Blank California Tractor Bill of Sale Document

When buying or selling a tractor in California, having a proper bill of sale is crucial for both parties involved in the transaction. This document serves as a legal record that outlines the details of the sale, ensuring clarity and protection for the buyer and seller alike. A California Tractor Bill of Sale typically includes essential information such as the names and addresses of both the buyer and seller, the tractor's make, model, year, and Vehicle Identification Number (VIN). It also specifies the sale price and the date of the transaction. Additionally, the form may include a statement regarding the condition of the tractor, which can help prevent disputes later on. By using this form, individuals can facilitate a smoother transfer of ownership, making it easier to register the tractor with the Department of Motor Vehicles (DMV) if necessary. Understanding the importance of this document can save time and potential legal headaches in the future.

Document Attributes

| Fact Name | Description |

|---|---|

| Purpose | The California Tractor Bill of Sale form serves as a legal document to record the sale and transfer of ownership of a tractor between a seller and a buyer. |

| Governing Law | This form is governed by the California Vehicle Code, specifically Sections 5600-5603, which outline the requirements for vehicle sales and transfers. |

| Required Information | Essential details must be included, such as the names and addresses of both the seller and buyer, the tractor's make, model, year, and Vehicle Identification Number (VIN). |

| Notarization | While notarization is not mandatory for the bill of sale, having it notarized can provide additional legal protection for both parties involved in the transaction. |

| Use for Registration | The completed bill of sale is often required for registering the tractor with the California Department of Motor Vehicles (DMV) to establish proof of ownership. |

Similar forms

The Tractor Bill of Sale form serves as an important document in the transfer of ownership for a tractor. Several other documents share similar functions, ensuring that transactions involving vehicles or equipment are properly recorded and legally binding. Below are four documents that are comparable to the Tractor Bill of Sale:

- Vehicle Bill of Sale: This document is used when buying or selling a motor vehicle, such as a car or truck. Like the Tractor Bill of Sale, it outlines the details of the transaction, including the buyer and seller's information, vehicle identification number (VIN), and the sale price. Both documents serve to transfer ownership and provide proof of the transaction.

Hold Harmless Agreement: To ensure liability protection, refer to the important Hold Harmless Agreement guidelines that clarify legal obligations in various contracts.

- Boat Bill of Sale: Similar to the Tractor Bill of Sale, this document is specifically for the sale of boats. It includes essential information about the boat, such as its hull identification number (HIN), and confirms the transfer of ownership from the seller to the buyer. Both documents ensure that the buyer has legal rights to the property acquired.

- Motorcycle Bill of Sale: This document facilitates the sale of a motorcycle, providing a record of the transaction. It contains information about the motorcycle, including the make, model, and VIN, much like the Tractor Bill of Sale. Both documents help protect the interests of both parties involved in the sale.

- Equipment Bill of Sale: Used for the sale of various types of equipment, this document outlines the specifics of the transaction, including the equipment description and sale price. It functions similarly to the Tractor Bill of Sale by formalizing the transfer of ownership and ensuring that both parties have a clear understanding of the sale.

