Blank Affidavit of Gift Document

The Affidavit of Gift form serves as a vital document in the realm of gifting personal property, ensuring that both the giver and receiver are protected during the transfer process. This form is particularly important when the value of the gift exceeds a certain threshold, as it provides a clear record of the transaction and helps avoid potential disputes in the future. It typically includes essential information such as the names and addresses of both the donor and the recipient, a detailed description of the property being gifted, and the date of the transfer. Furthermore, the form often requires the signature of the donor, affirming their intent to give the property without any expectation of payment or compensation. In some cases, witnesses may also be needed to validate the document, adding an extra layer of authenticity. By utilizing the Affidavit of Gift form, individuals can navigate the complexities of gifting with greater ease and confidence, ensuring that their intentions are formally recognized and legally documented.

Document Attributes

| Fact Name | Description |

|---|---|

| Definition | An Affidavit of Gift is a legal document used to declare a gift of property or assets from one person to another. |

| Purpose | This form serves to provide proof that a gift was made and is often used for tax purposes or to clarify ownership. |

| Notarization | Typically, the affidavit must be notarized to ensure its authenticity and to verify the identity of the parties involved. |

| State Variations | Different states may have specific requirements or forms for the Affidavit of Gift. Always check local laws. |

| Tax Implications | Gifts above a certain value may require the filing of a gift tax return. Consult IRS guidelines for details. |

| Governing Law | In many states, the Uniform Probate Code governs the transfer of property through gifts, but local laws may apply. |

| Who Can Use It | Anyone giving or receiving a significant gift may use this form to document the transaction formally. |

| Contents | The form typically includes details about the donor, the recipient, a description of the gift, and signatures. |

| Record Keeping | It is advisable to keep a copy of the signed affidavit for personal records and future reference. |

Similar forms

-

Bill of Sale: This document serves as proof of the transfer of ownership of personal property. Like the Affidavit of Gift, it outlines the details of the transaction, including the parties involved and the description of the item being transferred. Both documents confirm that the transfer is voluntary and without compensation.

- Nyc Apartment Registration Form: For landlords and property managers, this form collects essential information about the apartment and its owner, ensuring compliance with housing regulations. More details can be found at nytemplates.com/blank-nyc-apartment-registration-template.

-

Gift Letter: A gift letter is often used in real estate transactions. It states that a certain amount of money is being given as a gift, not a loan. Similar to the Affidavit of Gift, it provides assurance to the recipient and any financial institutions involved that the funds do not need to be repaid.

-

Trust Agreement: A trust agreement outlines the management of assets placed in a trust. It can be similar to an Affidavit of Gift when assets are transferred into a trust as a gift. Both documents detail the intentions of the giver and the responsibilities of the recipient or trustee.

-

Power of Attorney: This document grants one person the authority to act on behalf of another. While it is not strictly a gift document, it can be used to facilitate the transfer of gifts. Both the Power of Attorney and the Affidavit of Gift require clear consent and intention from the giver.

-

Charitable Donation Receipt: When someone donates to a charity, they receive a receipt that acknowledges the gift. This document is similar to the Affidavit of Gift because it serves as proof of a transfer without expectation of return. Both documents emphasize the voluntary nature of the gift.

