Blank California Promissory Note Document

The California Promissory Note form serves as a crucial financial instrument in various lending scenarios, providing a clear outline of the terms under which money is borrowed and repaid. This document typically includes essential details such as the principal amount, interest rate, repayment schedule, and the consequences of default. Borrowers and lenders alike rely on this form to establish a mutual understanding and legally binding agreement that protects their interests. In addition to specifying the payment terms, the note may also address prepayment options, late fees, and any collateral involved in the transaction. By understanding the nuances of this form, individuals and businesses can navigate the lending landscape with greater confidence, ensuring that their financial agreements are both transparent and enforceable. As a fundamental component of personal and commercial finance in California, the Promissory Note form plays a significant role in fostering trust and accountability between parties engaged in lending activities.

Document Attributes

| Fact Name | Description |

|---|---|

| Definition | A California Promissory Note is a written promise to pay a specific amount of money to a designated party at a defined time. |

| Governing Law | The form is governed by the California Civil Code, specifically Sections 3300-3302. |

| Types | Promissory notes can be secured or unsecured, depending on whether collateral is involved. |

| Interest Rates | Interest rates on promissory notes in California must comply with state usury laws. |

| Form Requirements | The note must include essential details such as the amount, interest rate, and payment terms. |

| Signatures | Both the borrower and lender must sign the note for it to be legally binding. |

| Default Terms | Terms regarding default should be clearly outlined to protect the lender's interests. |

| Transferability | Promissory notes can often be transferred or sold to another party unless stated otherwise. |

| Enforcement | If the borrower defaults, the lender has the right to take legal action to recover the owed amount. |

Similar forms

- Loan Agreement: Similar to a promissory note, a loan agreement outlines the terms and conditions of a loan, including repayment schedules and interest rates. However, it often includes more detailed provisions regarding the responsibilities of both the lender and borrower.

- IOU (I Owe You): An IOU is a simple acknowledgment of debt. While it lacks the formal structure of a promissory note, it serves a similar purpose by indicating that one party owes money to another.

- Mortgage: A mortgage is a specific type of loan secured by real property. Like a promissory note, it involves a promise to repay, but it also includes details about the collateral (the property) and the consequences of default.

- Secured Note: This document is a promissory note backed by collateral. It shares similarities with a standard promissory note but includes specific terms about what happens if the borrower fails to repay.

- Credit Agreement: A credit agreement outlines the terms of credit extended to a borrower. While it may be broader than a promissory note, it still contains key elements like repayment terms and interest rates.

- Installment Agreement: This document details a payment plan for a debt. It resembles a promissory note by specifying how much is owed and when payments are due, but it usually involves multiple payments over time.

- Personal Guarantee: A personal guarantee involves a promise made by an individual to repay a debt if the primary borrower defaults. It functions similarly to a promissory note in that it establishes a commitment to pay.

- Boat Bill of Sale: The California Boat Bill of Sale serves as an important document that formalizes the transfer of ownership for watercraft. This document not only provides protection for both buyer and seller but also ensures a clear legal acknowledgment of the transaction. To fill out the form accurately, refer to California PDF Forms.

- Lease Agreement: In some cases, a lease agreement can include a promissory note if it involves rental payments. It specifies the terms of the lease and payment obligations, similar to how a promissory note outlines repayment terms.

