Free Adp Pay Stub Template

The ADP Pay Stub form serves as an essential document for employees, providing a detailed summary of earnings and deductions for each pay period. This form typically includes key information such as the employee's gross pay, net pay, and various deductions like taxes, health insurance, and retirement contributions. By breaking down the components of an employee's paycheck, the pay stub helps individuals understand how their earnings are calculated and what amounts are withheld for different purposes. Furthermore, the form often contains vital details such as the pay period dates, employee identification, and employer information, ensuring transparency in the payroll process. For many, the ADP Pay Stub is not just a record of payment; it is a tool for financial planning and tracking income over time.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The ADP Pay Stub form provides employees with a detailed breakdown of their earnings, deductions, and net pay for each pay period. |

| Access | Employees can access their pay stubs online through the ADP portal or receive them via email, ensuring easy access to important financial information. |

| State-Specific Regulations | In some states, employers are required to provide specific information on pay stubs, such as California's Labor Code Section 226, which mandates detailed reporting of deductions and hours worked. |

| Importance for Employees | Understanding the pay stub is crucial for employees to verify their earnings, ensure proper tax withholdings, and track their financial health over time. |

Similar forms

- Paycheck Stub: Similar to the ADP Pay Stub, a paycheck stub provides a breakdown of an employee's earnings for a specific pay period. It includes gross pay, deductions, and net pay, allowing employees to understand their compensation details clearly.

- Power of Attorney Form: For those needing to manage decisions on behalf of another, the comprehensive Power of Attorney form guide helps ensure all legalities are addressed effectively.

- W-2 Form: The W-2 form summarizes an employee's annual wages and the taxes withheld from their paycheck. While the ADP Pay Stub shows pay for a specific period, the W-2 offers a comprehensive view of earnings and taxes for the entire year.

- Direct Deposit Receipt: A direct deposit receipt is provided when an employee's paycheck is directly deposited into their bank account. Like the ADP Pay Stub, it confirms payment details, including the amount deposited and the pay period covered.

- Payroll Summary Report: A payroll summary report offers an overview of all employee payments within a specific timeframe. It includes total earnings, deductions, and net pay for multiple employees, similar to how the ADP Pay Stub breaks down individual employee earnings.

