Blank California Articles of Incorporation Document

Starting a business in California involves several important steps, and one of the first is completing the Articles of Incorporation form. This document serves as the foundation for your corporation, outlining essential details such as the corporation's name, purpose, and the address of its initial registered office. It also includes information about the number of shares the corporation is authorized to issue and the names of the initial directors. Filing this form with the California Secretary of State is crucial, as it officially establishes your corporation as a legal entity. Understanding the requirements and implications of the Articles of Incorporation can provide peace of mind as you embark on your entrepreneurial journey. Careful attention to detail in this form can help avoid delays and ensure that your business is set up correctly from the start.

Document Attributes

| Fact Name | Details |

|---|---|

| Purpose | The California Articles of Incorporation is used to create a corporation in the state of California. |

| Governing Law | The form is governed by the California Corporations Code. |

| Filing Requirement | Filing the Articles of Incorporation with the California Secretary of State is mandatory for incorporation. |

| Information Required | The form requires the corporation's name, address, and the names of the initial directors. |

| Types of Corporations | It can be used for both profit and non-profit corporations. |

| Filing Fee | A filing fee is required, which varies based on the type of corporation. |

| Processing Time | Standard processing time can take several weeks, but expedited options are available. |

| Amendments | Changes to the Articles of Incorporation can be made by filing an amendment form with the Secretary of State. |

| Public Record | Once filed, the Articles of Incorporation become a public record accessible to the public. |

Similar forms

The Articles of Incorporation form is a crucial document for establishing a corporation. However, it shares similarities with several other important documents in the business formation process. Here are four documents that resemble the Articles of Incorporation:

- Bylaws: Bylaws outline the internal rules and procedures of a corporation. While the Articles of Incorporation establish the corporation's existence, bylaws govern how it operates, detailing the roles of directors and officers, meeting protocols, and voting procedures.

- Operating Agreement: This document is similar to bylaws but is typically used for Limited Liability Companies (LLCs). It defines the management structure and operating procedures of the LLC, much like how bylaws function for corporations.

- Certificate of Incorporation: In some states, this term is used interchangeably with Articles of Incorporation. It serves the same purpose: to formally create a corporation and outline its basic details, such as name, purpose, and registered agent.

- Aaa International Driving Permit Application: To apply for an international driving permit, individuals should complete the required form, which can be found at PDF Templates Online. This ensures that travelers have the necessary credentials to drive legally in various countries.

- Business License: A business license is required to legally operate a business within a jurisdiction. While the Articles of Incorporation establish a corporation, the business license permits it to conduct activities, ensuring compliance with local regulations.

