Blank California Deed in Lieu of Foreclosure Document

In California, homeowners facing financial difficulties and the looming threat of foreclosure may find a valuable alternative in the Deed in Lieu of Foreclosure form. This legal instrument allows property owners to voluntarily transfer the title of their home back to the lender, effectively sidestepping the lengthy and often stressful foreclosure process. By utilizing this form, homeowners can mitigate the negative impacts on their credit scores and potentially avoid the costs associated with foreclosure proceedings. The Deed in Lieu of Foreclosure not only provides a streamlined method for lenders to reclaim their collateral but also offers a sense of closure for borrowers who are grappling with the emotional and financial burden of their situation. Key elements of this form include the mutual agreement between the homeowner and lender, the requirement for the property to be free of other liens, and the potential for the borrower to negotiate terms that may include the forgiveness of remaining debt. Understanding these aspects can empower homeowners to make informed decisions during a challenging time.

Document Attributes

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers the title of their property to the lender to avoid foreclosure proceedings. |

| Governing Laws | This form is governed by California Civil Code Sections 2924-2924k. |

| Eligibility | To qualify, the borrower must be facing financial difficulties and unable to continue making mortgage payments. |

| Benefits | This option can help borrowers avoid the lengthy foreclosure process and potentially reduce the impact on their credit score. |

| Process | The borrower must negotiate with the lender, complete the necessary paperwork, and ensure that all liens on the property are addressed. |

Similar forms

- Loan Modification Agreement: This document allows a borrower to change the terms of their existing loan. Similar to a Deed in Lieu of Foreclosure, it aims to prevent foreclosure by making the loan more manageable for the borrower.

- Short Sale Agreement: In a short sale, the lender agrees to accept less than the total amount owed on the mortgage. Like a Deed in Lieu, it provides an alternative to foreclosure, allowing the homeowner to sell the property for less than the mortgage balance.

- Forbearance Agreement: This document temporarily suspends or reduces mortgage payments. It is similar to a Deed in Lieu of Foreclosure because both options help borrowers avoid foreclosure while they work on a long-term solution.

- New York MV51 Form: This form is essential for documenting the sale or transfer of vehicles older than 1972, ensuring proper legal ownership transfer. It is critical for private sales and must be supported by additional documents. For more information, refer to nytemplates.com/blank-new-york-mv51-template.

- Repayment Plan: A repayment plan allows borrowers to catch up on missed payments over time. It serves a similar purpose as a Deed in Lieu by providing a structured way to avoid foreclosure.

- Bankruptcy Filing: Filing for bankruptcy can halt foreclosure proceedings and provide a way to restructure debts. While it differs in process, it shares the goal of protecting the borrower from losing their home.

- Quitclaim Deed: A quitclaim deed transfers ownership of a property without any guarantees. Similar to a Deed in Lieu, it allows the borrower to relinquish their interest in the property, often to avoid the negative impacts of foreclosure.