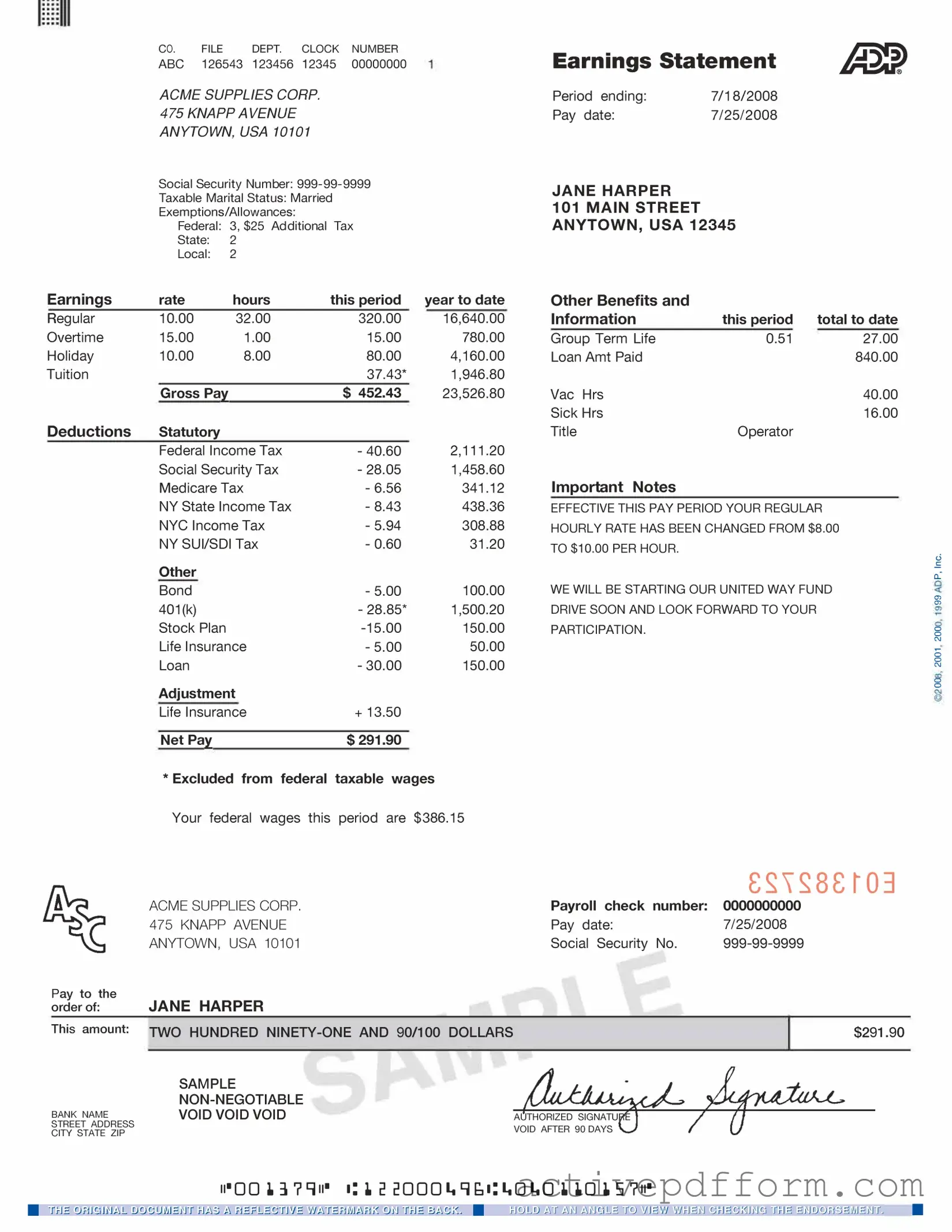

Adp Pay Stub Example

|

CO. |

FILE |

DEPT. |

CLOCK |

NUMBER |

|

|

ABC |

126543 123456 |

12345 |

00000000 |

|

|

|

ACME SUPPLIES CORP. |

|

|

|||

|

475 KNAPP AVENUE |

|

|

|

||

|

ANYTOWN, USA 10101 |

|

|

|||

|

Social Security Number: |

|

||||

|

Taxable Marital Status: Married |

|

|

|||

|

Exemptions/Allowances: |

|

|

|

||

|

Federal: 3, $25 Additional Tax |

|

||||

|

State: |

2 |

|

|

|

|

|

Local: |

2 |

|

|

|

|

Earnings |

rate |

|

hours |

this period |

year to date |

|

Regular |

10.00 |

|

32.00 |

|

320.00 |

16,640.00 |

Overtime |

15.00 |

|

1.00 |

|

15.00 |

780.00 |

Holiday |

10.00 |

|

8.00 |

|

80.00 |

4,160.00 |

Tuition |

|

|

|

|

37.43* |

1,946.80 |

|

Gross Pa� |

|

|

$ 452.43 |

23,526.80 |

|

Deductions |

Statutory |

|

|

|

2,111.20 |

|

|

Federal Income Tax |

|

- 40.60 |

|||

|

Social Security Tax |

|

- 28.05 |

1,458.60 |

||

|

Medicare Tax |

|

- 6.56 |

341.12 |

||

|

NY State Income Tax |

|

- 8.43 |

438.36 |

||

|

NYC Income Tax |

|

- 5.94 |

308.88 |

||

|

NY SUI/SDI Tax |

|

- 0.60 |

31.20 |

||

|

Other |

|

|

|

|

|

|

Bond |

|

|

|

- 5.00 |

100.00 |

|

401(k) |

|

|

|

- 28.85* |

1,500.20 |

|

Stock Plan |

|

|

150.00 |

||

|

Life Insurance |

|

- 5.00 |

50.00 |

||

|

Loan |

|

|

|

- 30.00 |

150.00 |

|

Adjustment |

|

|

|

||

|

Life Insurance |

|

+ 13.50 |

|

||

|

Net Pa� |

|

|

$291.90 |

|

|

*Excluded from federal taxable wages Your federal wages this period are $386.15

ACME SUPPLIES CORP. 475 KNAPP AVENUE ANYTOWN, USA 10101

Pay to the

order of: JANE HARPER

This amount: TWO HUNDRED

SAMPLE

BANK NAMEVOID VOID VOID

STREET ADDRESS

CITY STATE ZIP

Earnings Statement

Period ending: |

7/18/2008 |

Pay date: |

7/25/2008 |

JANE HARPER

101MAIN STREET

ANYTOWN, USA 12345

Other Benefits and

Information |

this period |

total to date |

|

|

Group Term Life |

0.51 |

27.00 |

|

|

Loan Amt Paid |

|

840.00 |

|

|

Vac Hrs |

|

40.00 |

|

|

Sick Hrs |

|

16.00 |

|

|

Title |

Operator |

|

|

|

Important Notes |

|

|

|

|

EFFECTIVE THIS PAY PERIOD YOUR REGULAR |

|

|||

HOURLY RATE HAS BEEN CHANGED FROM $8.00 |

|

|||

TO $10.00 PER HOUR. |

|

|

0 |

|

|

|

|

||

|

|

|

.!: |

|

WE WILL BE STARTING OUR UNITED WAY FUND |

0: |

|||

"' |

||||

DRIVE SOON AND LOOK FORWARD TO YOUR |

|

|||

|

|

|||

PARTICIPATION. |

|

|

0 |

|

|

|

|

0 |

|

C\J

0

0

C\J

0

0

|

£�,�8£�03 |

Payroll check number: |

0000000000 |

Pay date: |

7/25/2008 |

Social Security No. |

$291.90

Understanding Adp Pay Stub

What is an ADP Pay Stub?

An ADP Pay Stub is a document provided to employees that details their earnings for a specific pay period. It typically includes information such as gross pay, deductions, taxes withheld, and net pay. This document serves as a record of compensation and is important for personal financial management.

How can I access my ADP Pay Stub?

