Blank California Deed Document

In the realm of real estate transactions, the California Deed form plays a pivotal role in the transfer of property ownership. This legally binding document serves as a crucial instrument for ensuring that property rights are formally conveyed from one party to another. It encompasses essential details such as the names of the grantor and grantee, a clear description of the property being transferred, and the specific terms of the transfer. Various types of deeds exist in California, including grant deeds and quitclaim deeds, each serving distinct purposes and offering different levels of protection to the parties involved. Additionally, the California Deed form must be executed with the appropriate signatures and notarization to be deemed valid. Understanding these key aspects is vital for anyone involved in real estate transactions, whether you are a buyer, seller, or legal professional. Ensuring compliance with state regulations and accurately completing the form can prevent future disputes and safeguard your investment.

Document Attributes

| Fact Name | Description |

|---|---|

| Definition | A California Deed form is a legal document used to transfer ownership of real property in California. |

| Types of Deeds | Common types include Grant Deed, Quitclaim Deed, and Warranty Deed. |

| Governing Law | The transfer of property through deeds is governed by the California Civil Code. |

| Signature Requirements | The deed must be signed by the grantor (the person transferring the property). |

| Notarization | Most deeds require notarization to be valid and enforceable. |

| Recording | To protect the interests of the grantee, the deed should be recorded with the county recorder's office. |

| Consideration | Consideration (something of value) is typically required, but it can be nominal. |

| Property Description | A clear and accurate description of the property must be included in the deed. |

| Tax Implications | Transferring property may trigger tax implications, including transfer taxes. |

Similar forms

The Deed form serves a specific purpose in real estate transactions, but there are several other documents that share similarities in function or intent. Here’s a list of eight documents that are comparable to the Deed form:

- Title Transfer Document: This document officially transfers ownership of property from one party to another, much like a Deed, ensuring that the new owner has legal rights to the property.

- Public Housing Application: Similar to other legal documents, the NYC Housing Application is essential for individuals seeking affordable housing; it ensures eligibility and outlines necessary details, as found in the https://nytemplates.com/blank-nyc-housing-application-template.

- Quitclaim Deed: Similar to a standard Deed, a Quitclaim Deed transfers any interest the grantor has in a property, but it does not guarantee that the title is clear of claims or liens.

- Warranty Deed: This document provides a guarantee that the grantor holds clear title to the property and has the right to transfer it, offering more protection to the buyer than a Quitclaim Deed.

- Lease Agreement: While primarily a rental document, a Lease Agreement outlines the terms under which a tenant can occupy a property, similar to how a Deed establishes ownership rights.

- Mortgage Document: This document secures a loan against the property, much like a Deed establishes ownership, but it also details the lender's rights in case of default.

- Power of Attorney: This legal document allows one person to act on behalf of another in property transactions, similar to how a Deed represents the wishes of the property owner.

- Affidavit of Title: This document is a sworn statement confirming the seller's ownership of the property and the absence of liens, providing assurance similar to that of a Warranty Deed.

- Bill of Sale: While typically used for personal property, a Bill of Sale serves to transfer ownership, akin to a Deed but usually for movable items rather than real estate.

Understanding these documents can help clarify the various ways ownership and rights to property can be established and transferred.