California Articles of Incorporation Example

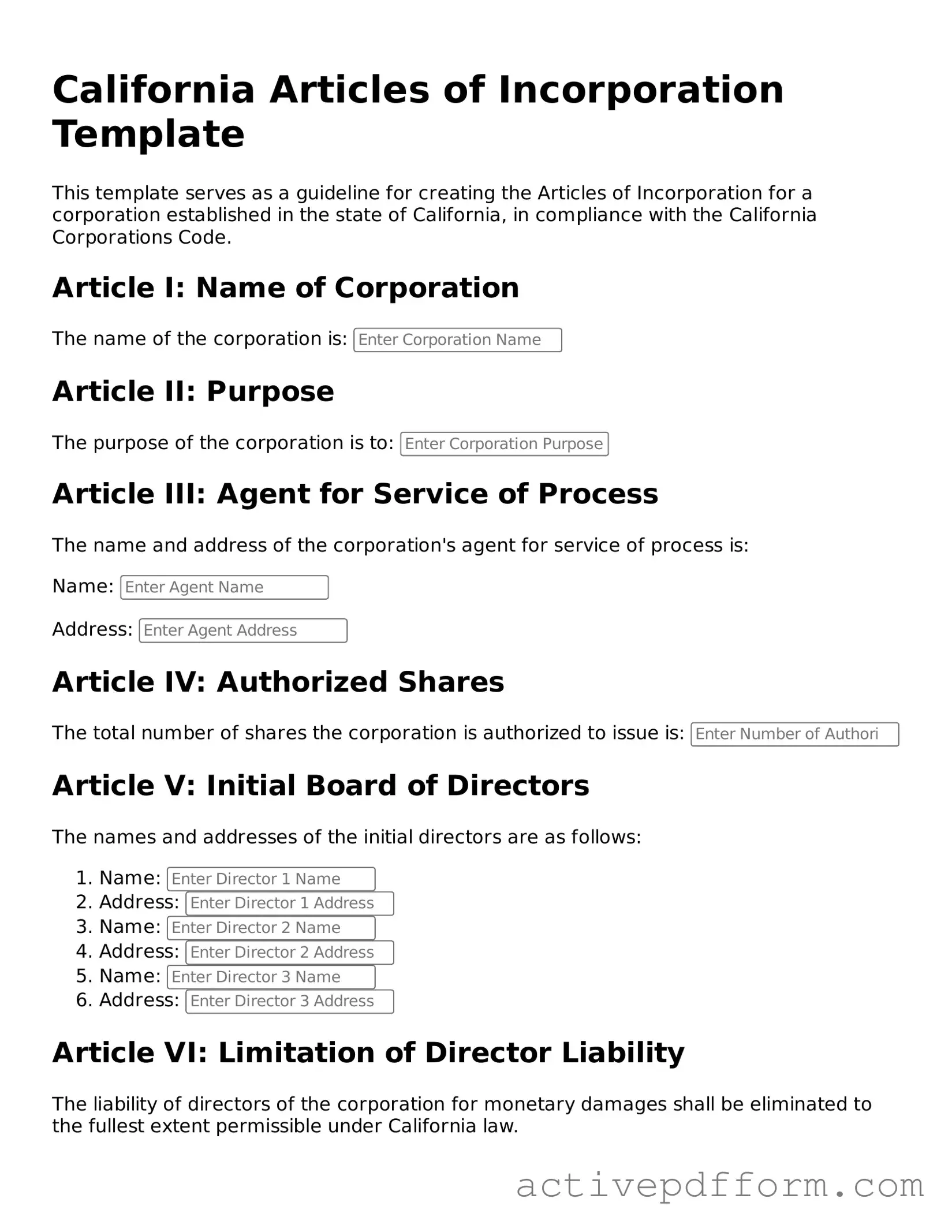

California Articles of Incorporation Template

This template serves as a guideline for creating the Articles of Incorporation for a corporation established in the state of California, in compliance with the California Corporations Code.

Article I: Name of Corporation

The name of the corporation is:

Article II: Purpose

The purpose of the corporation is to:

Article III: Agent for Service of Process

The name and address of the corporation's agent for service of process is:

Name:

Address:

Article IV: Authorized Shares

The total number of shares the corporation is authorized to issue is:

Article V: Initial Board of Directors

The names and addresses of the initial directors are as follows:

- Name:

- Address:

- Name:

- Address:

- Name:

- Address:

Article VI: Limitation of Director Liability

The liability of directors of the corporation for monetary damages shall be eliminated to the fullest extent permissible under California law.

Article VII: Incorporator

The name and address of the incorporator(s) are as follows:

- Name:

- Address:

Date:

Signature of Incorporator:

By signing, the incorporator affirms that the above information is accurate and acknowledges the responsibilities entailed in forming a corporation in California.

Understanding California Articles of Incorporation

What is the purpose of the California Articles of Incorporation form?

The California Articles of Incorporation form serves as the foundational document for establishing a corporation in California. It outlines key information about the corporation, including its name, purpose, and the address of its initial registered office. Filing this document with the California Secretary of State is a crucial step in the process of legally forming a corporation in the state.

What information is required to complete the Articles of Incorporation?

To complete the Articles of Incorporation, several key pieces of information are necessary. This includes the corporation's name, which must be unique and not misleading. The purpose of the corporation must be stated clearly, and the address of the initial registered office is required. Additionally, the names and addresses of the incorporators must be included. This information ensures that the corporation is properly identified and registered.

Who can file the Articles of Incorporation?

Any individual or entity can file the Articles of Incorporation in California, provided they have the authority to do so. This typically includes the incorporators, who are individuals responsible for creating the corporation. Incorporators do not need to be residents of California, but they must be at least 18 years old. It is important that the person filing the form has a clear understanding of the information being submitted.

What is the filing fee for the Articles of Incorporation in California?

The filing fee for the Articles of Incorporation in California varies based on the type of corporation being formed. Generally, the fee is around $100 for a standard corporation. Additional fees may apply for expedited processing or for specific types of corporations, such as nonprofit organizations. It is advisable to check the California Secretary of State's website for the most current fee schedule.

How long does it take to process the Articles of Incorporation?

The processing time for the Articles of Incorporation can vary. Typically, the California Secretary of State processes filings within a few weeks. However, if expedited service is requested, the processing time can be significantly reduced. It is important to plan accordingly and allow sufficient time for the processing of the document, especially if there are time-sensitive matters involved.

Can the Articles of Incorporation be amended after filing?

Yes, the Articles of Incorporation can be amended after they have been filed. If there are changes to the corporation's name, purpose, or other critical information, an amendment must be filed with the California Secretary of State. This ensures that the corporation's records remain accurate and up to date. The process for amending the Articles of Incorporation involves submitting the appropriate form and paying any required fees.

What happens if the Articles of Incorporation are not filed?

If the Articles of Incorporation are not filed, the corporation will not be legally recognized in California. This means that the entity cannot conduct business, enter into contracts, or enjoy the legal protections afforded to corporations. It is essential to complete this step to ensure that the corporation is established properly and can operate within the bounds of the law.

Dos and Don'ts

When filling out the California Articles of Incorporation form, it is crucial to follow specific guidelines to ensure accuracy and compliance. Here are eight essential do's and don'ts to consider:

- Do provide a clear and concise name for your corporation that complies with California naming requirements.

- Do include the purpose of the corporation, stating its business activities clearly.

- Do list the names and addresses of the initial directors accurately.

- Do ensure that the registered agent's information is current and correct.

- Don't use abbreviations or acronyms in the corporation's name unless they are legally permitted.

- Don't leave any required fields blank; incomplete forms can delay processing.

- Don't forget to sign and date the form before submission.

- Don't submit the form without checking for typos or errors, as these can lead to rejection.

Browse Other Popular Articles of Incorporation Templates for Specific States

How Much Does a Llc Cost in Texas - The incorporation process varies by state, influencing the content of the Articles.

The California Employment Verification form serves as a crucial document used to confirm an individual's employment status and history in the state. Essential for various purposes, including loan applications and rental agreements, accurate completion of this form ensures compliance with legal and administrative requirements. To facilitate this process, you can access the Employment Verification form, which will help you streamline many procedures, so take a moment to complete it.