Blank California RV Bill of Sale Document

When purchasing or selling a recreational vehicle (RV) in California, having the right documentation is essential for a smooth transaction. The California RV Bill of Sale form serves as a crucial record of the sale, detailing important information about both the buyer and the seller, as well as the vehicle itself. This form typically includes the RV's make, model, year, and Vehicle Identification Number (VIN), ensuring that all parties are clear on the specifics of the vehicle being transferred. Additionally, it outlines the sale price, payment method, and any warranties or conditions that may apply. By providing a clear and concise account of the transaction, this form not only protects both parties but also helps in the registration process with the Department of Motor Vehicles (DMV). Whether you're a seasoned RV enthusiast or a first-time buyer, understanding the significance of the RV Bill of Sale can make your experience more efficient and secure.

Document Attributes

| Fact Name | Description |

|---|---|

| Purpose | The California RV Bill of Sale form is used to document the sale of a recreational vehicle, providing proof of the transaction for both the buyer and seller. |

| Governing Law | This form is governed by the California Vehicle Code, specifically sections related to the sale and transfer of vehicles. |

| Required Information | Both parties must provide their names, addresses, and signatures. Details about the RV, such as the make, model, year, and VIN, are also necessary. |

| Notarization | While notarization is not mandatory, it can add an extra layer of security and legitimacy to the transaction. |

| Transfer of Ownership | The form serves as a record of the transfer of ownership, which is essential for the buyer to register the RV with the Department of Motor Vehicles (DMV). |

| Tax Implications | Completing the Bill of Sale can help clarify tax responsibilities for both parties, particularly regarding sales tax on the transaction. |

Similar forms

The RV Bill of Sale form is similar to several other documents used in the transfer of ownership for various types of vehicles and property. Here are seven documents that share similarities:

- Vehicle Bill of Sale: This document is used for the sale of standard vehicles like cars and trucks. It includes details about the buyer, seller, and vehicle, similar to the RV Bill of Sale.

- Boat Bill of Sale: Just like the RV Bill of Sale, this document facilitates the transfer of ownership for boats. It outlines the sale terms and includes necessary information about the vessel.

- California Fotm Reg 262: This form is essential when transferring ownership of vehicles and vessels in California. It works alongside the title or a duplicate title application, making it vital to the process. Ensure to complete this necessary document by visiting California PDF Forms.

- Motorcycle Bill of Sale: This document is specific to motorcycles. It captures the same essential details as the RV Bill of Sale, ensuring both parties have a record of the transaction.

- Trailer Bill of Sale: Used for the sale of trailers, this document provides proof of ownership transfer, similar to the RV Bill of Sale for recreational vehicles.

- Real Estate Purchase Agreement: While more complex, this agreement outlines the sale of property. It includes buyer and seller information and sale terms, akin to the RV Bill of Sale.

- Lease Agreement: This document outlines the terms for renting a property or vehicle. It shares similarities with the RV Bill of Sale in that it establishes a legal agreement between parties.

- Gift Letter: When a vehicle is given as a gift, a gift letter can serve as documentation of the transfer. It includes details about the giver and recipient, similar to the RV Bill of Sale.

