Free Advance Beneficiary Notice of Non-coverage Template

The Advance Beneficiary Notice of Non-coverage (ABN) is an important document for Medicare beneficiaries that helps clarify the coverage status of certain medical services or items. When healthcare providers believe that a service may not be covered by Medicare, they are required to issue an ABN to inform patients of the potential financial implications. This form outlines the specific service in question, explains why it may not be covered, and provides beneficiaries with options on how to proceed. Patients can choose to accept the service and assume financial responsibility if Medicare denies coverage, or they can decline the service altogether. Understanding the ABN is crucial for beneficiaries, as it allows them to make informed decisions about their healthcare and finances. Additionally, the form serves to protect both patients and providers by ensuring transparency and clear communication regarding coverage issues.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Advance Beneficiary Notice of Non-coverage (ABN) informs patients that Medicare may not cover a service or item. |

| When to Use | Providers must issue the ABN before providing services that they believe Medicare may deny. |

| Patient Rights | Patients can choose to receive the service and accept financial responsibility if Medicare denies coverage. |

| Signature Requirement | Patients must sign the ABN to acknowledge understanding of the potential non-coverage. |

| State-Specific Forms | Some states may have additional requirements for ABNs under state law, but the federal guidelines apply universally. |

| Validity Period | The ABN is valid for the specific service or item indicated and does not cover future services. |

Similar forms

- Medicare Summary Notice (MSN): This document provides a summary of services billed to Medicare, detailing what was covered and what costs the beneficiary is responsible for. Like the Advance Beneficiary Notice of Non-coverage, it informs beneficiaries about potential out-of-pocket expenses.

- Explanation of Benefits (EOB): Issued by private insurers, this document explains the services provided, the amount billed, and what the insurance will pay. Similar to the Advance Beneficiary Notice, it helps beneficiaries understand their financial responsibilities.

- Notice of Exclusion from Medicare Benefits (NEMB): This notice is given when a service is not covered by Medicare, providing a clear explanation of why. It serves a similar purpose to the Advance Beneficiary Notice by informing beneficiaries of non-coverage.

- Vehicle/Vessel Transfer and Reassignment Form (REG 262): This important form must accompany the official title during a vehicle or vessel ownership transfer. Make sure to complete it to ensure a smooth transaction by visiting California PDF Forms.

- Prior Authorization Request: This document is submitted to insurers to obtain approval for certain medical services before they are provided. Like the Advance Beneficiary Notice, it can prevent unexpected costs by ensuring coverage beforehand.

- Patient Responsibility Notice: This notice outlines the costs that a patient is expected to pay for services rendered. It parallels the Advance Beneficiary Notice by clarifying financial obligations related to care.

- Claim Denial Letter: When a claim is denied, this letter explains the reasons for the denial. Much like the Advance Beneficiary Notice, it provides essential information regarding coverage decisions.

- Out-of-Pocket Cost Estimate: This document gives an estimate of the costs a patient may incur for upcoming services. It shares similarities with the Advance Beneficiary Notice by helping beneficiaries plan for their expenses.

