Blank Business Purchase and Sale Agreement Document

When considering the sale or purchase of a business, a Business Purchase and Sale Agreement is a crucial document that outlines the terms and conditions of the transaction. This agreement serves as a roadmap for both parties, detailing the purchase price, payment terms, and the assets being transferred. It typically includes information about the liabilities that may be assumed by the buyer and any representations or warranties made by the seller regarding the business's operations and financial health. Additionally, the agreement often addresses contingencies that must be met before the sale can be finalized, such as financing approvals or due diligence investigations. Clarity in this document is essential to prevent misunderstandings and protect the interests of both the buyer and seller throughout the process. By establishing clear expectations and responsibilities, the Business Purchase and Sale Agreement helps facilitate a smoother transition of ownership, ensuring that both parties can move forward with confidence.

Document Attributes

| Fact Name | Description |

|---|---|

| Purpose | A Business Purchase and Sale Agreement outlines the terms and conditions under which a business is sold, ensuring clarity for both the buyer and seller. |

| Key Components | The agreement typically includes details such as purchase price, payment terms, and the assets being sold. |

| Governing Law | The agreement is subject to state-specific laws. For example, in California, it is governed by the California Commercial Code. |

| Confidentiality | Many agreements include a confidentiality clause to protect sensitive information shared during the sale process. |

| Due Diligence | Buyers often conduct due diligence to verify the business's financial status and operational details before finalizing the purchase. |

| Closing Process | The closing process involves finalizing the transaction, which may require the signing of additional documents and the transfer of funds. |

Similar forms

Letter of Intent (LOI): This document outlines the preliminary understanding between the buyer and seller before a formal agreement is made. It sets the stage for negotiations, similar to a Business Purchase and Sale Agreement, but is generally less detailed.

Asset Purchase Agreement: This document specifies the terms for purchasing specific assets of a business rather than the entire company. Like the Business Purchase and Sale Agreement, it details the purchase price and conditions but focuses on assets rather than ownership.

Stock Purchase Agreement: This agreement involves the sale of a company’s stock. It shares similarities with the Business Purchase and Sale Agreement in that it covers the transfer of ownership but focuses on shares rather than business assets.

Confidentiality Agreement (NDA): Often signed during negotiations, this document protects sensitive information shared between parties. It complements the Business Purchase and Sale Agreement by ensuring confidentiality during the sale process.

Due Diligence Checklist: This list helps buyers assess the business they are considering purchasing. While not a formal agreement, it serves a similar purpose by ensuring all necessary information is gathered before finalizing a sale.

Purchase Order: This document is used to initiate a purchase transaction. It is similar to the Business Purchase and Sale Agreement in that it outlines the terms of the transaction, but it is typically used for smaller purchases rather than entire businesses.

Operating Agreement: This document outlines the management structure and operating procedures of a business. It can be relevant in a sale, especially for LLCs, and shares the goal of clarifying terms and responsibilities like the Business Purchase and Sale Agreement.

- Investment Letter of Intent: This vital document signals the agreement to negotiate terms surrounding potential funding, making it prudent to refer to our comprehensive Investment Letter of Intent resource for guidance.

Bill of Sale: This document transfers ownership of tangible items from seller to buyer. Similar to the Business Purchase and Sale Agreement, it formalizes the transaction but focuses specifically on physical assets rather than the entire business.

Franchise Agreement: This document governs the relationship between a franchisor and franchisee. While it’s specific to franchises, it shares the structure of outlining rights and obligations, akin to the Business Purchase and Sale Agreement.

Shareholder Agreement: This document outlines the rights and responsibilities of shareholders in a corporation. It is similar to the Business Purchase and Sale Agreement in that it defines ownership and management structure, particularly when shares are involved in a sale.

