Blank California Durable Power of Attorney Document

The California Durable Power of Attorney form is a vital legal document that allows individuals to appoint someone they trust to make financial and legal decisions on their behalf when they are unable to do so. This form ensures that the appointed agent has the authority to manage a wide range of affairs, including handling bank transactions, paying bills, and making investment decisions. Importantly, the durable aspect of the document means that it remains effective even if the principal becomes incapacitated. The form must be signed by the principal and typically requires the signatures of witnesses or a notary to ensure its validity. Understanding the nuances of this form is essential for anyone considering who will manage their affairs in times of need. By clearly outlining the powers granted to the agent, the Durable Power of Attorney helps prevent confusion and potential disputes among family members and caregivers. It is a proactive step that individuals can take to safeguard their interests and maintain control over their financial and legal matters, even when they cannot actively participate in those decisions.

Document Attributes

| Fact Name | Description |

|---|---|

| Definition | A California Durable Power of Attorney allows an individual to appoint someone to make financial decisions on their behalf. |

| Governing Law | This form is governed by the California Probate Code, specifically Sections 4000-4545. |

| Durability | The "durable" aspect means the authority remains effective even if the principal becomes incapacitated. |

| Agent Authority | The appointed agent can manage financial matters, including banking, real estate, and investments. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are competent. |

| Signing Requirements | The form must be signed by the principal and witnessed by at least one person or notarized. |

Similar forms

- General Power of Attorney: Like the Durable Power of Attorney, this document allows one person to act on behalf of another. However, it typically becomes invalid if the person who created it becomes incapacitated.

- Healthcare Power of Attorney: This document specifically grants someone the authority to make medical decisions for another person if they are unable to do so themselves.

- California LLC 1 Form: To establish your Limited Liability Company in California, it is essential to complete the California PDF Forms accurately and submit it promptly to facilitate the filing process.

- Living Will: A living will outlines a person's wishes regarding medical treatment in situations where they cannot communicate. It complements the Healthcare Power of Attorney.

- Financial Power of Attorney: This document allows a designated person to manage financial matters on behalf of someone else, similar to a Durable Power of Attorney but often limited to financial issues.

- Trust Agreement: A trust agreement establishes a trust to manage assets for beneficiaries. It can provide similar authority over assets as a Durable Power of Attorney.

- Advance Directive: This document combines a living will and a healthcare power of attorney, allowing individuals to express their healthcare preferences and appoint someone to make decisions for them.

- Letter of Authority: This informal document grants someone the power to act on another's behalf in specific situations, though it is less formal than a Durable Power of Attorney.

- Guardianship Papers: These legal documents establish a guardian for someone who cannot care for themselves. They provide authority similar to that of a Durable Power of Attorney in terms of decision-making.

- Representative Payee Agreement: This document designates someone to manage Social Security or other government benefits for an individual, similar to the financial authority granted by a Durable Power of Attorney.

- Business Power of Attorney: This type of document allows someone to make business decisions on behalf of another person or entity, similar to the broader powers granted in a Durable Power of Attorney.

