Blank California Quitclaim Deed Document

In the realm of real estate transactions, the California Quitclaim Deed form serves as a crucial instrument for property owners looking to transfer their interests in a property without the complexities often associated with traditional deeds. This straightforward legal document allows an individual, known as the grantor, to relinquish their claim to a property, effectively passing any rights they hold to another party, referred to as the grantee. Unlike warranty deeds, which provide guarantees about the title and the absence of liens, a quitclaim deed offers no such assurances. Its simplicity can be advantageous, particularly in situations involving family transfers, divorces, or clearing up title issues. While it may lack the robust protections of other deed types, the quitclaim deed is often favored for its ease of use and speed, making it a popular choice in California’s fast-paced real estate market. Understanding the nuances of this form, including its requirements, implications, and potential pitfalls, is essential for anyone considering a property transfer in the Golden State.

Document Attributes

| Fact Name | Description |

|---|---|

| Definition | A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without any warranties. |

| Governing Law | The Quitclaim Deed in California is governed by the California Civil Code, specifically Sections 683-688. |

| Usage | This form is often used between family members or in situations where the parties know each other well. |

| Warranties | Unlike other deeds, a Quitclaim Deed does not guarantee that the grantor has clear title to the property. |

| Filing Requirements | To be effective, the Quitclaim Deed must be signed by the grantor and notarized before being recorded with the county. |

| Tax Implications | Transferring property using a Quitclaim Deed may have tax implications, including potential reassessment of property taxes. |

| Revocation | A Quitclaim Deed cannot be revoked once it has been executed and recorded; it is a permanent transfer of ownership. |

| Consideration | While consideration (payment) is not required, it is common to include a nominal amount to validate the transaction. |

| Common Uses | Quitclaim Deeds are frequently used in divorce settlements, estate planning, and adding or removing a spouse from title. |

| Legal Advice | It is advisable to consult with a legal professional before executing a Quitclaim Deed to understand its implications fully. |

Similar forms

- Warranty Deed: This document provides a guarantee that the seller holds clear title to the property and has the right to sell it. Unlike a quitclaim deed, it offers more protection to the buyer against future claims.

- Grant Deed: Similar to a warranty deed, a grant deed transfers ownership of property. It assures that the property has not been sold to anyone else and that there are no undisclosed liens.

- Deed of Trust: This document secures a loan by transferring the property title to a trustee until the loan is paid off. It differs from a quitclaim deed as it involves a financial transaction and obligations.

- Lease Agreement: A lease allows one party to use another's property for a specified time in exchange for rent. While a quitclaim deed transfers ownership, a lease only grants temporary use.

- Bill of Sale: This document transfers ownership of personal property, such as vehicles or equipment. Unlike a quitclaim deed, it does not apply to real estate transactions.

-

Nyc Apartment Registration Form: This form is essential for landlords and property managers to collect information about the apartment and its owner, ensuring compliance with housing regulations. Properly completing this form is crucial for facilitating the rental process and maintaining transparency, as outlined in the official document available at https://nytemplates.com/blank-nyc-apartment-registration-template/.

- Power of Attorney: This legal document allows one person to act on behalf of another in legal matters. It can authorize the transfer of property but does not itself transfer ownership like a quitclaim deed.

- Affidavit of Title: This is a sworn statement confirming that the seller has clear title to the property. While it provides assurance, it does not transfer ownership like a quitclaim deed does.

- Partition Deed: Used to divide property among co-owners, this document allows for the transfer of ownership interests. It serves a different purpose than a quitclaim deed, which is focused on transferring full ownership.

