Blank California Gift Deed Document

When it comes to transferring property without the exchange of money, the California Gift Deed form plays a crucial role. This legal document allows individuals to give real estate as a gift, ensuring that the transfer is recognized by the state. Understanding its components is essential for both the giver and the recipient. The form typically includes details about the property being gifted, the names of both parties, and any relevant information that establishes the intent to make a gift. It also requires the signature of the giver, and in some cases, witnesses may be needed to validate the transaction. Additionally, filing the Gift Deed with the county recorder's office is necessary to complete the process and provide public notice of the transfer. This form not only simplifies the process of gifting property but also helps avoid potential disputes in the future. Whether you are considering gifting a family home or a piece of land, familiarizing yourself with the California Gift Deed form is an important step in ensuring a smooth and legally sound transfer.

Document Attributes

| Fact Name | Description |

|---|---|

| Purpose | The California Gift Deed is used to transfer property ownership as a gift without any payment involved. |

| Governing Law | This form is governed by California Civil Code Section 11911. |

| Signature Requirement | Both the donor (giver) and the recipient (receiver) must sign the deed for it to be valid. |

| Notarization | The Gift Deed must be notarized to be legally effective. |

| Recording | To protect the gift, the deed should be recorded with the county recorder’s office. |

Similar forms

A Gift Deed is a legal document that facilitates the transfer of property or assets without any exchange of money. Here are nine documents that share similarities with a Gift Deed:

- Will: A Will outlines how a person's assets should be distributed after their death. Like a Gift Deed, it involves the transfer of property, but a Will takes effect only upon death, while a Gift Deed is effective immediately.

- Trust Agreement: This document establishes a trust to manage assets for beneficiaries. Both documents involve the transfer of property, but a trust can manage assets over time, whereas a Gift Deed transfers ownership outright.

- Quitclaim Deed: A Quitclaim Deed transfers any interest one person has in a property to another. Similar to a Gift Deed, it does not guarantee the value or condition of the property being transferred.

- Sale Deed: A Sale Deed is used to transfer property ownership in exchange for payment. While a Gift Deed is a no-cost transfer, both documents serve to change ownership of real estate.

- Transfer on Death Deed: This deed allows property to pass to a beneficiary upon the owner's death. It is similar to a Gift Deed because it involves transferring property, but it is contingent on the owner's death.

- Lease Agreement: A Lease Agreement allows one party to use another's property for a specified time in exchange for payment. Like a Gift Deed, it involves property rights, but a lease does not transfer ownership.

- Power of Attorney: This document grants someone the authority to act on another's behalf in legal matters. While it doesn't transfer ownership, it can allow someone to manage or gift property for another.

- Deed of Trust: A Deed of Trust secures a loan by transferring property title to a trustee. It shares the property transfer aspect with a Gift Deed but is linked to a financial obligation.

Durable Power of Attorney: For ensuring your preferences are upheld during incapacitation, consider the essential Durable Power of Attorney documentation that allows an appointed individual to make legal decisions on your behalf.

- Affidavit of Heirship: This document establishes the heirs of a deceased person's estate. It relates to property transfer, similar to a Gift Deed, but it is used to clarify ownership after death rather than during life.

