Free California Affidavit of Death of a Trustee Template

The California Affidavit of Death of a Trustee form plays a crucial role in the management of trust assets following the death of a trustee. This document serves as a formal declaration that a trustee has passed away, enabling the successor trustee or beneficiaries to take necessary actions regarding the trust. It typically includes essential details such as the name of the deceased trustee, the date of their death, and information about the trust itself. By providing a clear record, this affidavit helps streamline the transition of responsibilities and ensures that the trust can continue to be administered according to the wishes of the deceased. Additionally, the form may require notarization, adding a layer of authenticity and legal validity to the declaration. Understanding how to properly complete and file this form is vital for anyone involved in trust management, as it helps maintain order and clarity during what can be a challenging time for families and beneficiaries alike.

Document Specifics

| Fact Name | Details |

|---|---|

| Purpose | The California Affidavit of Death of a Trustee form is used to officially declare the death of a trustee in a trust. |

| Governing Law | This form is governed by California Probate Code Section 15660. |

| Filing Requirements | The completed form must be filed with the county recorder's office where the trust property is located. |

| Signatures | The affidavit must be signed by the successor trustee or a beneficiary of the trust. |

Similar forms

- Affidavit of Death: This document is used to confirm the passing of an individual. It serves a similar purpose by providing legal acknowledgment of death, often required for settling estates or managing trusts.

- Certificate of Death: This official document is issued by a state or local government. It provides legal proof of an individual’s death, which can be essential for various legal and administrative processes.

- Trustee’s Deed: This document transfers property from the trust to the beneficiaries after the trustee’s death. It parallels the Affidavit of Death of a Trustee by facilitating the transition of assets following a trustee’s passing.

- Will: A will outlines how a person wishes their assets to be distributed upon death. It shares similarities in that both documents address the management and distribution of a deceased individual’s estate.

- Living Trust: This document allows individuals to manage their assets during their lifetime and specifies what happens after death. Like the Affidavit, it is crucial for estate planning and asset distribution.

- Power of Attorney Form: Ensuring proper management of one's affairs during incapacity, similar to the Affidavit's role, can be facilitated by utilizing resources like Arizona PDF Forms.

- Power of Attorney: While primarily focused on granting authority to another person during one’s lifetime, it can also outline what happens after death. Both documents are integral to managing affairs when a person is no longer able to do so.

- Notice of Death: This document formally informs interested parties of an individual’s death. It is similar in purpose, as it ensures that all relevant parties are aware of the death for legal proceedings.

- Probate Petition: This document is filed to initiate the legal process of administering an estate after someone dies. It is related to the Affidavit of Death of a Trustee as both involve the legal handling of a deceased person's affairs.