Employees can access their ADP Pay Stubs through the ADP employee portal. After logging in with their credentials, users can navigate to the pay statements section to view and download their pay stubs. If you are a new user, registration may be required to create an account.

What information is included on the ADP Pay Stub?

An ADP Pay Stub generally includes the employee's name, employee ID, pay period dates, gross earnings, various deductions (such as taxes, health insurance, retirement contributions), and the final net pay amount. It may also show year-to-date totals for earnings and deductions.

Why is my ADP Pay Stub important?

Your ADP Pay Stub is crucial for several reasons. It provides a clear breakdown of your earnings and deductions, which is helpful for budgeting and financial planning. Additionally, it serves as proof of income, which may be required for loan applications or tax purposes.

What should I do if I notice an error on my ADP Pay Stub?

If you find an error on your ADP Pay Stub, it is important to address it promptly. Contact your payroll department or human resources for assistance. They can investigate the issue and make any necessary corrections. Keeping a record of your pay stubs can help in resolving discrepancies.

Can I receive my ADP Pay Stub electronically?

Yes, employees have the option to receive their ADP Pay Stubs electronically. This can be done through the ADP employee portal, where you can choose to receive notifications via email when your pay stub is available. This method is convenient and environmentally friendly.

How long are ADP Pay Stubs stored online?

Typically, ADP Pay Stubs are stored online for a certain period, often up to three years, depending on your employer's policies. Employees can access past pay stubs during this time. It is advisable to download and save important pay stubs for personal records.

What should I do if I forget my ADP login credentials?

If you forget your ADP login credentials, you can reset your password through the ADP portal. Follow the prompts for "Forgot Password" or "Forgot Username." You may need to provide personal information to verify your identity before receiving instructions to reset your credentials.

Dos and Don'ts

When filling out the ADP Pay Stub form, it's essential to follow some straightforward guidelines. Here are six things to keep in mind:

- Do double-check all personal information for accuracy.

- Don't leave any required fields blank.

- Do use clear and legible handwriting if filling it out by hand.

- Don't forget to include your employee ID number.

- Do review your pay rates and deductions carefully.

- Don't submit the form without confirming all details are correct.

By following these tips, you can ensure that your ADP Pay Stub form is completed accurately and efficiently.

Check out Common Templates

Health Insurance Marketplace Statement - It's particularly important to understand the "Monthly Premium Amount" listed on the form.

Understanding the critical elements of a trailer bill of sale documentation can streamline the process of transferring ownership and ensure all necessary details are accurately captured.

Med Express Mt Pleasant Pa - The specimen ID number is essential for identifying samples within the testing facility.