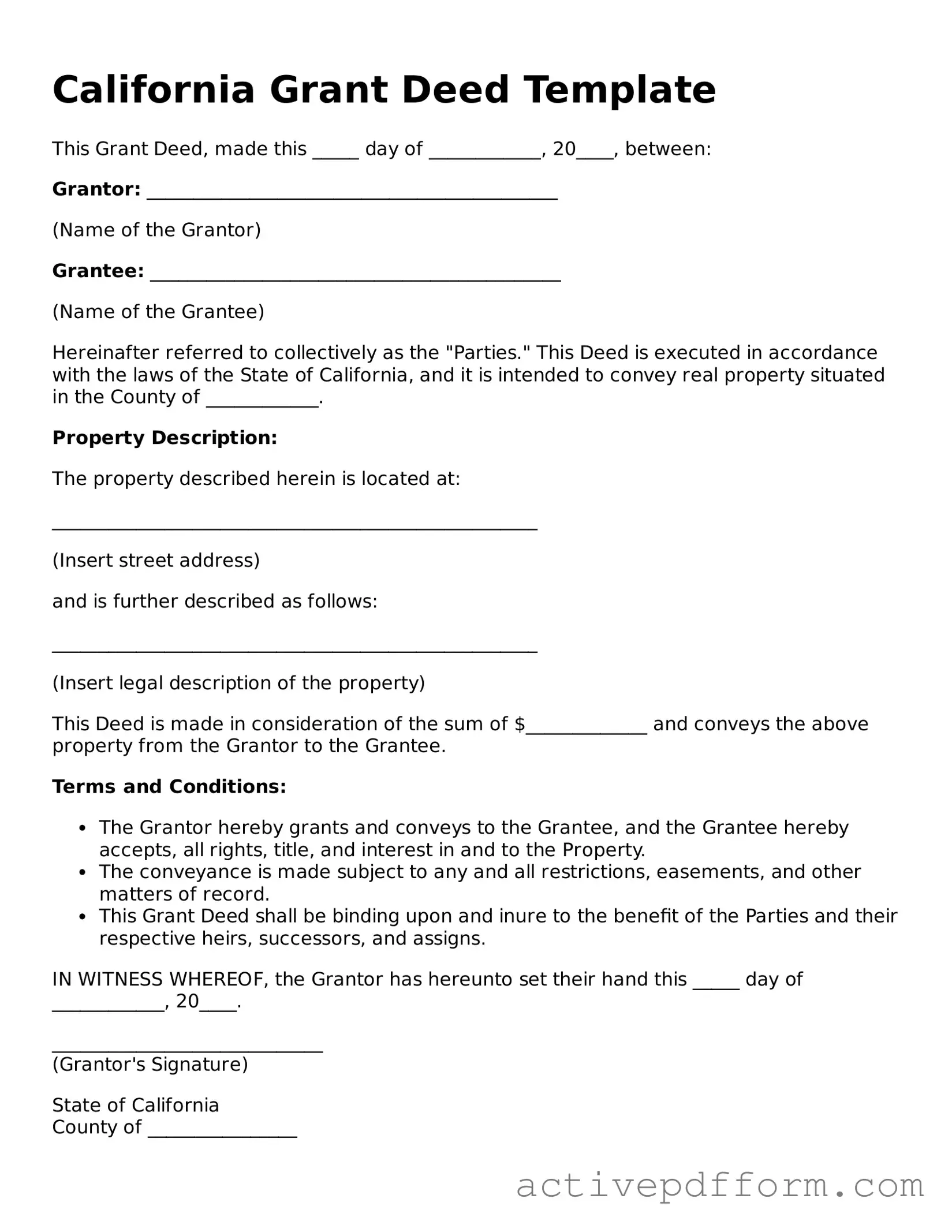

California Deed Example

California Grant Deed Template

This Grant Deed, made this _____ day of ____________, 20____, between:

Grantor: ____________________________________________

(Name of the Grantor)

Grantee: ____________________________________________

(Name of the Grantee)

Hereinafter referred to collectively as the "Parties." This Deed is executed in accordance with the laws of the State of California, and it is intended to convey real property situated in the County of ____________.

Property Description:

The property described herein is located at:

____________________________________________________

(Insert street address)

and is further described as follows:

____________________________________________________

(Insert legal description of the property)

This Deed is made in consideration of the sum of $_____________ and conveys the above property from the Grantor to the Grantee.

Terms and Conditions:

- The Grantor hereby grants and conveys to the Grantee, and the Grantee hereby accepts, all rights, title, and interest in and to the Property.

- The conveyance is made subject to any and all restrictions, easements, and other matters of record.

- This Grant Deed shall be binding upon and inure to the benefit of the Parties and their respective heirs, successors, and assigns.

IN WITNESS WHEREOF, the Grantor has hereunto set their hand this _____ day of ____________, 20____.