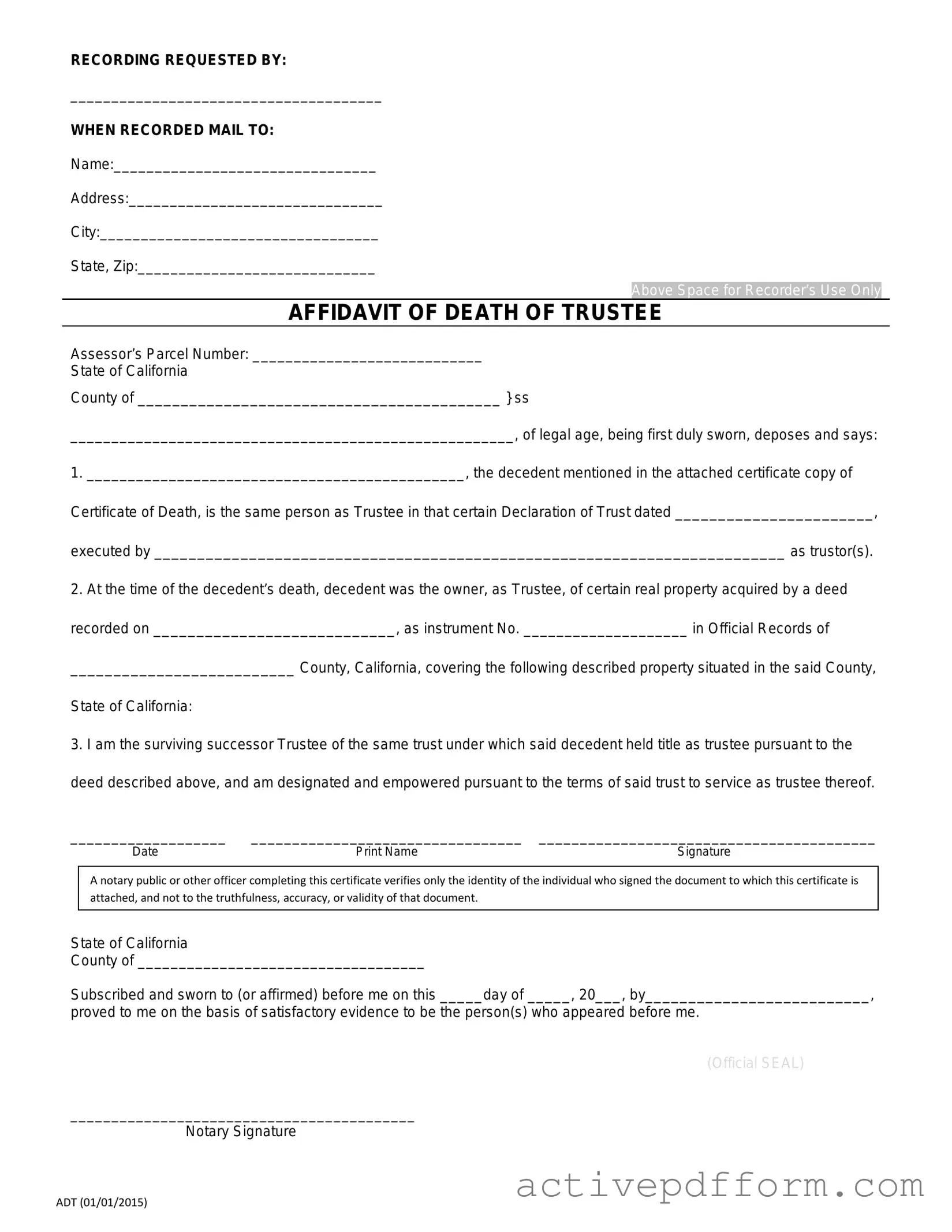

California Affidavit of Death of a Trustee Example

RECORDING REQUESTED BY:

______________________________________

WHEN RECORDED MAIL TO:

Name:________________________________

Address:_______________________________

City:__________________________________

State, Zip:_____________________________

Above Space for Recorder’s Use Only

AFFIDAVIT OF DEATH OF TRUSTEE

Assessor’s Parcel Number: ____________________________

State of California

County of __________________________________________ } ss

______________________________________________________, of legal age, being first duly sworn, deposes and says:

1.______________________________________________, the decedent mentioned in the attached certificate copy of Certificate of Death, is the same person as Trustee in that certain Declaration of Trust dated _______________________, executed by _________________________________________________________________________ as trustor(s).

2.At the time of the decedent’s death, decedent was the owner, as Trustee, of certain real property acquired by a deed recorded on ____________________________, as instrument No. ____________________ in Official Records of

__________________________ County, California, covering the following described property situated in the said County,

State of California:

3.I am the surviving successor Trustee of the same trust under which said decedent held title as trustee pursuant to the deed described above, and am designated and empowered pursuant to the terms of said trust to service as trustee thereof.

___________________ |

_________________________________ |

_________________________________________ |

Date |

Print Name |

Signature |

A notary public or other officer completing this certificate verifies only the identity of the individual who signed the document to which this certificate is attached, and not to the truthfulness, accuracy, or validity of that document.

State of California

County of ___________________________________

Subscribed and sworn to (or affirmed) before me on this _____day of _____, 20___, by__________________________,

proved to me on the basis of satisfactory evidence to be the person(s) who appeared before me.