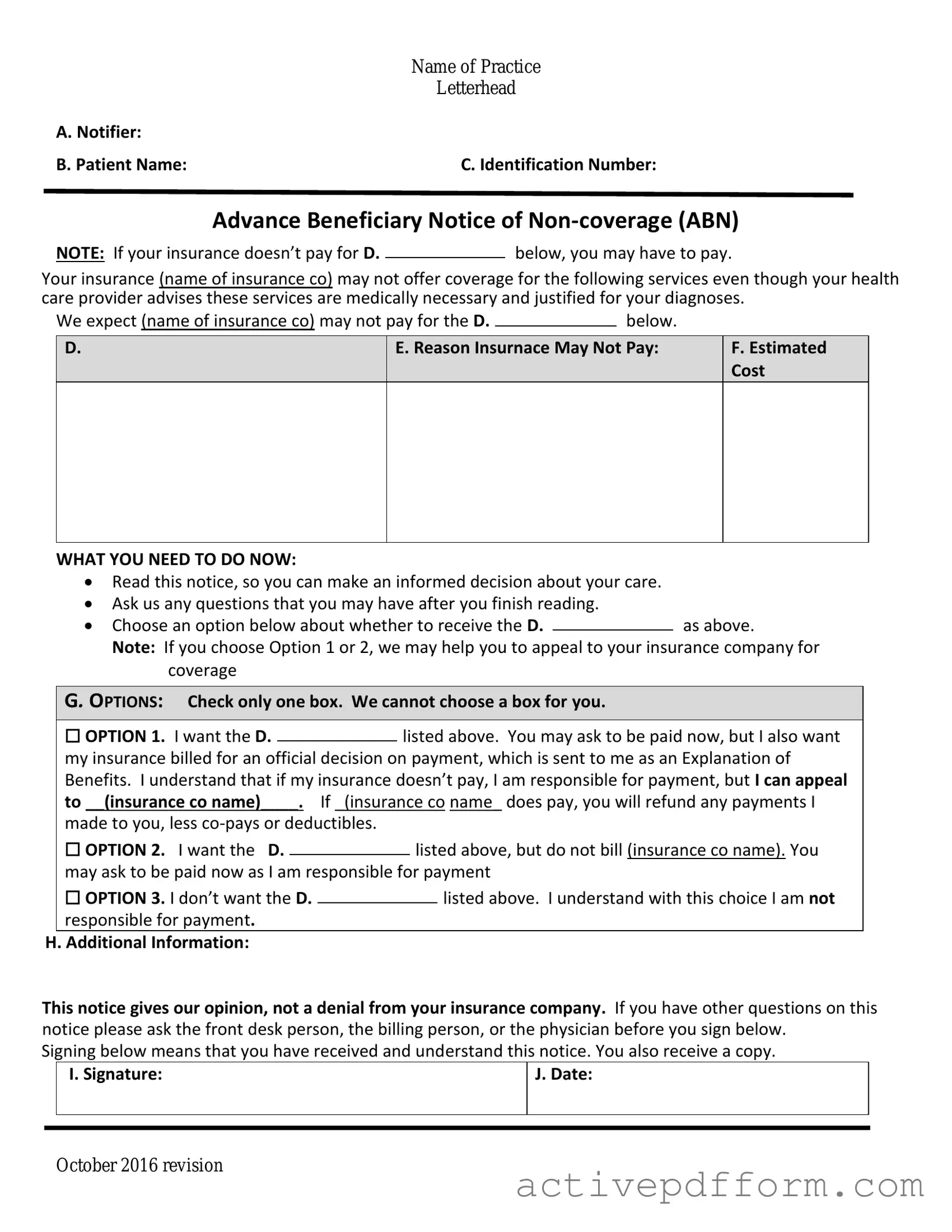

Advance Beneficiary Notice of Non-coverage Example

|

Name of Practice |

|

Letterhead |

A. Notifier: |

|

B. Patient Name: |

C. Identification Number: |

Advance Beneficiary Notice of

NOTE: If your insurance doesn’t pay for D.below, you may have to pay.

Your insurance (name of insurance co) may not offer coverage for the following services even though your health care provider advises these services are medically necessary and justified for your diagnoses.

We expect (name of insurance co) may not pay for the D. |

|

below. |

|

D.

E. Reason Insurnace May Not Pay:

F.Estimated Cost

WHAT YOU NEED TO DO NOW:

Read this notice, so you can make an informed decision about your care.

Ask us any questions that you may have after you finish reading.

Choose an option below about whether to receive the D.as above.