California Deed in Lieu of Foreclosure Example

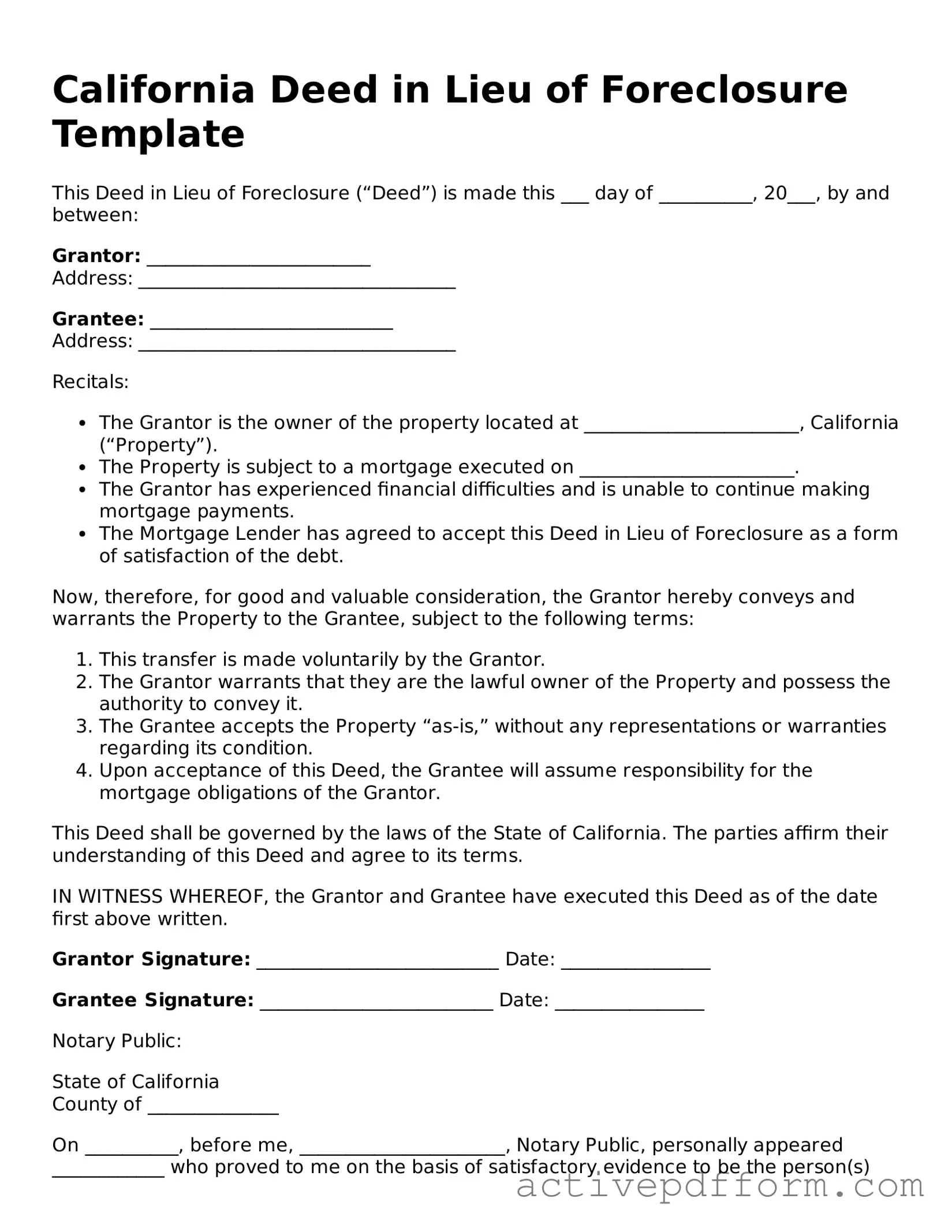

California Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure (“Deed”) is made this ___ day of __________, 20___, by and between:

Grantor: ________________________

Address: __________________________________

Grantee: __________________________

Address: __________________________________

Recitals:

- The Grantor is the owner of the property located at _______________________, California (“Property”).

- The Property is subject to a mortgage executed on _______________________.

- The Grantor has experienced financial difficulties and is unable to continue making mortgage payments.

- The Mortgage Lender has agreed to accept this Deed in Lieu of Foreclosure as a form of satisfaction of the debt.

Now, therefore, for good and valuable consideration, the Grantor hereby conveys and warrants the Property to the Grantee, subject to the following terms:

- This transfer is made voluntarily by the Grantor.

- The Grantor warrants that they are the lawful owner of the Property and possess the authority to convey it.

- The Grantee accepts the Property “as-is,” without any representations or warranties regarding its condition.

- Upon acceptance of this Deed, the Grantee will assume responsibility for the mortgage obligations of the Grantor.

This Deed shall be governed by the laws of the State of California. The parties affirm their understanding of this Deed and agree to its terms.

IN WITNESS WHEREOF, the Grantor and Grantee have executed this Deed as of the date first above written.

