Blank California Loan Agreement Document

When entering into a loan agreement in California, understanding the key components of the California Loan Agreement form is essential for both lenders and borrowers. This form serves as a formal contract outlining the terms of the loan, including the principal amount, interest rate, repayment schedule, and any collateral involved. It also specifies the rights and responsibilities of both parties, ensuring clarity and reducing the risk of disputes. Important details, such as the duration of the loan and conditions for default, are clearly articulated. Additionally, the form may include provisions for late fees and prepayment options, which can significantly impact the overall cost of borrowing. By familiarizing oneself with this form, individuals can navigate the lending process with greater confidence and security, knowing that their interests are protected under California law.

Document Attributes

| Fact Name | Description |

|---|---|

| Governing Law | The California Loan Agreement form is governed by the laws of the State of California. |

| Purpose | This form is used to outline the terms and conditions of a loan between a lender and a borrower. |

| Parties Involved | The agreement typically includes the lender, who provides the funds, and the borrower, who receives the funds. |

| Loan Amount | The specific amount of money being loaned must be clearly stated in the agreement. |

| Interest Rate | The form should specify the interest rate applicable to the loan, whether fixed or variable. |

| Repayment Terms | Details regarding the repayment schedule, including due dates and payment amounts, are outlined in the agreement. |

| Default Provisions | The agreement includes terms that define what constitutes a default and the consequences thereof. |

| Signatures | Both parties must sign the agreement for it to be legally binding. |

Similar forms

The Loan Agreement form shares similarities with several other financial and legal documents. Each of these documents serves a specific purpose in transactions involving loans, credit, or financial obligations. Here are six documents that are similar to a Loan Agreement:

- Promissory Note: This document outlines a borrower's promise to repay a loan. It specifies the loan amount, interest rate, and repayment terms, similar to a Loan Agreement.

- ATV Bill of Sale: This document serves as legal proof of ownership transfer for all-terrain vehicles, ensuring transparency in sales. For more details, visit California PDF Forms.

- Mortgage Agreement: Used when securing a loan with real estate, this document details the terms of the mortgage, including repayment obligations and the consequences of default.

- Credit Agreement: This document governs the terms of a line of credit. Like a Loan Agreement, it defines the borrowing limits, interest rates, and repayment schedules.

- Security Agreement: This agreement outlines collateral for a loan. It provides details on what assets are pledged, similar to how a Loan Agreement may specify collateral requirements.

- Loan Application: This document is completed by a borrower seeking a loan. It gathers essential information about the borrower, much like the initial steps taken before a Loan Agreement is finalized.

- Debt Settlement Agreement: This document outlines the terms under which a debtor agrees to settle a debt for less than the full amount owed. It shares similarities in terms of defining obligations and agreements between parties.