California RV Bill of Sale Example

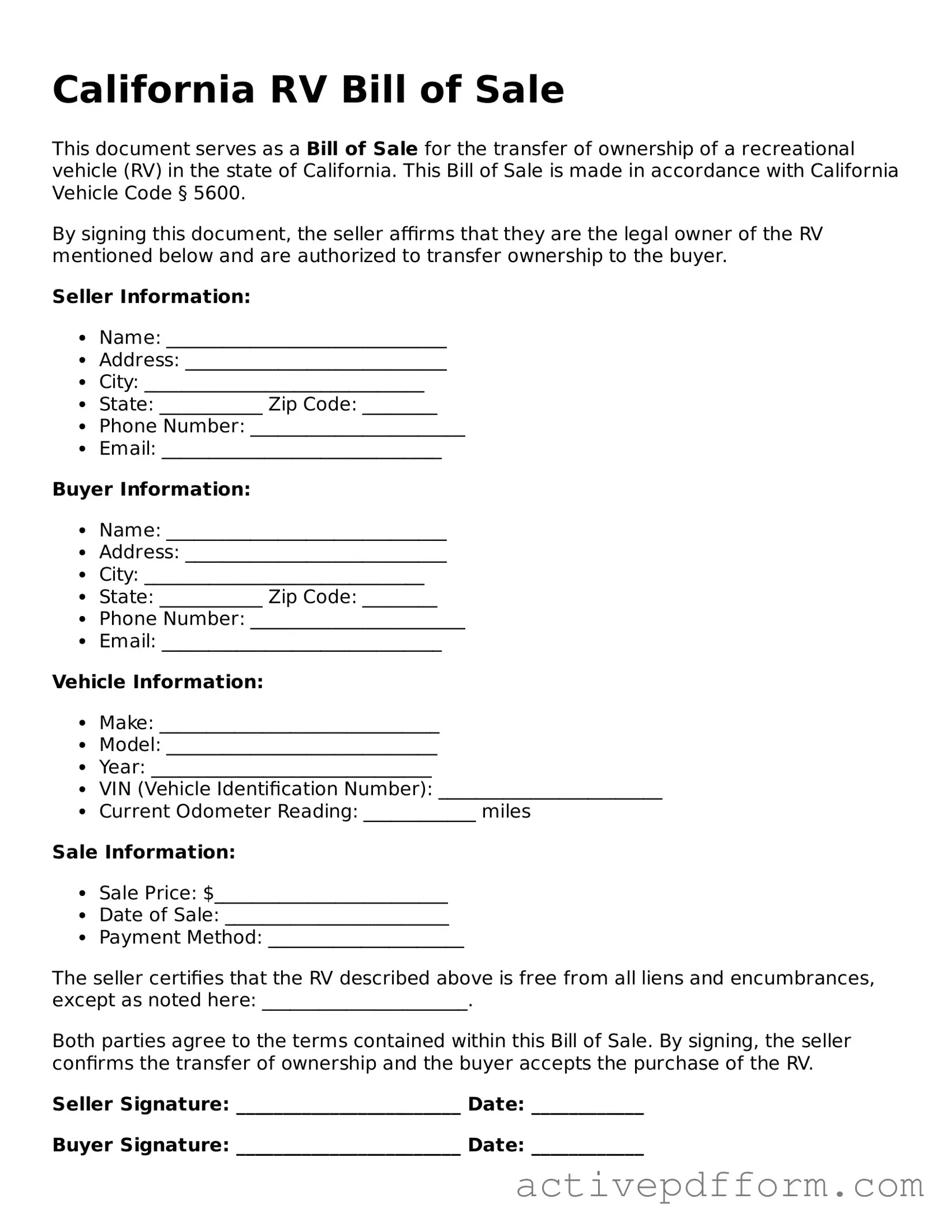

California RV Bill of Sale

This document serves as a Bill of Sale for the transfer of ownership of a recreational vehicle (RV) in the state of California. This Bill of Sale is made in accordance with California Vehicle Code § 5600.

By signing this document, the seller affirms that they are the legal owner of the RV mentioned below and are authorized to transfer ownership to the buyer.

Seller Information:

- Name: ______________________________

- Address: ____________________________

- City: ______________________________

- State: ___________ Zip Code: ________

- Phone Number: _______________________

- Email: ______________________________

Buyer Information:

- Name: ______________________________

- Address: ____________________________

- City: ______________________________

- State: ___________ Zip Code: ________

- Phone Number: _______________________

- Email: ______________________________

Vehicle Information:

- Make: ______________________________

- Model: _____________________________

- Year: ______________________________

- VIN (Vehicle Identification Number): ________________________

- Current Odometer Reading: ____________ miles

Sale Information:

- Sale Price: $_________________________

- Date of Sale: ________________________

- Payment Method: _____________________

The seller certifies that the RV described above is free from all liens and encumbrances, except as noted here: ______________________.

Both parties agree to the terms contained within this Bill of Sale. By signing, the seller confirms the transfer of ownership and the buyer accepts the purchase of the RV.