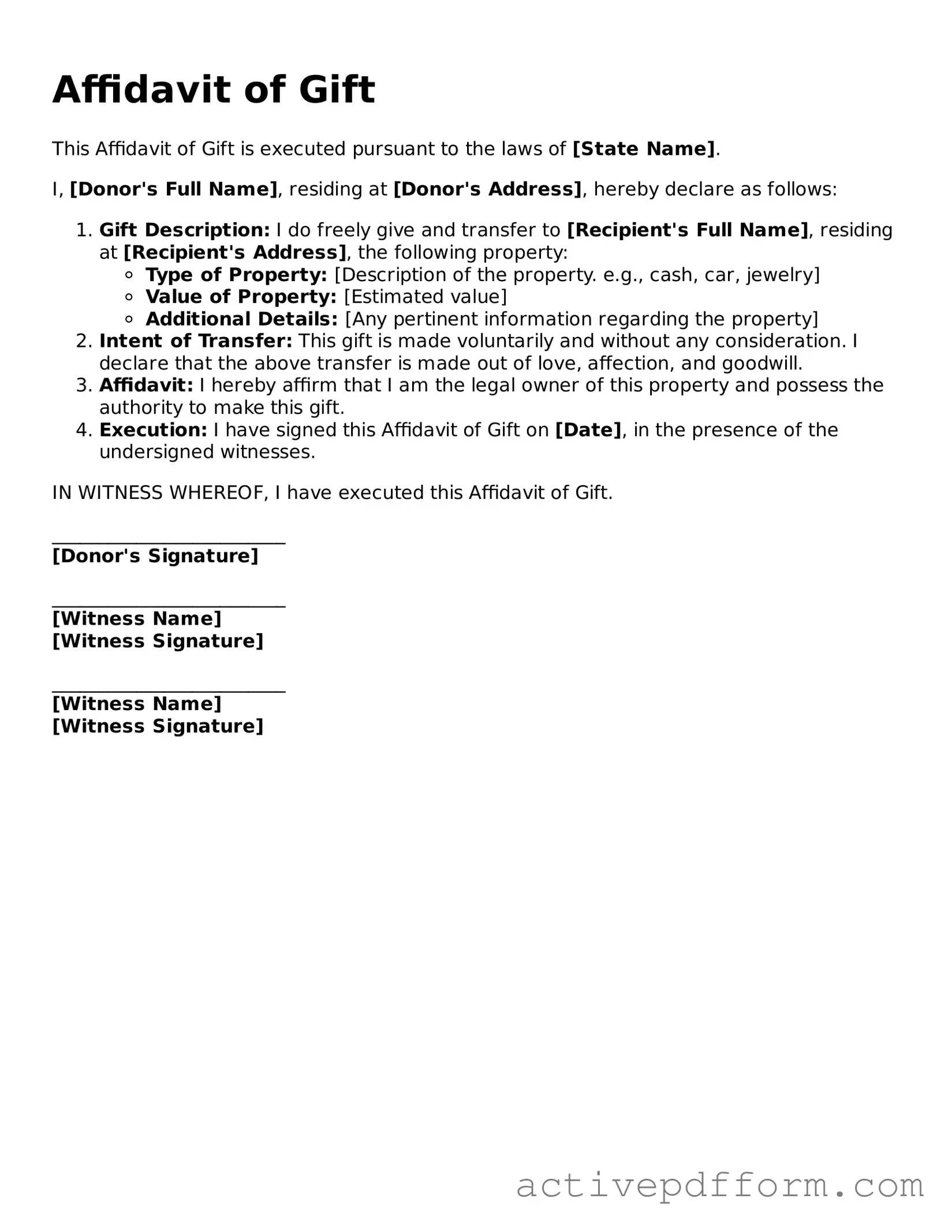

Affidavit of Gift Example

Affidavit of Gift

This Affidavit of Gift is executed pursuant to the laws of [State Name].

I, [Donor's Full Name], residing at [Donor's Address], hereby declare as follows:

- Gift Description: I do freely give and transfer to [Recipient's Full Name], residing at [Recipient's Address], the following property:

- Type of Property: [Description of the property. e.g., cash, car, jewelry]

- Value of Property: [Estimated value]

- Additional Details: [Any pertinent information regarding the property]

- Intent of Transfer: This gift is made voluntarily and without any consideration. I declare that the above transfer is made out of love, affection, and goodwill.

- Affidavit: I hereby affirm that I am the legal owner of this property and possess the authority to make this gift.

- Execution: I have signed this Affidavit of Gift on [Date], in the presence of the undersigned witnesses.

IN WITNESS WHEREOF, I have executed this Affidavit of Gift.

_________________________

[Donor's Signature]

_________________________

[Witness Name]

[Witness Signature]

_________________________

[Witness Name]

[Witness Signature]

Understanding Affidavit of Gift

What is an Affidavit of Gift?

An Affidavit of Gift is a legal document that confirms a gift has been made. It serves as proof that the donor intended to give the gift without expecting anything in return. This document is often used for transferring ownership of property, such as real estate or vehicles, from one person to another without a sale involved.

Who needs an Affidavit of Gift?

What information is included in an Affidavit of Gift?

The Affidavit of Gift typically includes the names and addresses of both the donor and the recipient, a description of the gift, and the date of the gift. It may also include statements affirming that the gift was made voluntarily and without any compensation expected in return.

Is an Affidavit of Gift legally binding?

Yes, an Affidavit of Gift is a legally binding document once it is signed by the donor. It can be used in legal situations to prove that a gift was made. However, it is important for both parties to understand the implications of the gift, especially concerning taxes.

Do I need a witness or notary for the Affidavit of Gift?

While it is not always required, having a witness or a notary public sign the Affidavit of Gift can add an extra layer of legitimacy. This can be particularly important if the gift is substantial or if there might be disputes in the future about the gift.

Can I revoke an Affidavit of Gift after it is signed?

Once an Affidavit of Gift is signed and the gift is transferred, it is generally considered final. Revoking it can be complicated and may require legal action. It is crucial to be sure about the decision to give a gift before signing the document.

Are there tax implications for gifts documented with an Affidavit of Gift?

Yes, there can be tax implications. In the U.S., gifts over a certain value may be subject to gift tax. It is advisable to consult with a tax professional to understand how the gift might affect your tax situation and whether any reporting is required.

How do I fill out an Affidavit of Gift?

Filling out an Affidavit of Gift involves providing the necessary information about the donor, the recipient, and the gift itself. It is important to be clear and accurate. Some templates are available online, but ensure they meet your state’s legal requirements.

Where can I obtain an Affidavit of Gift form?

You can find Affidavit of Gift forms at legal stationery stores, online legal document services, or through local government offices. Make sure to choose a form that complies with your state’s laws.

What should I do after completing the Affidavit of Gift?

After completing the Affidavit of Gift, both the donor and the recipient should keep copies for their records. If the gift involves property, it may also need to be filed with the appropriate government office to officially transfer ownership.

Dos and Don'ts

When completing the Affidavit of Gift form, attention to detail is crucial. Here are some important dos and don’ts to ensure the process goes smoothly.

- Do provide accurate information about the donor and recipient.

- Do clearly describe the gift being given, including its value.

- Do sign the form in the presence of a notary public if required.

- Do keep a copy of the completed form for your records.

- Don't leave any sections of the form blank; fill in all required fields.

- Don't use vague language; be specific about the details of the gift.

Consider More Types of Affidavit of Gift Templates

Affixture - This legal form might provide benefits in estate planning and the transfer of assets upon death.

For those looking to ensure a seamless transaction, utilizing the California Bill of Sale form is recommended, and you can conveniently access it through California PDF Forms to fill out all necessary details accurately.

Affidavit of Death Form California - This document can ultimately provide peace of mind during a difficult time.

Self Affidavit - The Self-Proving Affidavit can be a decisive factor in expediting the probate process.