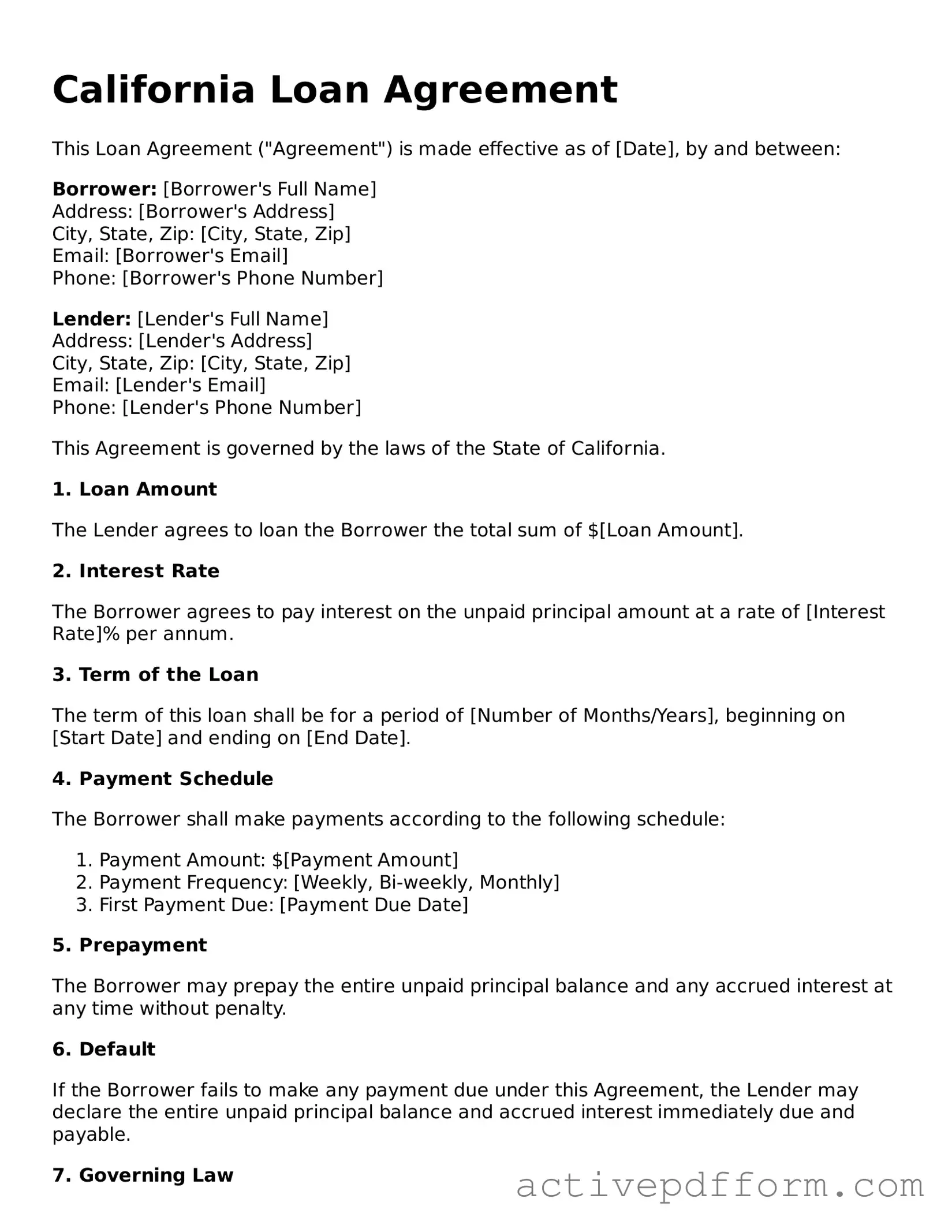

California Loan Agreement Example

California Loan Agreement

This Loan Agreement ("Agreement") is made effective as of [Date], by and between:

Borrower: [Borrower's Full Name]

Address: [Borrower's Address]

City, State, Zip: [City, State, Zip]

Email: [Borrower's Email]

Phone: [Borrower's Phone Number]

Lender: [Lender's Full Name]

Address: [Lender's Address]

City, State, Zip: [City, State, Zip]

Email: [Lender's Email]

Phone: [Lender's Phone Number]

This Agreement is governed by the laws of the State of California.

1. Loan Amount

The Lender agrees to loan the Borrower the total sum of $[Loan Amount].

2. Interest Rate

The Borrower agrees to pay interest on the unpaid principal amount at a rate of [Interest Rate]% per annum.

3. Term of the Loan

The term of this loan shall be for a period of [Number of Months/Years], beginning on [Start Date] and ending on [End Date].

4. Payment Schedule

The Borrower shall make payments according to the following schedule:

- Payment Amount: $[Payment Amount]

- Payment Frequency: [Weekly, Bi-weekly, Monthly]

- First Payment Due: [Payment Due Date]

5. Prepayment

The Borrower may prepay the entire unpaid principal balance and any accrued interest at any time without penalty.

6. Default

If the Borrower fails to make any payment due under this Agreement, the Lender may declare the entire unpaid principal balance and accrued interest immediately due and payable.