Seller Signature: ________________________ Date: ____________

Buyer Signature: ________________________ Date: ____________

This document may be used for record-keeping purposes and is recommended to be kept by both the seller and buyer. It is advisable to check with the California Department of Motor Vehicles for any additional requirements regarding the transfer of RV ownership.

Understanding California RV Bill of Sale

What is a California RV Bill of Sale?

A California RV Bill of Sale is a legal document that records the sale of a recreational vehicle (RV) between a buyer and a seller. It serves as proof of the transaction and includes important details about the RV, such as its make, model, year, Vehicle Identification Number (VIN), and the sale price.

Is a Bill of Sale required in California for RV sales?

While a Bill of Sale is not legally required for RV sales in California, it is highly recommended. This document protects both the buyer and the seller by providing a written record of the transaction, which can be useful for registration and tax purposes.

What information should be included in the RV Bill of Sale?

The RV Bill of Sale should include the following information: the names and addresses of both the buyer and seller, the RV's make, model, year, VIN, sale price, date of sale, and any terms of the sale. It is also helpful to include the odometer reading at the time of sale.

Do I need to have the Bill of Sale notarized?

Notarization is not required for a California RV Bill of Sale. However, having it notarized can add an extra layer of authenticity and may be beneficial if disputes arise in the future.

Can I create my own RV Bill of Sale?

Yes, you can create your own RV Bill of Sale. Ensure that it includes all the necessary information mentioned earlier. There are also templates available online that can help guide you in creating a comprehensive document.

How does the Bill of Sale affect registration?

The Bill of Sale is an important document when registering the RV in the buyer's name. The California Department of Motor Vehicles (DMV) typically requires a Bill of Sale to process the registration and transfer of ownership.

What if the RV has a lien on it?

If there is a lien on the RV, the seller must disclose this information to the buyer. The Bill of Sale should reflect any outstanding liens. The buyer may need to contact the lienholder to ensure that the lien is cleared before completing the sale.

How do I handle taxes related to the sale?

Sales tax is generally applicable to RV sales in California. The buyer is responsible for paying the sales tax, which is based on the sale price of the RV. It is advisable to consult with the California DMV or a tax professional for guidance on tax obligations.

What should I do if I lose the Bill of Sale?

If you lose the Bill of Sale, it is recommended to create a new one with the same details and have both parties sign it again. Keeping a copy of the document in a safe place is essential to avoid future complications.

Where can I find a sample RV Bill of Sale?

Sample RV Bill of Sale forms can be found online through various legal websites or state-specific resources. Make sure to choose a sample that complies with California laws and includes all necessary information.

Dos and Don'ts

When filling out the California RV Bill of Sale form, it’s essential to approach the task with care. Here are some important dos and don’ts to keep in mind:

- Do ensure all information is accurate and complete. Double-check names, addresses, and vehicle details.

- Do include the correct Vehicle Identification Number (VIN). This number uniquely identifies the RV.

- Do sign and date the form. Both the buyer and seller must provide their signatures for the sale to be valid.

- Do keep a copy of the completed Bill of Sale for your records. This document serves as proof of the transaction.

- Do verify if any additional documents are required. Depending on the situation, you might need to provide more information.

- Don't leave any sections blank. Incomplete forms may lead to complications down the road.

- Don't use white-out or other correction methods on the form. If a mistake occurs, it's best to start over with a new form.

- Don't forget to discuss payment details. Ensure both parties agree on the payment method before finalizing the sale.

- Don't rush through the process. Take your time to ensure everything is filled out correctly.

- Don't ignore local regulations. Be aware of any specific requirements in your county or city regarding RV sales.

Browse Other Popular RV Bill of Sale Templates for Specific States

Texas Dmv - Essential for registering the RV in the buyer’s name.

For those looking to navigate the process of vehicle ownership transfer, having a basic understanding of the Motor Vehicle Bill of Sale in Ohio can be invaluable. A well-prepared bill of sale is crucial to ensure accurate transaction records. You can learn more about this process through a thorough Motor Vehicle Bill of Sale overview.

Florida Trailer Registration Under 2,000 Lbs - Supports buyers in verifying the authenticity of ownership.