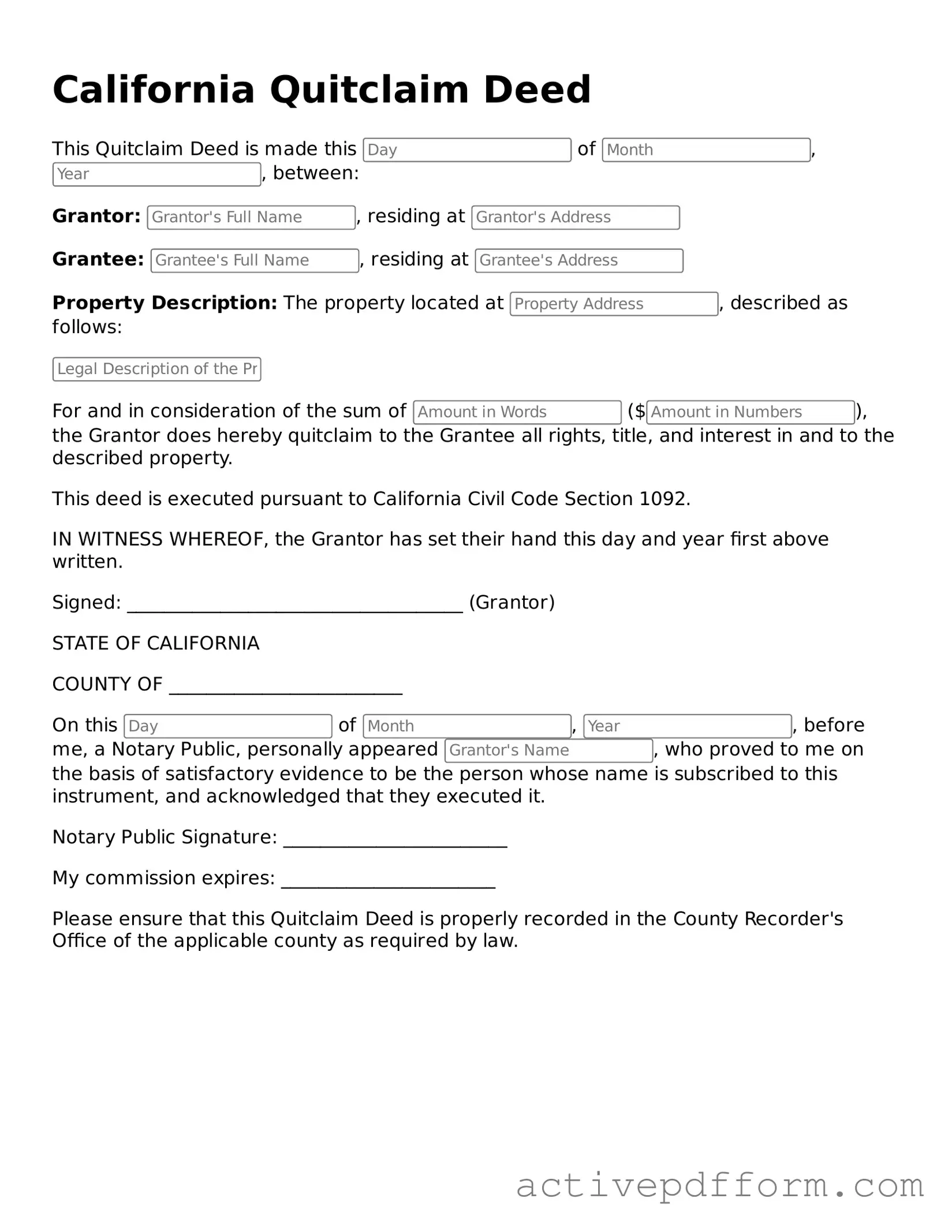

California Quitclaim Deed Example

California Quitclaim Deed

This Quitclaim Deed is made this of , , between:

Grantor: , residing at

Grantee: , residing at

Property Description: The property located at , described as follows:

For and in consideration of the sum of ($), the Grantor does hereby quitclaim to the Grantee all rights, title, and interest in and to the described property.

This deed is executed pursuant to California Civil Code Section 1092.

IN WITNESS WHEREOF, the Grantor has set their hand this day and year first above written.