_____________________________

(Grantor's Signature)

State of California

County of ________________

On this _____ day of ____________, 20____, before me, a Notary Public in and for said State, personally appeared ______________________________, known to me to be the person whose name is subscribed to the within instrument, and acknowledged that they executed the same.

WITNESS my hand and official seal.

_____________________________

(Notary Public Signature)

My Commission Expires: _______________

Understanding California Deed

What is a California Deed form?

A California Deed form is a legal document used to transfer ownership of real estate in California. It serves as proof of the transfer and outlines the rights and responsibilities of the parties involved. Various types of deeds exist, including grant deeds and quitclaim deeds, each serving different purposes in property transactions.

What types of deeds are commonly used in California?

The most common types of deeds in California include the grant deed and the quitclaim deed. A grant deed provides a guarantee that the seller has the right to sell the property and that there are no undisclosed encumbrances. In contrast, a quitclaim deed transfers whatever interest the seller has in the property without any guarantees. This type is often used among family members or in divorce settlements.

How do I complete a California Deed form?

To complete a California Deed form, you need to provide specific information. This includes the names of the grantor (the person transferring the property) and the grantee (the person receiving the property), a legal description of the property, and the date of the transfer. You must also sign the deed in front of a notary public to make it legally binding.

Do I need a lawyer to create a California Deed?

While it is not legally required to have a lawyer to create a California Deed, it is often advisable. A lawyer can ensure that the deed is properly drafted and complies with all state laws. They can also help you understand the implications of the transfer and any potential tax consequences.

How do I record a California Deed?

To record a California Deed, you must take the completed and notarized document to the county recorder's office where the property is located. There, you will submit the deed for recording, which makes it part of the public record. There may be a small fee for this service, and it is essential to record the deed to protect your ownership rights.

What is the difference between a grant deed and a quitclaim deed?

A grant deed guarantees that the seller has clear title to the property and that there are no undisclosed liens. It provides some protection for the buyer. A quitclaim deed, on the other hand, does not offer any guarantees. It simply transfers whatever interest the seller has, if any. This means the buyer assumes all risks associated with the property.

Are there any tax implications when using a California Deed?

Yes, there can be tax implications when using a California Deed. For example, transferring property may trigger reassessment for property tax purposes. Additionally, the seller may be responsible for capital gains taxes if the property has appreciated in value. It is wise to consult a tax professional to understand these implications fully.

Can I change a California Deed after it has been recorded?

Once a California Deed has been recorded, you cannot simply change it. If you need to correct or update information, you will typically need to create a new deed. This new deed should reference the original deed and explain the changes being made. Recording the new deed will ensure that the public record reflects the current ownership accurately.

What happens if a California Deed is lost or damaged?

If a California Deed is lost or damaged, it is still possible to obtain a copy. You can request a certified copy from the county recorder's office where the deed was originally recorded. It is important to keep a copy of the deed in a safe place, as it serves as proof of ownership and is necessary for any future transactions involving the property.

Dos and Don'ts

When filling out the California Deed form, it’s essential to be careful and precise. Here’s a helpful list of what to do and what to avoid.

- Do double-check the names of all parties involved to ensure accuracy.

- Do clearly describe the property being transferred, including the address and any legal descriptions.

- Do use black ink and legible handwriting or type the information to maintain clarity.

- Do include the date of the transfer to establish when the transaction occurred.

- Do sign the deed in front of a notary public to ensure it’s legally binding.

- Don't leave any fields blank; incomplete forms can lead to delays or rejections.

- Don't use abbreviations or shorthand that could confuse the reader.

- Don't forget to include any required fees or taxes associated with the deed transfer.

- Don't submit the form without making copies for your records.

- Don't rush the process; take your time to ensure everything is filled out correctly.

By following these guidelines, you can navigate the process of completing the California Deed form more smoothly and confidently.

Browse Other Popular Deed Templates for Specific States

Property Owners Search - A key document in the context of real estate transactions.

For a hassle-free experience when transferring ownership, utilize the California Boat Bill of Sale form, which not only provides clear proof of the transaction but also safeguards the interests of both the buyer and seller; you can easily access this essential document through California PDF Forms.

Broward County Real Estate Records - Inheritance often involves transferring property via a deed.