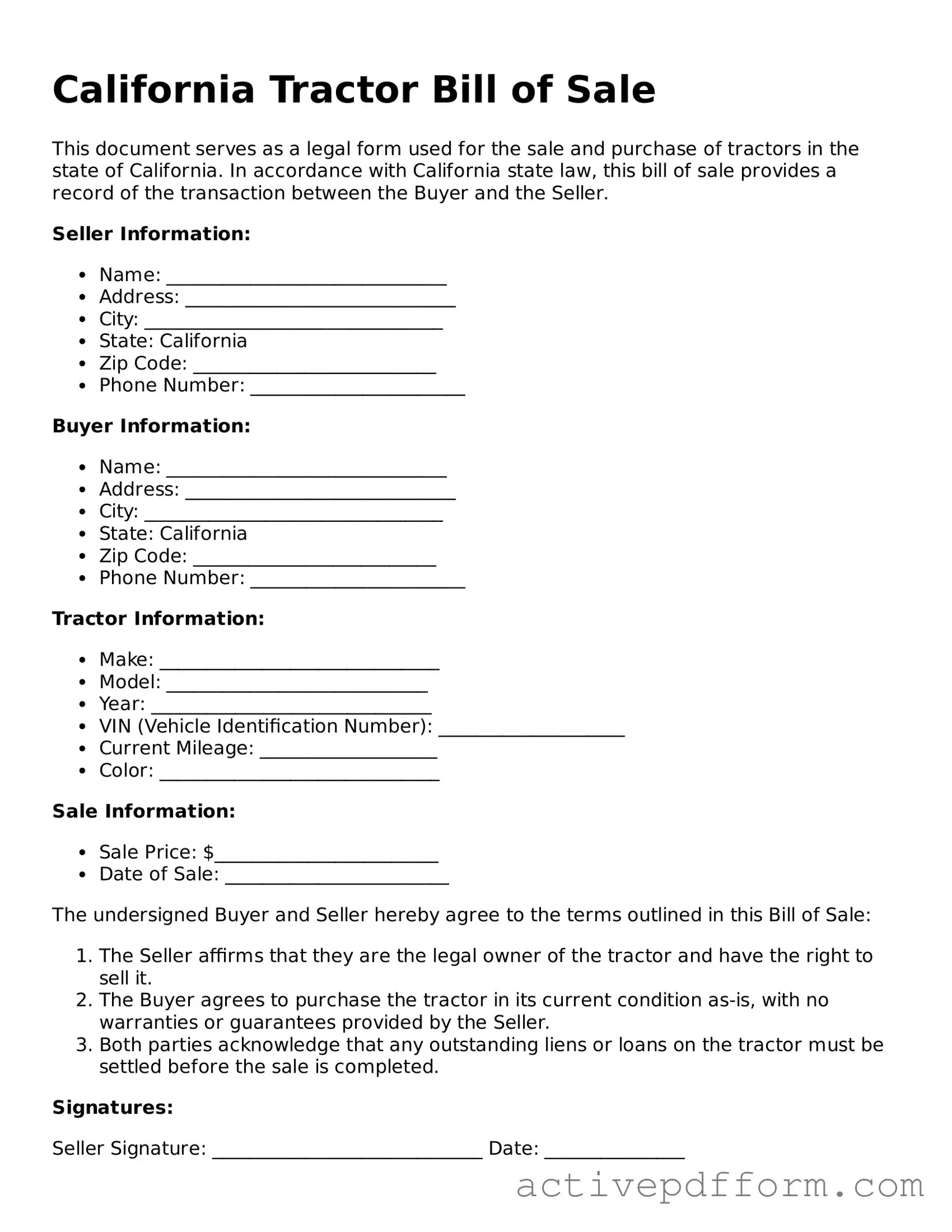

California Tractor Bill of Sale Example

California Tractor Bill of Sale

This document serves as a legal form used for the sale and purchase of tractors in the state of California. In accordance with California state law, this bill of sale provides a record of the transaction between the Buyer and the Seller.

Seller Information:

- Name: ______________________________

- Address: _____________________________

- City: ________________________________

- State: California

- Zip Code: __________________________

- Phone Number: _______________________

Buyer Information:

- Name: ______________________________

- Address: _____________________________

- City: ________________________________

- State: California

- Zip Code: __________________________

- Phone Number: _______________________

Tractor Information:

- Make: ______________________________

- Model: ____________________________

- Year: ______________________________

- VIN (Vehicle Identification Number): ____________________

- Current Mileage: ___________________

- Color: ______________________________

Sale Information:

- Sale Price: $________________________

- Date of Sale: ________________________

The undersigned Buyer and Seller hereby agree to the terms outlined in this Bill of Sale:

- The Seller affirms that they are the legal owner of the tractor and have the right to sell it.

- The Buyer agrees to purchase the tractor in its current condition as-is, with no warranties or guarantees provided by the Seller.