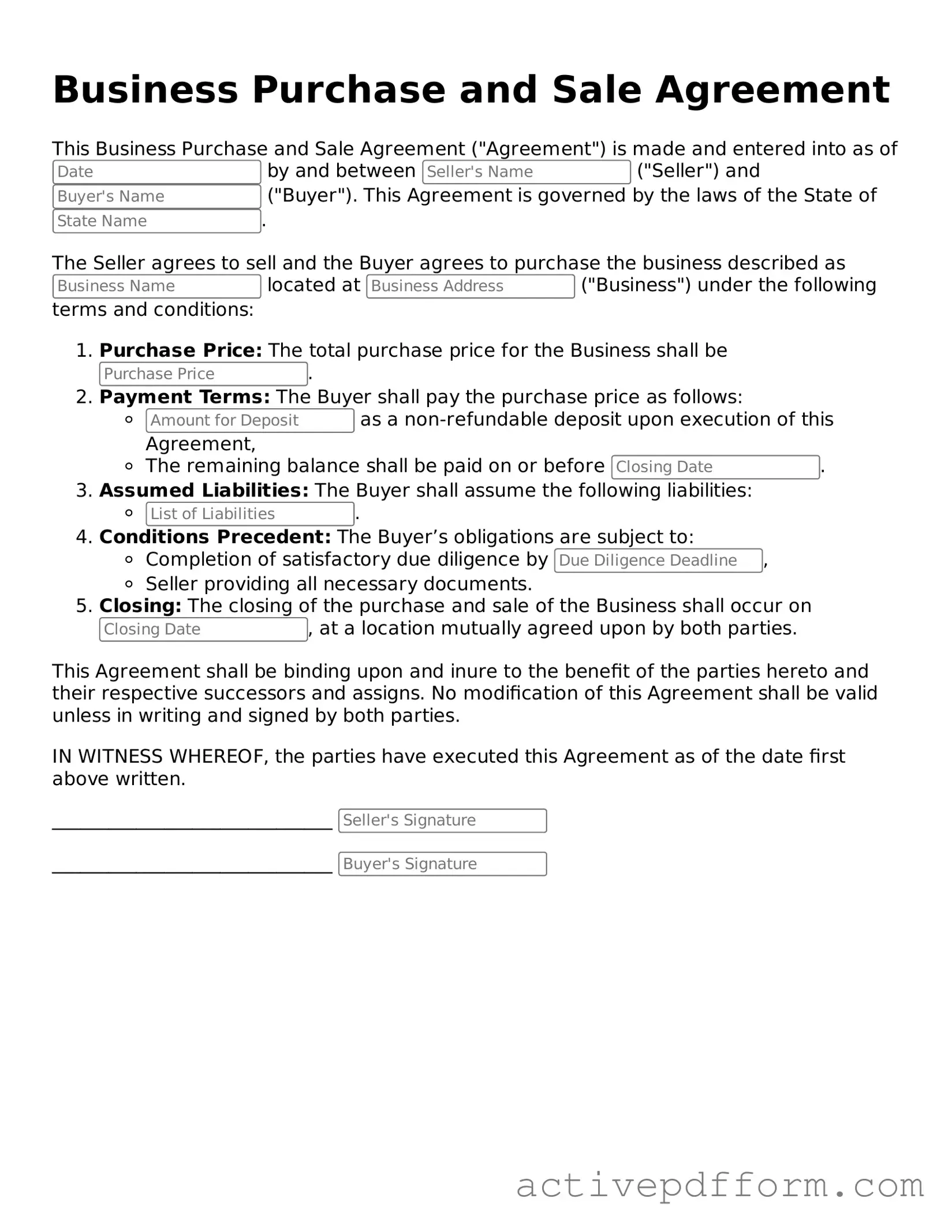

Business Purchase and Sale Agreement Example

Business Purchase and Sale Agreement

This Business Purchase and Sale Agreement ("Agreement") is made and entered into as of by and between ("Seller") and ("Buyer"). This Agreement is governed by the laws of the State of .

The Seller agrees to sell and the Buyer agrees to purchase the business described as located at ("Business") under the following terms and conditions:

- Purchase Price: The total purchase price for the Business shall be .

- Payment Terms: The Buyer shall pay the purchase price as follows:

- as a non-refundable deposit upon execution of this Agreement,

- The remaining balance shall be paid on or before .

- Assumed Liabilities: The Buyer shall assume the following liabilities:

- .

- Conditions Precedent: The Buyer’s obligations are subject to:

- Completion of satisfactory due diligence by ,

- Seller providing all necessary documents.

- Closing: The closing of the purchase and sale of the Business shall occur on , at a location mutually agreed upon by both parties.

This Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns. No modification of this Agreement shall be valid unless in writing and signed by both parties.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

______________________________

______________________________

Understanding Business Purchase and Sale Agreement

What is a Business Purchase and Sale Agreement?

A Business Purchase and Sale Agreement is a legal document that outlines the terms and conditions under which a business is bought or sold. This agreement details the assets being sold, the purchase price, payment terms, and any conditions that must be met before the sale can be finalized. It serves to protect both the buyer and the seller by clearly defining the expectations and responsibilities of each party involved in the transaction.

Why is a Business Purchase and Sale Agreement important?

This agreement is crucial because it helps prevent misunderstandings between the buyer and seller. It provides a clear framework for the transaction, ensuring that both parties are aware of their rights and obligations. Additionally, having a formal agreement can help avoid legal disputes in the future. In the event of a disagreement, the agreement serves as a reference point for resolving issues, making it a vital part of any business transaction.

What key elements should be included in the agreement?

A comprehensive Business Purchase and Sale Agreement should include several key elements. First, it should specify the names and addresses of both the buyer and seller. Next, it should detail the assets being sold, such as inventory, equipment, or intellectual property. The purchase price and payment terms must be clearly outlined, including any deposits or financing arrangements. Additionally, the agreement should address any warranties or representations made by the seller, as well as any conditions that must be met before the sale is completed.

Can the agreement be modified after it is signed?

Dos and Don'ts

When filling out the Business Purchase and Sale Agreement form, it's important to be thorough and accurate. Here are seven things to keep in mind:

- Do read the entire form carefully before starting.

- Do provide accurate information about both the buyer and the seller.

- Do clearly outline the terms of the sale, including price and payment methods.

- Do include any contingencies that may affect the sale.

- Don't leave any sections blank; fill in all required fields.

- Don't use vague language; be specific in your descriptions.

- Don't forget to review the agreement with a legal professional before signing.

Following these guidelines can help ensure a smooth transaction and protect your interests.

Create Popular Documents

Florida Realtors Commercial Contract - Compliance with federal tax laws regarding foreign investment is included.

In addition to the Civil Case Cover Sheet, it's important for applicants to familiarize themselves with the various resources available to assist in the completion of legal documents, such as California PDF Forms, which provide templates and guidance tailored for specific civil actions.

Navpers 1336 3 - Each section of the form has a specific purpose in the overall request framework.