Signed: ____________________________________ (Grantor)

STATE OF CALIFORNIA

COUNTY OF _________________________

On this of , , before me, a Notary Public, personally appeared , who proved to me on the basis of satisfactory evidence to be the person whose name is subscribed to this instrument, and acknowledged that they executed it.

Notary Public Signature: ________________________

My commission expires: _______________________

Please ensure that this Quitclaim Deed is properly recorded in the County Recorder's Office of the applicable county as required by law.

Understanding California Quitclaim Deed

What is a Quitclaim Deed in California?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one person to another. Unlike other types of deeds, a Quitclaim Deed does not guarantee that the person transferring the property has clear title. Instead, it simply conveys whatever interest the grantor has in the property, if any. This makes it a useful tool for situations like transferring property between family members or resolving title issues.

When should I use a Quitclaim Deed?

Consider using a Quitclaim Deed when you want to transfer property without the complexities of a traditional sale. Common scenarios include transferring property between spouses during a divorce, adding a spouse’s name to a title, or gifting property to a family member. However, it’s essential to understand that this type of deed does not provide any warranties regarding the property’s title.

How do I complete a Quitclaim Deed in California?

To complete a Quitclaim Deed in California, you will need to provide specific information. This includes the names of the grantor (the person transferring the property) and grantee (the person receiving the property), a description of the property, and the date of the transfer. It’s important to ensure that all information is accurate and clearly written. After filling out the form, both parties must sign it in the presence of a notary public.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. A Warranty Deed provides a guarantee that the grantor has clear title to the property and the right to sell it. In contrast, a Quitclaim Deed offers no such guarantees. This distinction is crucial, especially for buyers who want to ensure that they are receiving a property free of liens or other claims.

Do I need to file the Quitclaim Deed with the county?

Yes, after executing the Quitclaim Deed, it must be filed with the county recorder’s office where the property is located. This step is vital for ensuring that the transfer of ownership is legally recognized. Filing the deed also protects the interests of the grantee by making the transaction part of the public record.

Are there any taxes associated with a Quitclaim Deed?

While transferring property using a Quitclaim Deed may not trigger a sales tax, there may still be other fees or taxes involved. For example, California may impose a documentary transfer tax, depending on the county. It’s wise to check with local authorities or consult a tax professional to understand any potential financial implications.

Can I revoke a Quitclaim Deed after it has been executed?

Once a Quitclaim Deed has been executed and recorded, it cannot simply be revoked. However, the grantor may create a new deed to transfer the property back, effectively reversing the original transaction. This process can be complicated, so seeking legal advice is advisable if you wish to make changes after the deed has been executed.

What if the property has a mortgage?

Transferring property with an existing mortgage using a Quitclaim Deed does not eliminate the mortgage obligation. The original borrower remains responsible for the mortgage, even if the property is transferred to someone else. It’s crucial to communicate with the lender before proceeding, as some mortgages contain due-on-sale clauses that could trigger the loan to be paid in full upon transfer.

Can I use a Quitclaim Deed for commercial property?

Yes, a Quitclaim Deed can be used for commercial properties as well as residential properties. The same principles apply regardless of the type of property being transferred. However, it’s essential to consider the implications of such a transfer, especially if the property is subject to leases or other agreements.

Dos and Don'ts

When filling out the California Quitclaim Deed form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are four things you should and shouldn't do:

- Do ensure that all names are spelled correctly and match the names on the property title.

- Do include the legal description of the property, which can usually be found on the existing deed.

- Don't leave any required fields blank; this can lead to delays or rejections.

- Don't forget to have the form notarized before submitting it to the county recorder's office.

Browse Other Popular Quitclaim Deed Templates for Specific States

Quit Claim Deed Form Texas Pdf - A Quitclaim Deed can provide a fast method for property transfer without extensive legal processes.

To facilitate this process, you can utilize resources such as California PDF Forms, which provide easy access to the necessary documents needed for the transaction, ensuring that all legal requirements are met efficiently.