- Both parties acknowledge that any outstanding liens or loans on the tractor must be settled before the sale is completed.

Signatures:

Seller Signature: _____________________________ Date: _______________

Buyer Signature: ______________________________ Date: _______________

This document becomes effective as of the date above and serves as a legal transfer of ownership of the mentioned tractor from the Seller to the Buyer.

Understanding California Tractor Bill of Sale

What is a California Tractor Bill of Sale form?

A California Tractor Bill of Sale form is a legal document that records the sale and transfer of ownership of a tractor in the state of California. This form serves as proof of the transaction between the seller and the buyer, detailing important information about the tractor and the parties involved.

Why do I need a Bill of Sale for a tractor?

A Bill of Sale is essential for documenting the transfer of ownership. It protects both the seller and the buyer by providing a written record of the transaction. This document can also be useful for tax purposes and may be required when registering the tractor with the Department of Motor Vehicles (DMV).

What information is included in the California Tractor Bill of Sale?

The form typically includes the names and addresses of the buyer and seller, the date of the sale, a description of the tractor (including make, model, year, and Vehicle Identification Number), the sale price, and any terms of the sale. Both parties should sign the document to validate it.

Is the Bill of Sale required to register a tractor in California?

While a Bill of Sale is not always mandatory for registration, it is highly recommended. The DMV may request it to verify ownership and the sale price for tax calculations. Always check with your local DMV for specific requirements.

Can I create my own Bill of Sale, or do I need a specific form?

You can create your own Bill of Sale as long as it includes all necessary information. However, using a standard form can simplify the process and ensure that you don’t miss any critical details. Many online resources provide templates for California Tractor Bills of Sale.

Do I need to have the Bill of Sale notarized?

Notarization is not typically required for a Bill of Sale in California. However, having it notarized can add an extra layer of authenticity and may be beneficial in case of disputes in the future.

What if I lose my Bill of Sale?

If you lose your Bill of Sale, it is advisable to contact the seller to obtain a copy. If that is not possible, you may need to provide other documentation to prove ownership when dealing with the DMV or for any legal purposes.

Can I use a Bill of Sale for a tractor purchased out of state?

Yes, you can use a Bill of Sale for a tractor purchased out of state. However, make sure the form complies with California laws and includes all necessary information for registration. Check with the DMV for any additional requirements for out-of-state purchases.

What should I do after completing the Bill of Sale?

After completing the Bill of Sale, both the buyer and seller should keep a signed copy for their records. The buyer should take the document to the DMV when registering the tractor. It’s also wise to confirm that the seller has removed the tractor from their records to avoid future liabilities.

Are there any fees associated with filing a Bill of Sale?

There are generally no fees for creating or filing a Bill of Sale in California. However, there may be fees associated with the registration of the tractor at the DMV, which can vary based on the vehicle's value and other factors.

Dos and Don'ts

When filling out the California Tractor Bill of Sale form, it is essential to approach the process with care. Here are seven important dos and don'ts to keep in mind:

- Do provide accurate information about the tractor, including the make, model, year, and Vehicle Identification Number (VIN).

- Don't leave any sections blank. Each part of the form should be completed to avoid delays in processing.

- Do include the sale price clearly. This helps establish the value for tax purposes.

- Don't use nicknames or informal terms. Use the official names for all parties involved in the transaction.

- Do sign and date the form. Both the seller and buyer should provide their signatures to validate the transaction.

- Don't forget to keep a copy of the completed form for your records. This can be crucial for future reference.

- Do double-check all entries before submitting. A small mistake could lead to complications later on.

Browse Other Popular Tractor Bill of Sale Templates for Specific States

Tractor Bill of Sale Word Template - Captures the essence of a sales agreement in a concise manner.

It is important for landlords and tenants to be aware of the resources available for understanding the eviction process, including documents like the New York Notice to Quit form. A helpful template can be found at nytemplates.com/blank-notice-to-quit-template/, which can assist landlords in creating an effective notice that complies with legal standards while effectively communicating the need for a tenant to vacate the property.