Free Auto Insurance Card Template

When driving in the United States, having an Auto Insurance Card on hand is crucial for both legal compliance and peace of mind. This card serves as proof of insurance coverage, detailing essential information about your policy. Key elements include the insurance company’s name, your policy number, and the effective and expiration dates of your coverage. Additionally, it lists the year, make, and model of your vehicle, along with the Vehicle Identification Number (VIN), ensuring that your specific vehicle is covered under the policy. The card is issued by your insurance agency and must be kept in the insured vehicle at all times. In the event of an accident, it is imperative to present this card upon request and to report the incident to your insurance agent as soon as possible. Collecting pertinent information from all parties involved, such as names, addresses, and insurance details, is also a critical step. Lastly, a security feature on the card, an artificial watermark, can be viewed by holding it at an angle, adding an extra layer of authenticity to this important document.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Auto Insurance Card serves as proof of insurance coverage for the vehicle specified on the card. |

| State-Specific | Each state has its own version of the Auto Insurance Card, governed by local laws and regulations. |

| Required Information | The card must include essential details such as the insurance company number and policy number. |

| Effective Dates | It is important to note both the effective date and expiration date of the insurance coverage on the card. |

| Vehicle Details | The card lists the year, make, and model of the insured vehicle, along with its Vehicle Identification Number (VIN). |

| Issuing Agency | The agency or company that issues the card is clearly stated, providing a point of contact for the insured. |

| Legal Requirement | Many states require that the Auto Insurance Card be kept in the vehicle at all times and presented upon demand. |

| Accident Reporting | In case of an accident, the insured must report the incident to their agent or insurance company promptly. |

| Watermark Feature | The front of the card contains an artificial watermark, which can be viewed by holding the card at an angle. |

Similar forms

-

Proof of Insurance Certificate: Like the Auto Insurance Card, this document verifies that you have an active insurance policy. It includes details such as the policy number and coverage dates, ensuring that you can demonstrate financial responsibility when required.

-

Insurance Policy Declaration Page: This page outlines the specifics of your insurance coverage, including limits and deductibles. Similar to the Auto Insurance Card, it serves as proof of insurance but provides more detailed information about your policy.

-

Temporary Insurance Card: Issued when you first purchase a policy, this document functions like the Auto Insurance Card by providing immediate proof of insurance. It typically includes the same essential information but is valid for a shorter duration.

-

Vehicle Registration Document: While primarily used to confirm ownership of a vehicle, this document often includes insurance information. Like the Auto Insurance Card, it must be kept in the vehicle and presented when necessary, such as during a traffic stop.

-

Accident Report Form: This document is used to record the details of an accident. It shares similarities with the Auto Insurance Card in that both require specific information to be filled out after an incident, helping to facilitate communication with insurance companies.

- Mobile Home Bill of Sale Form: To ensure a proper transfer of ownership for mobile homes, refer to the comprehensive Mobile Home Bill of Sale documentation that outlines necessary details for a seamless transaction.

-

Insurance Claim Form: This form is submitted to request compensation for damages or losses. Like the Auto Insurance Card, it requires specific details about the incident and the insured party, ensuring that claims are processed accurately and efficiently.