7. Governing Law

This Agreement shall be governed in accordance with the laws of the State of California.

8. Signatures

The parties have executed this Loan Agreement as of the date first above written.

______________________________

Signature of Borrower

______________________________

Signature of Lender

Understanding California Loan Agreement

What is a California Loan Agreement form?

The California Loan Agreement form is a legal document used to outline the terms and conditions of a loan between a lender and a borrower. It specifies important details such as the loan amount, interest rate, repayment schedule, and any collateral involved. This agreement serves to protect both parties by clearly defining their rights and obligations.

Who can use a California Loan Agreement form?

Any individual or business in California looking to lend or borrow money can utilize a Loan Agreement form. This includes personal loans between friends or family, business loans, and even loans involving real estate transactions. It is essential for both parties to understand the terms before entering into the agreement.

What are the key components of a Loan Agreement?

A well-drafted Loan Agreement typically includes several key components: the names and addresses of the parties involved, the loan amount, the interest rate, the repayment schedule, any fees or penalties for late payments, and provisions for default. Additionally, it may outline any collateral securing the loan and conditions under which the agreement can be modified or terminated.

Is it necessary to have the Loan Agreement notarized?

While notarization is not always required for a Loan Agreement to be legally binding in California, it is highly recommended. Having the document notarized adds a layer of authenticity and can help prevent disputes over the agreement's validity in the future.

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender has the right to take specific actions as outlined in the Loan Agreement. This may include demanding immediate repayment of the outstanding balance, charging late fees, or taking possession of any collateral. The lender may also pursue legal action to recover the owed amount, depending on the terms of the agreement.

Can the terms of the Loan Agreement be changed after it is signed?

Yes, the terms of a Loan Agreement can be modified after it is signed, but both parties must agree to any changes. It is advisable to document any amendments in writing and have both parties sign the new agreement to ensure clarity and legal enforceability.

Are there any specific laws governing Loan Agreements in California?

Yes, Loan Agreements in California are subject to both state and federal laws. The California Civil Code contains provisions that govern loans, including interest rate limits and disclosure requirements. Additionally, federal regulations may apply, particularly for loans involving consumer credit. It is crucial to be aware of these laws to ensure compliance and protect both parties' rights.

What should I do if I have a dispute regarding the Loan Agreement?

If a dispute arises regarding the Loan Agreement, the first step is to communicate directly with the other party to try to resolve the issue amicably. If that fails, consider mediation or arbitration as alternative dispute resolution methods. If necessary, legal action may be pursued, but it is often advisable to consult with a legal professional before taking this step.

Where can I obtain a California Loan Agreement form?

California Loan Agreement forms can be obtained from various sources, including legal stationery stores, online legal service providers, or through legal counsel. It is important to ensure that the form complies with California laws and is tailored to the specific needs of the parties involved.

Dos and Don'ts

When filling out the California Loan Agreement form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are five things to do and five things to avoid:

Things You Should Do:

- Read the entire form carefully before starting to fill it out.

- Provide accurate and complete information in all sections.

- Double-check all figures and calculations to prevent errors.

- Sign and date the form in the designated areas.

- Keep a copy of the completed form for your records.

Things You Shouldn't Do:

- Don't rush through the form; take your time to ensure accuracy.

- Avoid using abbreviations or unclear terms that could lead to confusion.

- Do not leave any required fields blank.

- Refrain from altering the form in any way, such as crossing out text.

- Don't forget to review the terms and conditions before signing.

Browse Other Popular Loan Agreement Templates for Specific States

Free Promissory Note Template Florida - The Loan Agreement includes provisions for late payments.

The Ohio Horse Bill of Sale form is crucial for anyone looking to document the transfer of equine ownership effectively. For those interested, a reliable resource for understanding the specifics can be found in the comprehensive guide to the Horse Bill of Sale process at comprehensive overview of the Horse Bill of Sale.

Promissory Note Texas - Clear terms help prevent misunderstandings later.