Free Business Credit Application Template

The Business Credit Application form serves as a crucial tool for companies seeking to establish credit with suppliers or lenders. This form typically collects essential information about the business, including its legal name, address, and type of ownership. It also requests details about the business's financial standing, such as annual revenue, banking information, and trade references. Additionally, applicants may need to provide personal guarantees from owners or key stakeholders, enhancing the lender's confidence in the business's ability to repay any credit extended. The form often includes sections for the applicant to disclose any prior bankruptcies or legal issues, which can significantly impact credit decisions. By gathering this comprehensive information, the Business Credit Application form facilitates a thorough assessment of the business's creditworthiness, ultimately aiding in the decision-making process for credit approval. Understanding the nuances of this form is vital for businesses aiming to secure favorable credit terms and maintain healthy supplier relationships.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Business Credit Application form is used to assess the creditworthiness of a business. |

| Information Required | Applicants must provide business details, ownership information, and financial statements. |

| Legal Compliance | The form must comply with federal and state laws regarding credit applications. |

| State Variations | Some states have specific requirements or forms that must be used, governed by local laws. |

| Confidentiality | Information submitted is typically kept confidential and used solely for credit evaluation. |

| Approval Process | Submission of the form initiates a review process that may include credit checks. |

| Denial Reasons | Common reasons for denial include poor credit history or insufficient financial stability. |

| Signature Requirement | A signature from an authorized representative is usually required to validate the application. |

| Updates | Businesses should update their application if there are significant changes in ownership or finances. |

| Record Keeping | It is important for businesses to keep copies of submitted applications for their records. |

Similar forms

Loan Application Form: Similar to the Business Credit Application, this document requests financial and business information to assess creditworthiness for a loan.

Vendor Credit Application: This form is used by suppliers to evaluate a business's credit history and financial stability before extending credit terms.

Lease Application: A lease application gathers information about a business's finances and operations to determine eligibility for leasing equipment or property.

Tax Filing Assistance: Completing tax forms can be complex, especially with amendments. For example, the It 1040X Ohio form is specifically designed for correcting errors on previously filed Ohio income tax returns, making it essential for accurate reporting and compliance.

Business License Application: This document requires detailed business information, including ownership and financial data, to obtain a license to operate legally.

Partnership Agreement: While primarily a legal document outlining the relationship between partners, it often includes financial disclosures similar to those found in credit applications.

Insurance Application: This application requires businesses to disclose financial and operational information to assess risk and determine coverage options.

Grant Application: Similar to credit applications, this document requires detailed financial information to evaluate the business's viability for receiving funding.

Account Opening Form: Banks and financial institutions use this form to collect essential business information for opening a new account, assessing creditworthiness in the process.

Financial Statement: Often required alongside a credit application, this document provides a snapshot of a business's financial health, including assets, liabilities, and income.

Credit Reference Request: This document seeks information from other creditors about a business's payment history and credit behavior, similar to the information collected in a credit application.