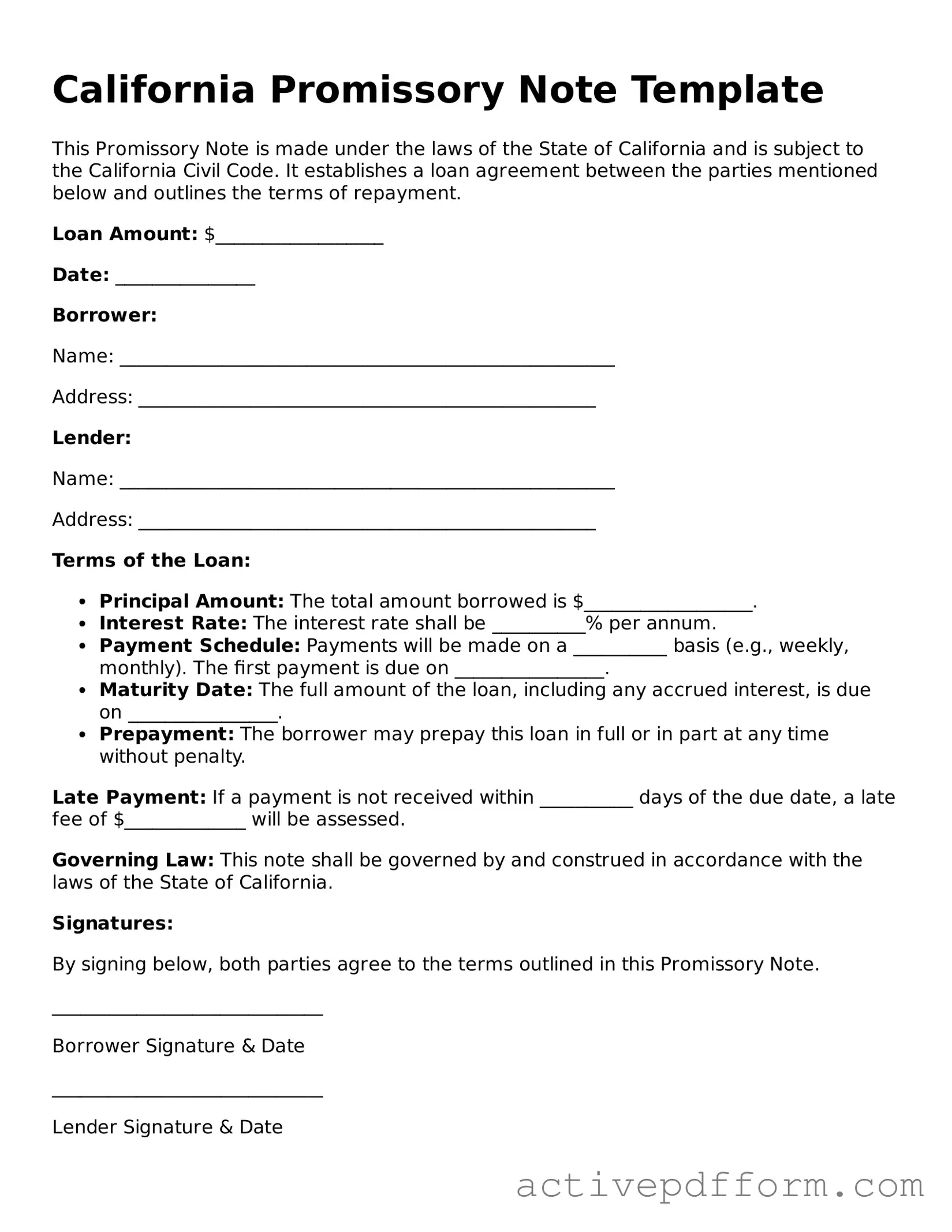

California Promissory Note Example

California Promissory Note Template

This Promissory Note is made under the laws of the State of California and is subject to the California Civil Code. It establishes a loan agreement between the parties mentioned below and outlines the terms of repayment.

Loan Amount: $__________________

Date: _______________

Borrower:

Name: _____________________________________________________

Address: _________________________________________________

Lender:

Name: _____________________________________________________

Address: _________________________________________________

Terms of the Loan:

- Principal Amount: The total amount borrowed is $__________________.

- Interest Rate: The interest rate shall be __________% per annum.

- Payment Schedule: Payments will be made on a __________ basis (e.g., weekly, monthly). The first payment is due on ________________.

- Maturity Date: The full amount of the loan, including any accrued interest, is due on ________________.

- Prepayment: The borrower may prepay this loan in full or in part at any time without penalty.

Late Payment: If a payment is not received within __________ days of the due date, a late fee of $_____________ will be assessed.

Governing Law: This note shall be governed by and construed in accordance with the laws of the State of California.

Signatures:

By signing below, both parties agree to the terms outlined in this Promissory Note.

_____________________________

Borrower Signature & Date

_____________________________

Lender Signature & Date

Understanding California Promissory Note

What is a California Promissory Note?

A California Promissory Note is a written agreement in which one party (the borrower) promises to pay a specific amount of money to another party (the lender) under defined terms. This document outlines the amount borrowed, the interest rate, payment schedule, and any other relevant conditions. It serves as a legal record of the loan and the borrower's commitment to repay it.

Who can use a California Promissory Note?

Individuals, businesses, and organizations can use a California Promissory Note. It is commonly utilized for personal loans, business financing, and real estate transactions. Both the lender and borrower should ensure they understand the terms and implications of the agreement before signing.

What are the key components of a California Promissory Note?

A California Promissory Note typically includes the following key components: the names and addresses of the borrower and lender, the principal amount borrowed, the interest rate, the repayment schedule, and any late fees or penalties for missed payments. Additionally, it may outline provisions for default and any collateral securing the loan.

Is a California Promissory Note legally binding?

Yes, a California Promissory Note is legally binding once it is signed by both parties. It creates a legal obligation for the borrower to repay the loan according to the agreed terms. If the borrower fails to meet these obligations, the lender may pursue legal action to recover the owed amount.

Do I need a witness or notary for a California Promissory Note?

While it is not required by law, having a witness or notary public can enhance the credibility of a California Promissory Note. A notary public can verify the identities of the parties involved and the authenticity of the signatures. This may provide additional protection in case of disputes.

Can a California Promissory Note be modified after it is signed?

Yes, a California Promissory Note can be modified after it is signed, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the amended agreement to ensure clarity and enforceability.

Dos and Don'ts

When filling out the California Promissory Note form, it is important to follow certain guidelines to ensure accuracy and legality. Below is a list of things you should and shouldn't do.

- Do read the entire form carefully before starting to fill it out.

- Do include all necessary information, such as the names of the borrower and lender.

- Do specify the loan amount clearly to avoid any confusion.

- Do indicate the interest rate, if applicable, and clarify whether it is fixed or variable.

- Do outline the repayment terms, including the schedule and method of payment.

- Don't leave any sections blank; all fields should be completed.

- Don't use vague language; be specific about all terms and conditions.

- Don't forget to date and sign the document; both parties should sign it.

- Don't ignore local laws that may affect the terms of the note.

Browse Other Popular Promissory Note Templates for Specific States

Loan Agreement Template Florida - Promissory notes can be bought and sold, making them transferable assets.

When renting property, it's crucial to understand the implications of a thorough Lease Agreement template. This document clearly delineates the responsibilities of both landlords and tenants, helping to foster a transparent and respectful rental relationship while establishing essential terms to prevent disputes.

Promissory Note Texas - The note serves as proof that a loan has taken place.