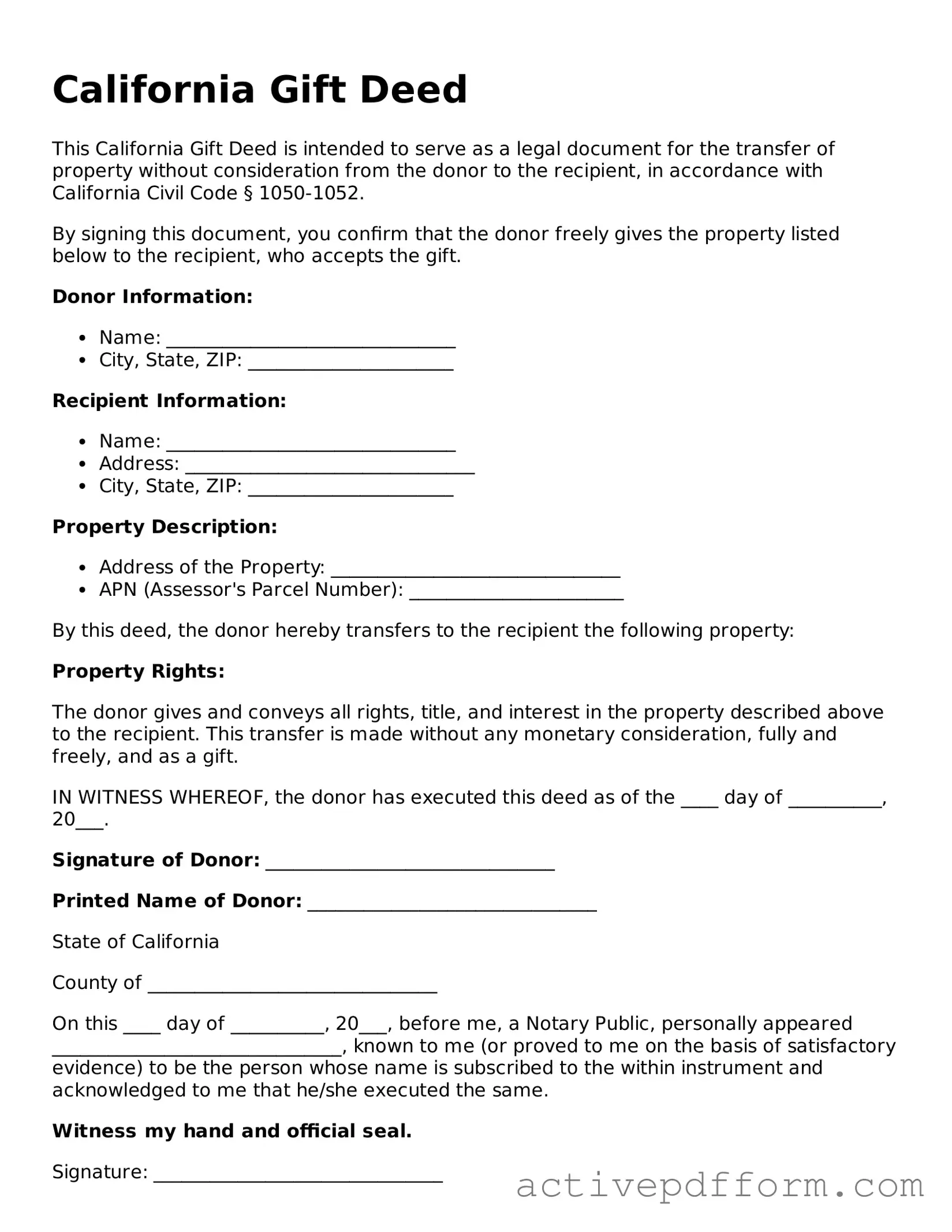

California Gift Deed Example

California Gift Deed

This California Gift Deed is intended to serve as a legal document for the transfer of property without consideration from the donor to the recipient, in accordance with California Civil Code § 1050-1052.

By signing this document, you confirm that the donor freely gives the property listed below to the recipient, who accepts the gift.

Donor Information:

- Name: _______________________________

- City, State, ZIP: ______________________

Recipient Information:

- Name: _______________________________

- Address: _______________________________

- City, State, ZIP: ______________________

Property Description:

- Address of the Property: _______________________________

- APN (Assessor's Parcel Number): _______________________

By this deed, the donor hereby transfers to the recipient the following property:

Property Rights:

The donor gives and conveys all rights, title, and interest in the property described above to the recipient. This transfer is made without any monetary consideration, fully and freely, and as a gift.

IN WITNESS WHEREOF, the donor has executed this deed as of the ____ day of __________, 20___.