Note: If you choose Option 1 or 2, we may help you to appeal to your insurance company for coverage

G. OPTIONS: Check only one box. We cannot choose a box for you.

|

☐ OPTION 1. I want the D. |

|

listed above. You may ask to be paid now, but I also want |

||||

|

|

||||||

|

my insurance billed for an official decision on payment, which is sent to me as an Explanation of |

||||||

|

Benefits. I understand that if my insurance doesn’t pay, I am responsible for payment, but I can appeal |

||||||

|

to __(insurance co name)____. If _(insurance co name_ does pay, you will refund any payments I |

||||||

|

made to you, less |

|

|

|

|||

|

☐ OPTION 2. I want the D. |

|

|

listed above, but do not bill (insurance co name). You |

|||

|

|

|

|||||

|

may ask to be paid now as I am responsible for payment |

||||||

|

☐ OPTION 3. I don’t want the D. |

|

|

|

listed above. I understand with this choice I am not |

||

|

|

|

|

||||

|

responsible for payment. |

|

|

|

|||

H. Additional Information: |

|

|

|

||||

This notice gives our opinion, not a denial from your insurance company. If you have other questions on this notice please ask the front desk person, the billing person, or the physician before you sign below.

Signing below means that you have received and understand this notice. You also receive a copy.

|

I. Signature: |

J. Date: |

|

|

|

|

|

|

October 2016 revision

Understanding Advance Beneficiary Notice of Non-coverage

What is the Advance Beneficiary Notice of Non-coverage (ABN)?

The Advance Beneficiary Notice of Non-coverage, commonly known as the ABN, is a form used in the Medicare program. It informs beneficiaries that a service or item may not be covered by Medicare. When a healthcare provider believes that Medicare may deny coverage for a particular service, they must provide this notice to the patient. The ABN allows patients to make informed decisions about their healthcare and whether to proceed with the service knowing they may have to pay out of pocket.

When should I receive an ABN?

You should receive an ABN before you receive a service or item that your healthcare provider thinks Medicare might not cover. This could happen, for example, if the provider believes the service is not medically necessary or if it falls outside of Medicare guidelines. The provider must give you the ABN in advance, allowing you time to consider your options.

What should I do if I receive an ABN?

If you receive an ABN, carefully read the document. It will explain the service in question, the reason Medicare may deny coverage, and your financial responsibilities. You will have the option to either accept the service and agree to pay for it if Medicare denies coverage or decline the service altogether. It is essential to ask your provider any questions you may have to fully understand your choices.

Can I appeal if Medicare denies coverage after I received an ABN?

Yes, you can appeal a denial of coverage even if you received an ABN. The ABN serves as a notification of potential non-coverage, but it does not prevent you from seeking reimbursement from Medicare. If you believe the service was necessary and should be covered, you can file an appeal with Medicare. Be sure to keep a copy of the ABN and any related documents to support your case.

Does signing an ABN mean I am agreeing to pay for the service?

Not necessarily. Signing the ABN indicates that you understand the service may not be covered by Medicare, and you acknowledge the potential financial responsibility. However, you can still choose not to proceed with the service. If you do decide to go ahead, you will be agreeing to pay for it if Medicare denies coverage. Always consider your options before signing.

Are there any exceptions to when an ABN is required?

Yes, there are certain situations where an ABN is not required. For instance, if a service is explicitly covered by Medicare, an ABN does not need to be provided. Additionally, if the provider is performing a service that is considered routine or preventive, such as an annual wellness visit, an ABN may not be necessary. However, it is always best to communicate with your healthcare provider to clarify whether an ABN should be expected for a specific service.

Dos and Don'ts

When filling out the Advance Beneficiary Notice of Non-coverage (ABN) form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are five things you should and shouldn't do:

- Do read the instructions carefully before starting to fill out the form.

- Do provide accurate information regarding the services you received or plan to receive.

- Do sign and date the form to confirm your understanding of the information provided.

- Don't leave any required fields blank; this may lead to delays or complications.

- Don't ignore any questions or sections; each part of the form is important for proper processing.

Check out Common Templates

How to Get a Qdro Form - A marital fraction method is available for specific situations only.

The NYC Payroll Form serves as a critical tool for contractors and subcontractors, enabling them to report weekly payroll information for employees engaged in public projects. This form not only ensures compliance with the Department of Labor's Bureau of Public Work requirements but also helps in maintaining transparency and accuracy in wage reporting. For those looking for a streamlined template to facilitate this process, the resource available at https://nytemplates.com/blank-nyc-payroll-template can be particularly helpful.

Schedule 941 B - Understanding the completion of Schedule B can empower employers in tax management strategies.