Deed.

- Payable-on-Death (POD) Accounts: These accounts allow individuals to name beneficiaries who will receive the funds upon their death. Like a Transfer-on-Death Deed, it facilitates a straightforward transfer of assets without going through probate.

- Life Estate Deed: This deed allows a person to retain rights to use property during their lifetime while designating another person to receive the property after their death. It shares similarities in terms of transferring property rights after death.

- Transfer-on-Death Vehicle Title: This document allows vehicle owners to designate a beneficiary who will inherit the vehicle upon their death, similar to how a Transfer-on-Death Deed works for real estate.

- Irrevocable Trust: Once established, this trust cannot be changed, and it holds assets for beneficiaries. It serves a similar purpose in asset distribution after death, though it is less flexible than a Transfer-on-Death Deed.

California Transfer-on-Death Deed Example

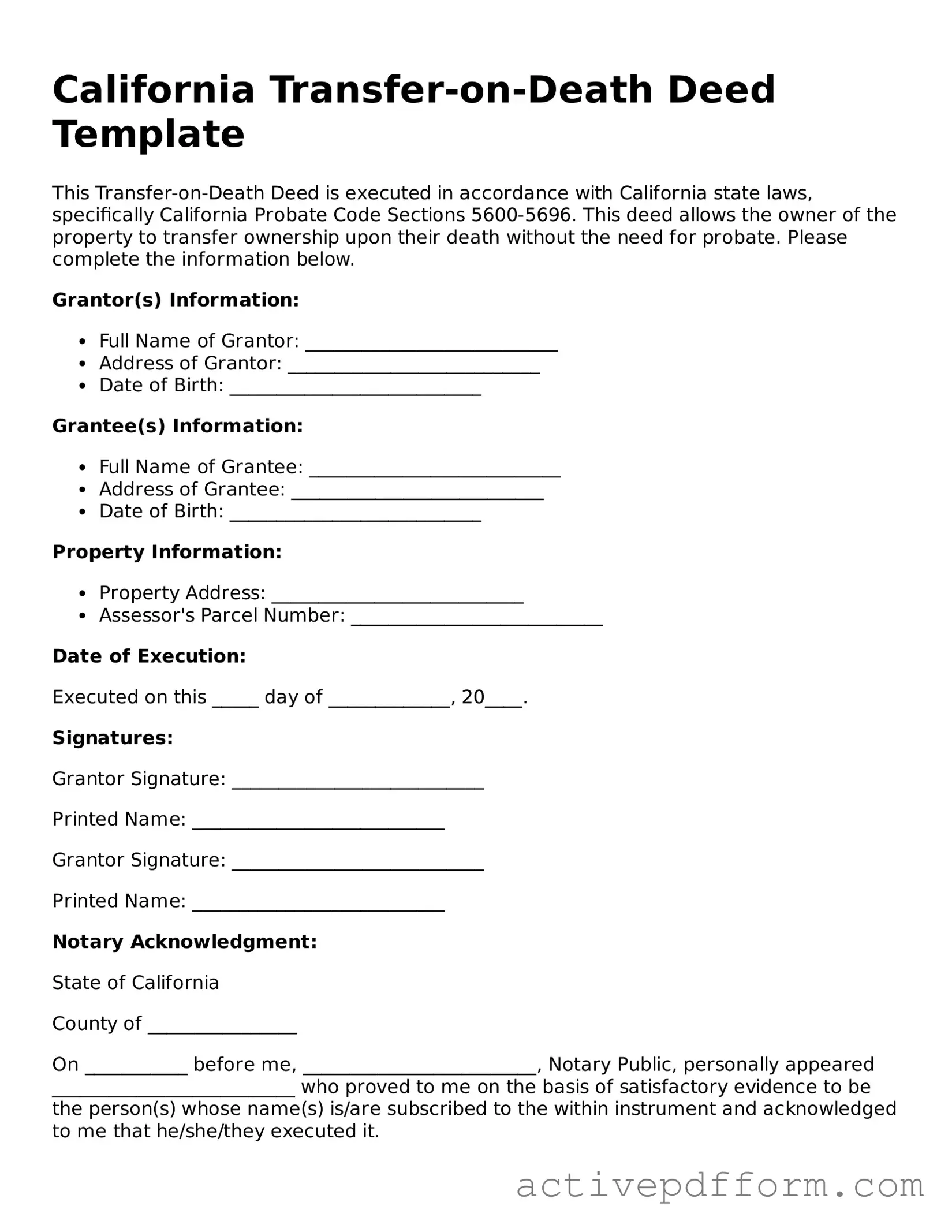

California Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed in accordance with California state laws, specifically California Probate Code Sections 5600-5696. This deed allows the owner of the property to transfer ownership upon their death without the need for probate. Please complete the information below.