Signature of Donor: _______________________________

Printed Name of Donor: _______________________________

State of California

County of _______________________________

On this ____ day of __________, 20___, before me, a Notary Public, personally appeared _______________________________, known to me (or proved to me on the basis of satisfactory evidence) to be the person whose name is subscribed to the within instrument and acknowledged to me that he/she executed the same.

Witness my hand and official seal.

Signature: _______________________________

Name: _______________________________

Notary Public, State of California

Understanding California Gift Deed

What is a California Gift Deed?

A California Gift Deed is a legal document used to transfer ownership of real property from one person to another as a gift. This type of deed does not involve any exchange of money or other compensation. It is often used among family members or close friends to facilitate the transfer of property without the complications of a sale.

Who can use a Gift Deed in California?

Any property owner in California can use a Gift Deed to transfer their property to another individual. This is commonly done between family members, such as parents gifting property to their children. However, it is essential that the grantor (the person giving the gift) is of sound mind and legally capable of making such a transfer.

What information is required on a Gift Deed?

A Gift Deed must include specific information to be valid. This includes the names and addresses of both the grantor and the grantee (the person receiving the gift), a legal description of the property, and the statement indicating that the property is being given as a gift. Additionally, the deed must be signed by the grantor and notarized to ensure its authenticity.

Are there tax implications when using a Gift Deed?

Yes, there can be tax implications when transferring property as a gift. The IRS allows individuals to gift a certain amount each year without incurring gift tax. However, if the value of the property exceeds this annual exclusion amount, the donor may need to file a gift tax return. It is advisable to consult with a tax professional to understand the specific tax consequences.

Do I need to file the Gift Deed with the county?

Yes, after completing a Gift Deed, it must be recorded with the county recorder's office where the property is located. This step is crucial as it provides public notice of the transfer and protects the rights of the new owner. Failing to record the deed may lead to complications in establishing ownership.

Can a Gift Deed be revoked?

Once a Gift Deed is executed and recorded, it generally cannot be revoked. The transfer of ownership is considered final. However, if the grantor retains certain rights or conditions in the deed, it may be possible to contest the gift under specific circumstances. Legal advice should be sought if there are concerns about revocation.

What happens if the grantor passes away after signing the Gift Deed?

If the grantor passes away after executing a Gift Deed, the property typically remains with the grantee, as the transfer of ownership has already occurred. However, if the gift was not properly documented or recorded, it may lead to disputes among heirs. Proper documentation is essential to avoid potential conflicts.

Is legal assistance needed to prepare a Gift Deed?

While it is not legally required to have an attorney prepare a Gift Deed, seeking legal assistance can be beneficial. An attorney can ensure that the deed is correctly drafted, meets all legal requirements, and addresses any specific concerns related to the transfer. This can help prevent future disputes and complications.

Dos and Don'ts

When filling out the California Gift Deed form, it is important to approach the process with care and attention to detail. Below is a list of things to do and avoid to ensure a smooth experience.

- Do provide accurate information about the donor and recipient.

- Do clearly describe the property being gifted.

- Do ensure all signatures are present and legible.

- Do include the date of the gift.

- Do have the document notarized to validate it.

- Don't leave any sections of the form blank.

- Don't use vague language when describing the property.

- Don't forget to check for errors before submitting.

- Don't submit the form without understanding the tax implications.

- Don't ignore local recording requirements.

By following these guidelines, individuals can help ensure that the Gift Deed is completed correctly and fulfills its intended purpose.

Browse Other Popular Gift Deed Templates for Specific States

Gift Deed Form Texas - Any disputes from a Gift Deed may lead to legal complications.

When selling or purchasing a recreational vehicle in Arizona, it is crucial to utilize the proper documentation to ensure a smooth transaction. The Arizona RV Bill of Sale form is specifically designed for this purpose, providing a detailed record of the sale and transfer of ownership. To facilitate the completion of this form, you can find valuable resources like the Arizona PDF Forms that will assist you in preparing the necessary information.