Auto Insurance Card Example

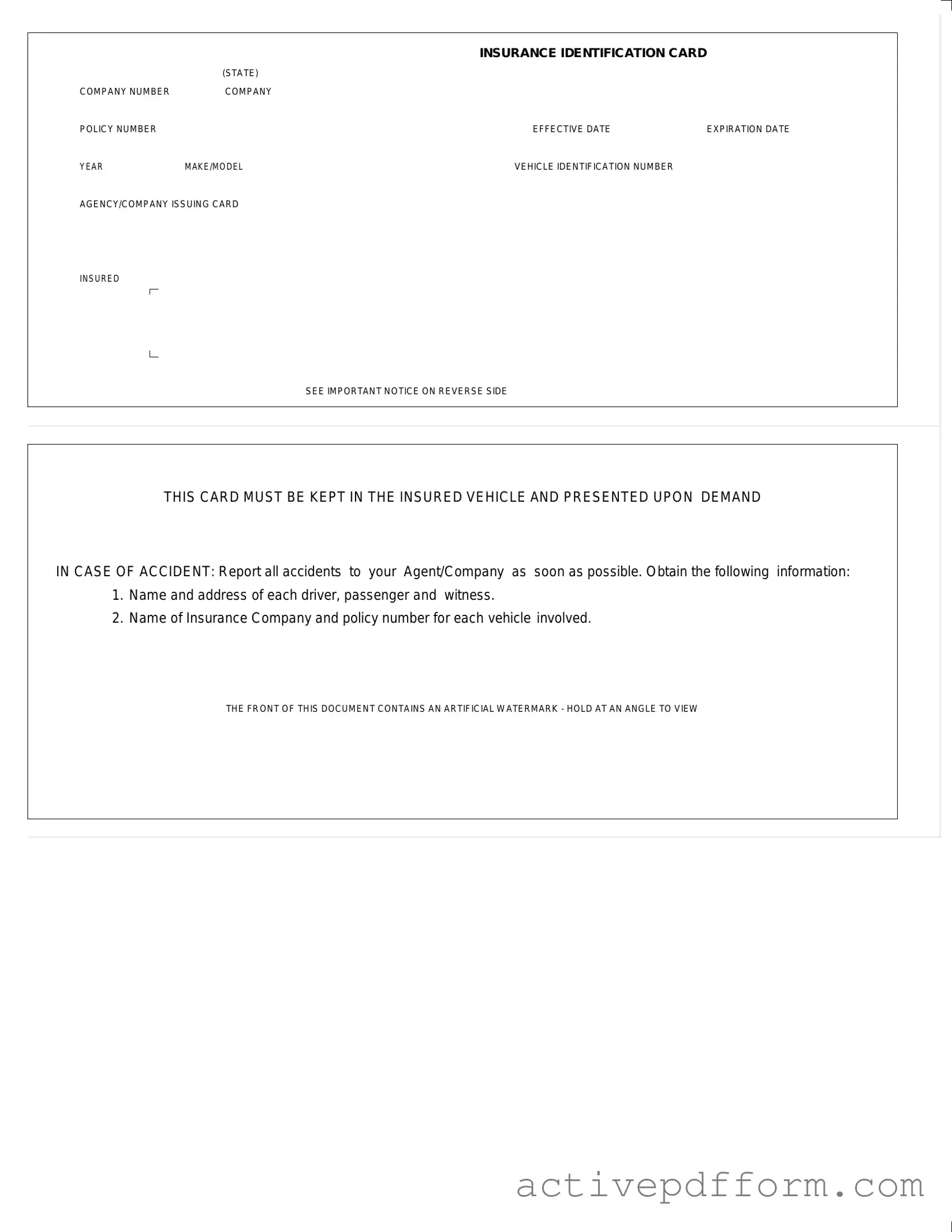

|

|

INSURANCE IDENTIFICATION CARD |

|

|

(STATE) |

|

|

COMPANY NUMBER |

COMPANY |

|

|

POLICY NUMBER |

|

EFFECTIVE DATE |

EXPIRATION DATE |

YEAR |

MAKE/MODEL |

VEHICLE IDENTIFICATION NUMBER |

|

AGENCY/COMPANY ISSUING CARD

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

THIS CARD MUST BE KEPT IN THE INSURED VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

Understanding Auto Insurance Card

What is an Auto Insurance Card?

An Auto Insurance Card is a document that proves you have valid car insurance. It contains important information about your insurance policy, including the company name, policy number, effective dates, and vehicle details. You must keep this card in your vehicle and present it if requested by law enforcement or in case of an accident.

What information is included on the Auto Insurance Card?

Your Auto Insurance Card includes several key details: the insurance company name, company number, policy number, effective and expiration dates, vehicle make and model, and the Vehicle Identification Number (VIN). This information is essential for verifying your coverage and ensuring you comply with state requirements.

Why is it important to keep the Auto Insurance Card in the vehicle?

It is crucial to keep the Auto Insurance Card in your vehicle because it serves as proof of insurance. If you are involved in an accident or stopped by law enforcement, you must present this card. Failing to do so can result in penalties, including fines or even license suspension.

What should I do if I lose my Auto Insurance Card?

If you lose your Auto Insurance Card, contact your insurance agent or company immediately. They can issue a replacement card for you. It’s important to have a valid card on hand to avoid any complications while driving.

What should I do in case of an accident?

In the event of an accident, report it to your insurance agent or company as soon as possible. Gather information from all parties involved, including names and addresses of drivers, passengers, and witnesses. Also, note the insurance company and policy numbers for each vehicle involved. This information will help facilitate the claims process.

What is the significance of the watermark on the Auto Insurance Card?

The front of the Auto Insurance Card features an artificial watermark. This watermark is a security measure to prevent fraud. To view it, hold the card at an angle. If you notice any discrepancies or if the watermark is missing, contact your insurance company for clarification.

Dos and Don'ts

When filling out the Auto Insurance Card form, it is crucial to be accurate and thorough. Here are some important dos and don'ts to keep in mind:

- Do fill in all required fields completely.

- Do double-check the policy number for accuracy.

- Do ensure that the effective and expiration dates are clearly stated.

- Do keep the card in the insured vehicle at all times.

- Don't leave any sections blank; incomplete forms can lead to issues.

- Don't use incorrect or outdated information about the vehicle.

- Don't forget to report any accidents to your agent promptly.

- Don't ignore the important notice on the reverse side of the card.

Check out Common Templates

Erc Forms - Provide clarity on property ownership types and implications for sale.

The California DV-260 form, also known as the Confidential CLETS Information Form, is essential for individuals seeking protection through a restraining order. This form ensures that sensitive information is kept private while allowing law enforcement to access necessary details to enforce the order. For those looking to take the next step in this important process, you can find the necessary resources at California PDF Forms.

Family Information Form (imm5707) - Consider legal assistance if there are uncertainties regarding form completion.

Making a Family Crest - An ornate combination of symbols expressing identity.