California Durable Power of Attorney Example

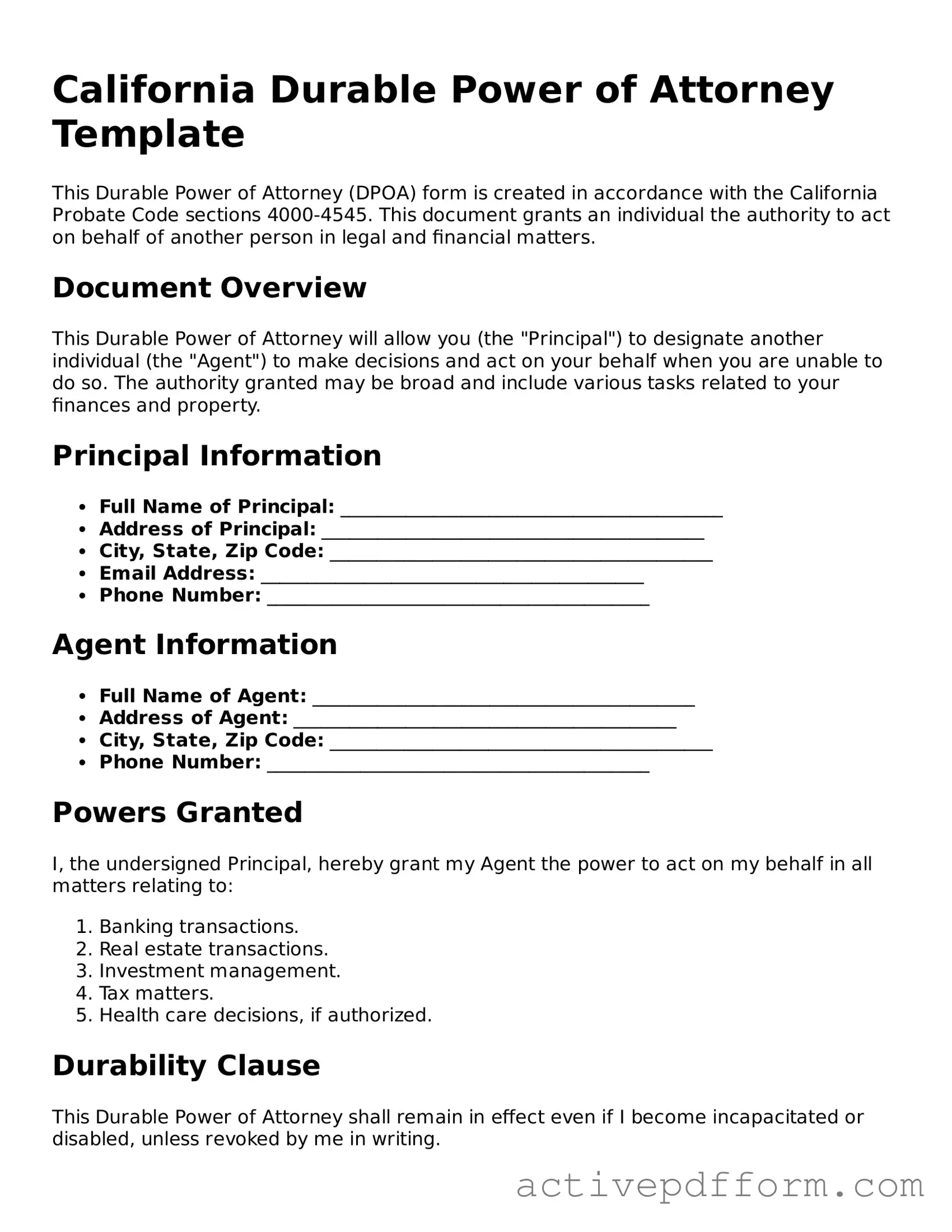

California Durable Power of Attorney Template

This Durable Power of Attorney (DPOA) form is created in accordance with the California Probate Code sections 4000-4545. This document grants an individual the authority to act on behalf of another person in legal and financial matters.

Document Overview

This Durable Power of Attorney will allow you (the "Principal") to designate another individual (the "Agent") to make decisions and act on your behalf when you are unable to do so. The authority granted may be broad and include various tasks related to your finances and property.

Principal Information

- Full Name of Principal: _________________________________________

- Address of Principal: _________________________________________

- City, State, Zip Code: _________________________________________

- Email Address: _________________________________________

- Phone Number: _________________________________________

Agent Information

- Full Name of Agent: _________________________________________

- Address of Agent: _________________________________________

- City, State, Zip Code: _________________________________________

- Phone Number: _________________________________________

Powers Granted

I, the undersigned Principal, hereby grant my Agent the power to act on my behalf in all matters relating to:

- Banking transactions.

- Real estate transactions.

- Investment management.

- Tax matters.

- Health care decisions, if authorized.

Durability Clause

This Durable Power of Attorney shall remain in effect even if I become incapacitated or disabled, unless revoked by me in writing.

Signatures

By signing below, I acknowledge that I understand and agree to the terms set forth in this document.

- Signature of Principal: _______________________________

- Date: _________________________________________

Witness:

- Witness Name: _______________________________

- Witness Signature: _______________________________

- Date: _________________________________________

Notary Public:

- Notary Name: _______________________________

- Date of Acknowledgment: _______________________________

Understanding California Durable Power of Attorney

What is a California Durable Power of Attorney?

A California Durable Power of Attorney is a legal document that allows you to appoint someone you trust to manage your financial and legal affairs if you become unable to do so yourself. This document remains effective even if you become incapacitated, ensuring that your affairs can continue to be handled without interruption.

Who can be appointed as an agent in a Durable Power of Attorney?

You can choose anyone you trust to act as your agent, often referred to as your attorney-in-fact. This could be a family member, a close friend, or a professional such as an attorney or accountant. It's important to select someone who is responsible and understands your values and wishes, as they will have significant control over your financial matters.

What powers can I grant to my agent?

The powers you grant can be tailored to your needs. Common powers include managing bank accounts, paying bills, buying or selling property, and handling investments. You can also specify limitations or conditions on the powers you grant. This flexibility allows you to ensure that your agent acts in a manner that aligns with your preferences.

Do I need to have my Durable Power of Attorney notarized?

Yes, in California, it is recommended to have your Durable Power of Attorney notarized to ensure its validity. Notarization helps confirm that you signed the document willingly and that you were of sound mind at the time. Some financial institutions may require notarization before they will accept the document, so it's a good practice to have it done.

Can I revoke my Durable Power of Attorney?

Absolutely! You have the right to revoke your Durable Power of Attorney at any time as long as you are mentally competent. To revoke it, you should create a written document stating your intention to revoke, and it’s advisable to notify your agent and any institutions or individuals that may have a copy of the original document. This ensures that everyone is aware of the change and can act accordingly.

Dos and Don'ts

When filling out the California Durable Power of Attorney form, it’s important to follow certain guidelines to ensure everything is completed correctly. Here’s a helpful list of what to do and what to avoid.

- Do read the entire form carefully before starting.

- Do choose a trusted person as your agent.

- Do specify the powers you are granting clearly.

- Do sign the form in front of a notary public.

- Don't leave any sections blank unless instructed.

- Don't use outdated forms; always use the latest version.

- Don't forget to provide copies to your agent and relevant parties.

Following these tips can help ensure your Durable Power of Attorney is valid and effective. Always double-check your work to avoid any mistakes.

Browse Other Popular Durable Power of Attorney Templates for Specific States

Power of Attorney Form Texas Pdf - Understanding the implications of granting power is vital before signing this document.

For those in need of the essential Motorcycle Bill of Sale documentation, obtaining a reliable form can facilitate the accurate transfer of ownership and ensure compliance with legal requirements. You can easily access the information needed at a comprehensive source for Motorcycle Bill of Sale templates.