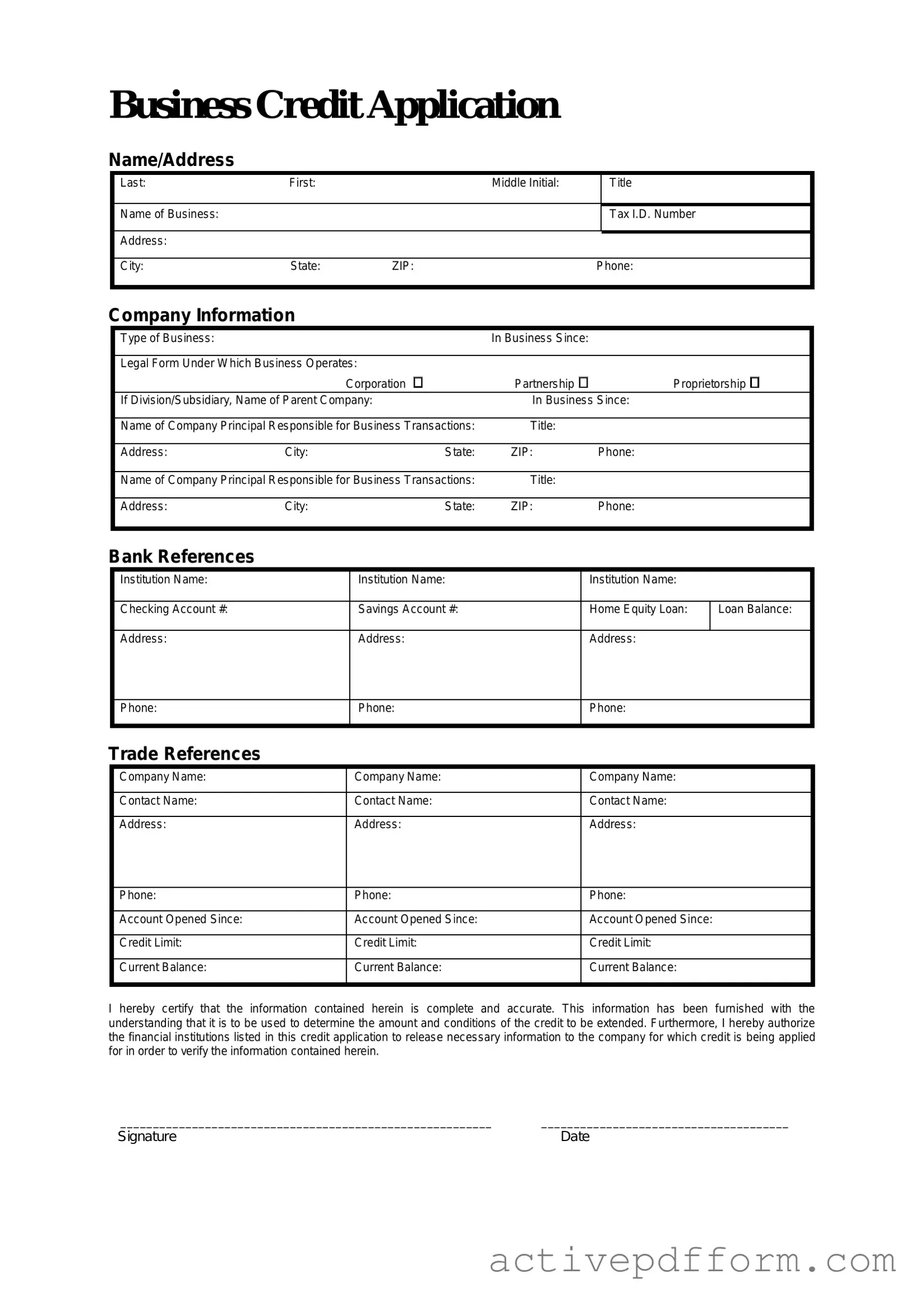

Business Credit Application Example

Business Credit Application

Name/Address

Last: |

First: |

|

Middle Initial: |

|

Title |

|

|

|

|

|

|

Name of Business: |

|

|

|

|

Tax I.D. Number |

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

City: |

State: |

ZIP: |

|

Phone: |

|

|

|

|

|

|

|

Company Information

|

Type of Business: |

|

|

|

In Business Since: |

|

|

|

|

|

|

|

|

|

|

||

|

Legal Form Under Which Business Operates: |

|

|

|

|

|||

|

|

|

Corporation |

Partnership |

Proprietorship |

|

||

|

If Division/Subsidiary, Name of Parent Company: |

In Business Since: |

|

|||||

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

|

|

Bank References |

|

|

|

|

|

|

|

|

|

Institution Name: |

|

|

Institution Name: |

|

Institution Name: |

||

|

|

|

|

|

|

|

|

|

|

Checking Account #: |

|

|

Savings Account #: |

|

Home Equity Loan: |

ILoan Balance: |

|

|

Address: |

|

|

Address: |

|

Address: |

|

|

Phone:

Phone:

Phone:

Trade References

Company Name: |

Company Name: |

Company Name: |

|

|

|

Contact Name: |

Contact Name: |

Contact Name: |

|

|

|

Address: |

Address: |

Address: |

|

|

|

Phone: |

Phone: |

Phone: |

|

|

|

Account Opened Since: |

Account Opened Since: |

Account Opened Since: |

|

|

|

Credit Limit: |

Credit Limit: |

Credit Limit: |

|

|

|

Current Balance: |

Current Balance: |

Current Balance: |

|

|

|

I hereby certify that the information contained herein is complete and accurate. This information has been furnished with the understanding that it is to be used to determine the amount and conditions of the credit to be extended. Furthermore, I hereby authorize the financial institutions listed in this credit application to release necessary information to the company for which credit is being applied for in order to verify the information contained herein.

_________________________________________________________ ______________________________________

Signature |

Date |

Understanding Business Credit Application

What is a Business Credit Application form?

The Business Credit Application form is a document that businesses fill out to request credit from a lender or supplier. This form provides essential information about the business, including its financial history, creditworthiness, and ownership details. Completing this form accurately is crucial for obtaining the credit needed to support business operations.

Why do I need to fill out this form?

Filling out the Business Credit Application form allows lenders and suppliers to assess your business's financial health and credit risk. This assessment helps them determine whether to extend credit and under what terms. It is an important step in establishing a credit relationship that can facilitate growth and operational flexibility.

What information is required on the form?

The form typically requires basic information about your business, such as its legal name, address, and type of business structure. You will also need to provide details about your ownership, financial history, and any existing credit relationships. Be prepared to include personal guarantees from business owners if necessary, as this may strengthen your application.

How long does it take to process the application?

The processing time for a Business Credit Application can vary. Generally, it takes anywhere from a few days to a couple of weeks. Factors influencing the timeline include the completeness of your application, the lender's internal processes, and any additional information they may require. Promptly responding to any requests for further information can help expedite the process.

What happens if my application is denied?

If your application is denied, you will receive a notification explaining the reasons for the denial. Common reasons include insufficient credit history, poor credit scores, or inadequate financial documentation. Understanding these reasons can help you address any issues and strengthen future applications. You may also inquire about the possibility of reapplying after addressing the concerns raised.

Can I appeal a denial decision?

Yes, you can appeal a denial decision. Contact the lender or supplier to discuss your application and ask for clarification on the denial reasons. If you believe you can provide additional information or documentation that supports your creditworthiness, present this during the appeal process. Engaging in open communication can often lead to a more favorable outcome.

Dos and Don'ts

When filling out a Business Credit Application form, attention to detail is crucial. Here are some essential dos and don'ts to guide you through the process.

- Do provide accurate and complete information.

- Do double-check your entries for typos or errors.

- Do include all required documentation, such as financial statements.

- Do be honest about your business's financial history.

- Don't leave any fields blank unless specified.

- Don't exaggerate your business's income or assets.

- Don't forget to sign and date the application.

- Don't rush through the application; take your time to ensure accuracy.

Check out Common Templates

Free Printable Cash Drawer Count Sheet Pdf - The Cash Drawer Count Sheet is essential for novice cash handlers.

Filing the necessary documents is vital for the success of your business, and the California LLC 12 Form is no exception; for assistance in completing this form accurately, you can refer to the California PDF Forms which provide valuable resources and guidance.

Place of Birth Passport Application - After processing, your passport will be mailed to the address provided.