Grantor Signature: __________________________ Date: ________________

Grantee Signature: _________________________ Date: ________________

Notary Public:

State of California

County of ______________

On __________, before me, ______________________, Notary Public, personally appeared ____________ who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument, the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

I certify under PENALTY OF PERJURY under the laws of the State of California that the foregoing paragraph is true and correct.

Notary Signature: __________________________

Understanding California Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal agreement between a homeowner and a lender. In this arrangement, the homeowner voluntarily transfers ownership of their property to the lender to avoid the foreclosure process. This option can help the homeowner avoid the negative impact of foreclosure on their credit score and may provide a smoother transition from the property.

What are the benefits of a Deed in Lieu of Foreclosure?

There are several benefits to consider. First, it can help you avoid the lengthy and stressful foreclosure process. Second, it may have a less damaging effect on your credit score compared to foreclosure. Additionally, it can provide a quicker resolution, allowing you to move on with your life. Lastly, some lenders may even offer relocation assistance as part of the agreement.

Who qualifies for a Deed in Lieu of Foreclosure?

Typically, homeowners who are facing financial difficulties and are unable to continue making mortgage payments may qualify. However, lenders will evaluate your specific situation. Factors such as the current value of the property, your payment history, and your willingness to cooperate with the lender will play a role in determining eligibility.

What steps are involved in the Deed in Lieu of Foreclosure process?

The process usually begins with contacting your lender to express your interest in a Deed in Lieu of Foreclosure. After this, you will need to provide documentation about your financial situation. The lender will review your information and, if approved, they will prepare the necessary paperwork. Finally, you will sign the deed, transferring ownership to the lender.

Will I still owe money after completing a Deed in Lieu of Foreclosure?

In many cases, a Deed in Lieu of Foreclosure can relieve you of your mortgage debt. However, this depends on the specific terms negotiated with your lender. It is essential to clarify whether the lender will pursue any deficiency judgments against you for the remaining balance on the mortgage. Always ask your lender about this before finalizing the agreement.

How does a Deed in Lieu of Foreclosure affect my credit score?

While a Deed in Lieu of Foreclosure will still impact your credit score, it is generally less damaging than a foreclosure. A foreclosure can remain on your credit report for up to seven years, while a Deed in Lieu may only stay for about four years. However, the exact impact can vary based on your overall credit history.

Can I still buy a home after a Deed in Lieu of Foreclosure?

Yes, you can still buy a home after completing a Deed in Lieu of Foreclosure. However, it may take some time before you can qualify for a mortgage again. Lenders typically require a waiting period, which can range from two to four years, depending on their policies and the circumstances surrounding your situation.

Should I consult a lawyer before proceeding with a Deed in Lieu of Foreclosure?

Consulting a lawyer is often a wise decision. A legal professional can help you understand your rights and obligations, as well as ensure that the process is handled correctly. They can also assist in negotiating terms with your lender, providing you with the best possible outcome for your situation.

Dos and Don'ts

When completing the California Deed in Lieu of Foreclosure form, it is essential to follow certain guidelines to ensure the process goes smoothly. Below is a list of things to do and avoid.

- Do read the entire form carefully before filling it out.

- Do provide accurate information regarding the property and parties involved.

- Do sign the document in the presence of a notary public.

- Do keep a copy of the completed form for your records.

- Do confirm that all required fields are filled out completely.

- Don't leave any sections blank unless instructed to do so.

- Don't use correction fluid or tape on the form.

- Don't submit the form without ensuring all signatures are present.

- Don't ignore any specific instructions provided with the form.

Browse Other Popular Deed in Lieu of Foreclosure Templates for Specific States

The Loan Servicer Might Agree to Put the Foreclosure on Hold to Give You Some Time to Sell Your Home - Homeowners should keep informed about their rights through this transitional process.

Ensuring that your affairs are managed according to your wishes is crucial, and the Arizona Power of Attorney form serves this purpose effectively. By allowing you to appoint an agent to make decisions on your behalf, this document can alleviate the burden on loved ones during difficult times. If you are considering this important step, you may want to explore templates and resources, such as Arizona PDF Forms, to assist you in the process of creating your Power of Attorney form.