Grantor(s) Information:

- Full Name of Grantor: ___________________________

- Address of Grantor: ___________________________

- Date of Birth: ___________________________

Grantee(s) Information:

- Full Name of Grantee: ___________________________

- Address of Grantee: ___________________________

- Date of Birth: ___________________________

Property Information:

- Property Address: ___________________________

- Assessor's Parcel Number: ___________________________

Date of Execution:

Executed on this _____ day of _____________, 20____.

Signatures:

Grantor Signature: ___________________________

Printed Name: ___________________________

Grantor Signature: ___________________________

Printed Name: ___________________________

Notary Acknowledgment:

State of California

County of ________________

On ___________ before me, _________________________, Notary Public, personally appeared __________________________ who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed it.

I certify under PENALTY OF PERJURY under the laws of the State of California that the foregoing paragraph is true and correct.

Witness my hand and official seal.

Signature: ________________________________

Notary Public Seal:

Understanding California Transfer-on-Death Deed

What is a Transfer-on-Death Deed in California?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows property owners in California to transfer their real estate directly to a designated beneficiary upon their death. This deed helps avoid the lengthy and often costly probate process, making it easier for loved ones to inherit property. The transfer occurs automatically without the need for court intervention, as long as the deed is properly executed and recorded before the owner's death.

Who can use a Transfer-on-Death Deed?

Any individual who owns real estate in California can utilize a Transfer-on-Death Deed. This includes homeowners, landlords, and anyone holding title to property. However, it is important to note that the property must be solely owned by the individual. Jointly owned properties or properties held in a trust cannot be transferred using this method.

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, you will need to fill out a specific form that includes details about the property and the beneficiary. The form must be signed by the property owner in the presence of a notary public. After signing, the deed must be recorded with the county recorder's office in the county where the property is located. This recording is crucial, as it makes the deed effective and legally binding.

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time while you are still alive. To do this, you must execute a new deed that either names a different beneficiary or revokes the previous deed entirely. This new deed must also be signed and recorded in the same manner as the original. It is essential to ensure that the most current deed is recorded to avoid confusion later on.

What happens if I do not record the Transfer-on-Death Deed?

If you do not record the Transfer-on-Death Deed, it will not take effect upon your death. The property will then be subject to probate, which can lead to delays and additional costs for your beneficiaries. Recording the deed is a critical step in ensuring that your wishes are honored and that the transfer occurs smoothly.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications when using a Transfer-on-Death Deed. The transfer of property does not trigger gift taxes, and the property retains its tax basis for the beneficiary. However, it is advisable to consult with a tax professional to understand any potential future tax liabilities or implications, especially regarding property taxes and estate taxes.

Can a Transfer-on-Death Deed be contested?

While it is possible for a Transfer-on-Death Deed to be contested, it is typically more straightforward than contesting a will. Challenges may arise if there are claims of undue influence, lack of capacity, or if the deed was not executed properly. To minimize the risk of contestation, it is recommended to ensure that the deed is executed correctly and to communicate your intentions clearly with family members.

Is a Transfer-on-Death Deed the right choice for everyone?

A Transfer-on-Death Deed can be an excellent option for many individuals, but it may not be suitable for everyone. It is particularly beneficial for those who wish to transfer property without going through probate. However, individuals with complex estates, multiple properties, or specific wishes regarding their estate may want to consider other estate planning tools, such as trusts or wills. Consulting with an estate planning professional can help you determine the best approach for your unique situation.

Dos and Don'ts

When filling out the California Transfer-on-Death Deed form, it's important to be careful and thorough. Here are some guidelines to help you navigate the process effectively.

- Do ensure that you clearly identify the property you want to transfer. Include the full address and legal description.

- Do verify that you are the legal owner of the property. Only the current owner can execute this deed.

- Do include the names of the beneficiaries accurately. Double-check spelling and ensure that their details are correct.

- Do sign the deed in front of a notary public. This step is crucial for the deed to be valid.

- Do file the completed deed with the county recorder's office. This action is necessary to make the transfer effective.

- Don't use vague language when describing the property. Ambiguity can lead to complications later.

- Don't forget to date the deed. An undated deed may create issues regarding its validity.

- Don't overlook the importance of consulting with a legal professional. They can provide guidance tailored to your situation.

- Don't assume that verbal agreements are enough. All terms should be documented in the deed.

- Don't wait too long to file the deed after signing. Timely filing is essential to ensure your wishes are honored.

Browse Other Popular Transfer-on-Death Deed Templates for Specific States

Deed on Death Texas - Having a Transfer-on-Death Deed may make it easier for heirs to retain ownership of the property without complications.

To assist you further with the Texas form, it is advisable to review all guidelines thoroughly before submitting your documents. You can get the pdf here to ensure you have the most accurate and up-to-date information at your fingertips.

Transfer on Death Deed Florida Form - The property must be titled in the owner's name to execute a Transfer-on-Death Deed.