(Official SEAL)

__________________________________________

Notary Signature

ADT (01/01/2015)

Understanding California Affidavit of Death of a Trustee

What is the California Affidavit of Death of a Trustee form?

The California Affidavit of Death of a Trustee is a legal document used to officially record the death of a trustee in a trust. This form serves to update the trust's records and inform beneficiaries and other interested parties about the change in trusteeship. It ensures that the trust can continue to operate smoothly, even after the loss of a trustee.

Who can complete the Affidavit of Death of a Trustee?

Typically, the surviving trustee or an interested party, such as a beneficiary, can complete this affidavit. It’s essential that the person filling out the form has the necessary information about the deceased trustee and the trust itself. This ensures accuracy and helps avoid potential disputes later on.

What information is required to complete the form?

To complete the affidavit, you will need the deceased trustee's name, the date of their death, and details about the trust, including its name and date of creation. Additionally, the form may require information about the successor trustee, if one is named in the trust document. Gathering this information ahead of time can make the process smoother.

Is the Affidavit of Death of a Trustee form filed with the court?

No, the Affidavit of Death of a Trustee is not typically filed with the court. Instead, it is usually recorded with the county recorder’s office where the trust property is located. This public record helps to notify all interested parties of the trustee's death and the subsequent changes in trust management.

What happens if there is no successor trustee named in the trust?

If a trust does not name a successor trustee, the remaining beneficiaries may need to petition the court to appoint a new trustee. This can complicate matters and may lead to delays in managing the trust. It’s a good practice to ensure that a successor trustee is designated to avoid such situations.

Can I use the Affidavit of Death of a Trustee form if the trustee died out of state?

Yes, you can use the Affidavit of Death of a Trustee form even if the trustee died out of state. However, you may need to provide additional documentation, such as a certified copy of the death certificate, to ensure that the affidavit is accepted in California. It’s always wise to check with local authorities to confirm what is required.

How does this affidavit affect the trust and its beneficiaries?

The affidavit serves as a formal acknowledgment of the trustee's death, allowing the trust to continue functioning under the guidance of a new or successor trustee. This transition is crucial for the beneficiaries, as it ensures that their interests in the trust are protected and managed according to the trust's terms.

Are there any fees associated with filing the Affidavit of Death of a Trustee?

Yes, there may be fees involved when recording the affidavit with the county recorder’s office. These fees can vary by county, so it’s advisable to check with the local office for the specific amount. Being prepared for these costs can help you manage the process more effectively.

What should I do if I have questions about the form or the process?

If you have questions about the Affidavit of Death of a Trustee or the process involved, it’s best to consult with an attorney who specializes in estate planning or trust law. They can provide personalized guidance and ensure that you understand your rights and responsibilities in this matter.

Dos and Don'ts

When filling out the California Affidavit of Death of a Trustee form, it’s essential to approach the task with care and attention to detail. Here are some key do's and don'ts to guide you through the process:

- Do ensure that you have the correct form for your specific situation.

- Do provide accurate and complete information about the deceased trustee.

- Do include any necessary supporting documents, such as a death certificate.

- Do have the affidavit notarized to ensure its validity.

- Do keep a copy of the completed form for your records.

- Don't leave any sections of the form blank unless instructed to do so.

- Don't rush through the process; take your time to review your entries.

- Don't submit the form without checking for errors or omissions.

- Don't forget to check the filing requirements for your specific county.

- Don't assume that a verbal confirmation is sufficient; written documentation is crucial.

Check out Common Templates

Nj Real Estate Transfer Tax Calculator - The affidavit fosters transparency within the real estate market in New Jersey.

For individuals seeking to manage their future decisions, understanding the steps to create a Durable Power of Attorney document is critical. This essential guide to a Durable Power of Attorney can provide clarity and ensure that your preferences are upheld when you cannot advocate for yourself. For more information, visit this resource on Durable Power of Attorney.

Credit Application Template - This form is an important step toward achieving your business goals.